Updated: 30 Jul, 2024

Let’s face it, having a regular savings plan was a lot easier when you were younger: you might have been earning a lot less but you didn’t have to keep up with things like rent and bills.

You’re probably earning a higher wage now but with property prices continuing to rise in most capital cities, saving up enough to buy your own home is laughable. Well, at least that’s what your mind is telling you.

Cheat code: Even if you have little to no savings right now there a number of no deposit options available so speak to one of our expert mortgage brokers today to find out how we can help you.

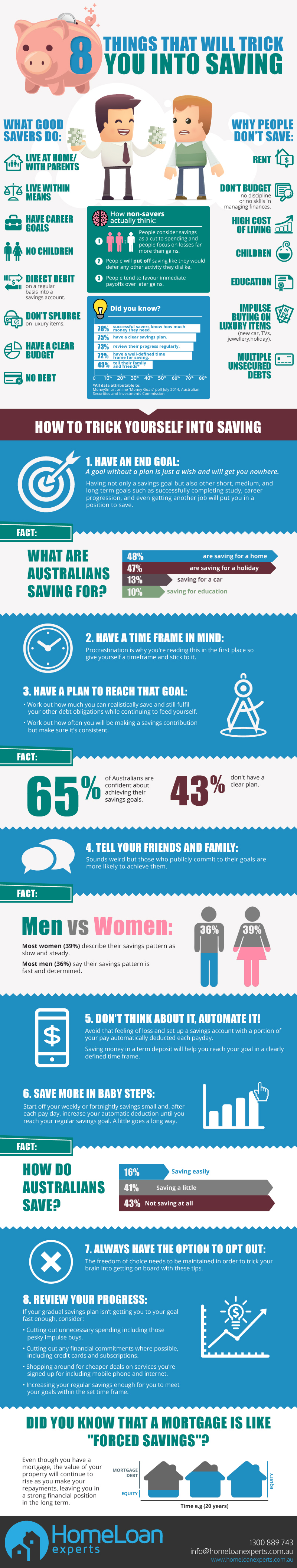

Why people don’t save

Your brain is a powerful organ and it’s actually been proven that non-savers liken saving to having their hair pulled out. Specifically, they:

- Consider savings as a cut to spending and people focus on losses far more than gains at a rate of 2:1

- Will put off saving like they would defer any other activity they’d rather not do.

- Tend to favour immediate payoffs over later gains.

Freud musings aside, it’s obvious that the real world can be a roadblock to putting money aside for a rainy day. According to our team of brokers, some people don’t save because:

- They pay rent

- They have no budget and no discipline

- They have a high cost of living

- They are undertaking tertiary study

- They impulse buy and spend money on luxury items like new cars, TVs, jewellery and holidays

- They have multiple forms of unsecured debt

So what can you do to kick arse at saving?

What good savers do that you don’t

The Australian Securities and Investment Commission’s (ASIC) MoneySmart online ‘Money Goals’ poll July 2014 found that 78% of successful savers know exactly how much money they need.

Almost as important to them is having a clear savings plan (75%) and reviewing their progress regularly (73%).

Our brokers found that good savers tend to:

- live at home (with their parents)

- live within their means

- set career goals

- don’t have children

- have a direct debit into a savings account

- don’t splurge on luxury items

- have a clear budget

- have no unnecessary debt

Build your savings in 8 steps

1. Have an end goal

A goal without a plan is just a wish and will get you nowhere.

Having not only a savings goal but also other short, medium, and long term goals such as successfully completing study, career progression, and even getting another job will put you in a position to save.

2. Have a time frame in mind

Procrastination is why you’re reading this in the first place so give yourself a time frame and stick to it. Around 72% of good savers do it so it must be important.

3. Have a plan to reach that goal

Take comfort in the fact that you’re not alone in your savings struggles. In fact, 43% of Australians don’t have a clear savings plan, MoneySmart found.

Buck the trend by:

- working out how much you can realistically save and still fulfil your other debt obligations (and continuing to feed yourself).

- working out how often you will be making a savings contribution but making sure it’s consistent.

4. Tell your friends and family

43% of great savers actually tell their family and friends about their savings plans. Sounds weird but those who publicly commit to their goals are more likely to achieve them.

5. Don’t think about it, automate it!

Avoid that feeling of loss and set up a savings account with a portion of your pay automatically deducted each payday.

Saving money in a term deposit will help you reach your goal in a clearly defined time frame.

6. Save more in baby steps

Start off your weekly or fortnightly savings small and, after each pay day, increase your automatic deduction until you reach your regular savings goal. A little goes a long way.

7. Always have the option to opt out

The freedom of choice needs to be maintained in order to trick your brain into getting on board with these tips.

8. Review your progress

If your gradual savings plan isn’t getting you to your goal fast enough, consider:

- Cutting out unnecessary spending including those pesky impulse buys.

- Cutting out any financial commitments where possible, including credit cards and subscriptions.

- Shopping around for cheaper deals on services you’re signed up for including mobile phone and internet.

- Increasing your regular savings enough for you to meet your goals within the set time frame.

Did you know that a mortgage is like forced savings?

Even though you have a mortgage, the value of your property will continue to rise as you make your repayments, leaving you in a strong financial position in the long term.

It’s true!

Best of all, if you’re a first home buyer, you may be in a position to receive Government grants and for your parents to act as guarantor on your home loan.

Call us on 1300 889 743 or complete our free assessment form to discover how you can qualify for a home loan.