Updated: 06 Dec, 2024

One of the most significant impacts of COVID-19 in Australia has been the ‘working from home’ shift.

According to the Household Impacts of COVID-19 Survey in February, 41% of people with a job have worked from home at least once a week in February 2021. Before March 2020, only 24% of people with a job worked at least once a week from home.

Even after the introduction of vaccines and with the worst of COVID behind us, the percentage of people working from home in 2021 remains higher than ever before.

Brokers report that more and more people are reassessing the time they may spend at home and looking to buy a home with more space.

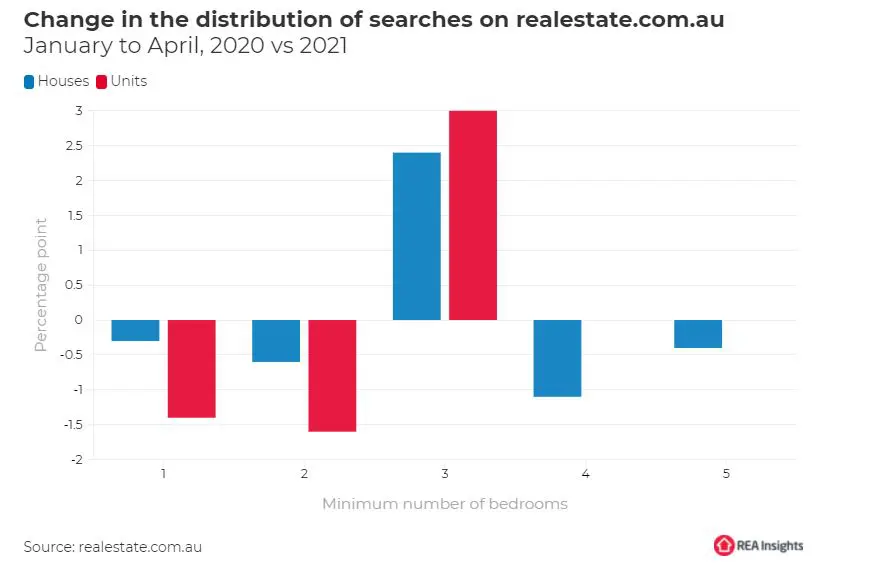

In April 2021, realestate.com.au reported that the number of people searching for three or more bedrooms has increased. On the other hand, the searches for single dwellings have been on a downward trend since January 2021.

With the demands for larger houses increasing, people have been turning to regional areas compared to the big cities, where the prices for larger homes are significantly higher.

That may be the reason why regional Australian properties are seeing a rise of an average of 13% from last year. In comparison, the two big capital cities, Sydney and Melbourne, grew at an average of 6%.

And it’s not just the owner-occupiers trying to get into the regional market. Since the turn of the year, investors have been jumping into the regional market because of rising rents.

The latest National Housing Market report has found that the total home loans market share of property investors stands at 21.9%, which has exceeded first home buyers at 19.3%. A large portion of the investors has been flooding to regional areas.

Some experts think that even with the value gap between regional markets and capital cities decreasing rapidly, the incentive to buy in regional areas may not fade away any time soon. The belief is that some regional areas may be experiencing a permanent shift in their value, relative to the capital cities, due to the increase in people working from home and the related desire for larger homes.

Are you looking to get into the regional market?

If you’re searching for the best regional area to invest in, you will need an expert at finding the best home loan deals for you. Please give us a call on 1300 889 743 or fill in our free assessment form, and one of our specialist mortgage brokers will discuss your situation with you in detail.