Updated: 10 Jul, 2024

QBE Australian Property Market Forecast: 2021-24

How Will The Market Emerge From The Pandemic?

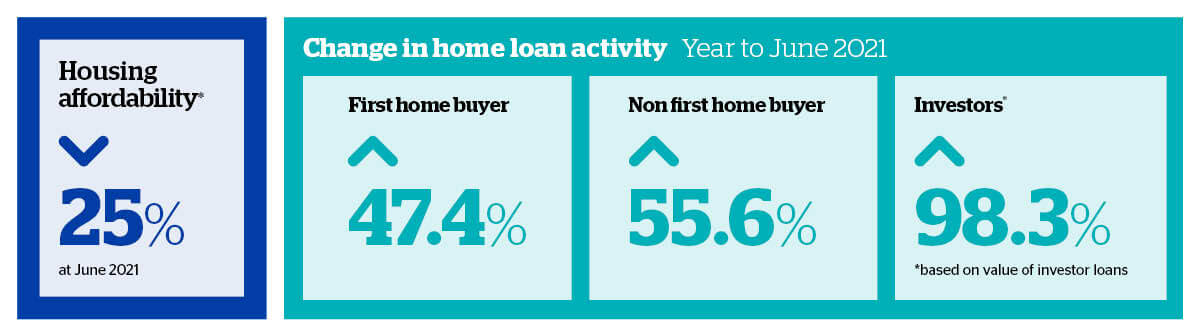

With the country not yet recovered from the break in international migration and other pandemic-related economic effects, QBE’s Australian Housing Outlook 2021-2024 takes a look at how COVID-19 has affected forecasts for the next three years. As a QBE executive says, “The disruption to the usual patterns of domestic and international migration, and continuing low interest rates, are changing the shape of our households and the property market.” All states and territories are expected to show growth over the next three years but some may feel the effects of the pandemic longer than others. Opportunities are there for those in the know, so if you are looking to buy, talk to one of our Home Loan Experts now.

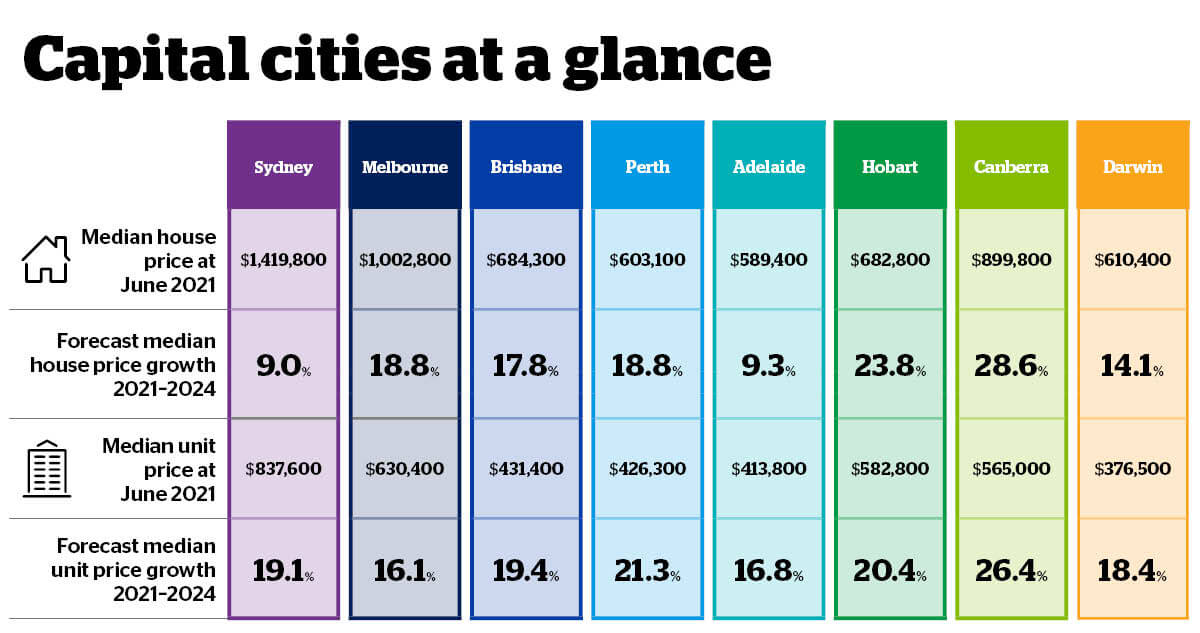

Overview Of Capital Cities

Sydney

House Market

The median housing price in Australia’s most populous city is expected to reach $1,547,000 in the June 2024 quarter, defying downward pressure from the ongoing pandemic. Even though growth is expected to be pedestrian in 2022/23 and 2023/24, that represents a rise of about 9% above June 2021 levels.

Unit Market

Uncertainty about international migration has weakened demand for units in Sydney, but now that rents have gone down, vacancy rates are going down as well.

Question: What happens when low interest rates meet declining numbers of building completions?

Answer: Demand is predicted to push the median unit price to $997,000 by 2024, an increase of 19% from June 2021.

Melbourne

House Market

As the economy recovers, a small boost to dwelling prices in Melbourne is expected in the near term. While fundamental oversupply, rising mortgage rates and crimped affordability will all have an impact through 2024, Melbourne’s median house price is still expected to rise by 19%, to $1,191,000, over the next three years.

Unit Market

Keeping in mind the anticipated bounceback of rental demand and tightening of vacancy rates when international students return, Melbourne’s median unit price is predicted to rise by a total of 16%, to $732,000, by June 2024, thanks also to a predicted rise in investor demand.

Brisbane

House Market

Brisbane is expected to remain slightly more affordable than Sydney and Melbourne; a median house price of about $806,000 is expected by June 2024, representing total three-year growth of 18%. QBE predicts that interstate migration inflows will prevent any sharp slowdown in momentum in 2022/23 and 2023/24.

Unit Market

Although the fallout caused by pandemic continues, Brisbane expects growth in the unit market following increased demand for rental properties. QBE predicts the unit price growth rate will surpass that of 2021/22, reaching a median price of $515,000 by June 2024 – representing a total increase of 19% on the June 2021 figure.

Perth

House Market

Due to rising prices and interest rates, Perth is expected to experience low affordability, causing a sharp rise in new supply. Median house prices are forecast to grow at a moderate 5.4% and 3.6% through to 2022/23 and 2023/24, respectively, reaching $716,000 by June 2024.

Unit Market

With returning expats and interstate migration putting extra pressure on what is already a tight supply market, increasing demand is expected to push prices up. QBE predicts the median unit price will reach $517,000 by June 2024, a 21% increase on June 2021 levels.

Adelaide

House Market

House prices in Adelaide are expected to achieve total growth of 9% over the next three years, bringing the median to $644,000 in 2023/24. The city’s housing market is less reliant on overseas migration; therefore, Adelaide is unlikely to experience the same hike in demand upon the opening of international borders as other cities are expecting to.

Unit Market

QBE projects that the median unit price will reach $483,000 by June 2024, representing overall growth of about 17% above June 2021 prices. This outlook is based on the now-normalizing property market fueled by additional supply and a return of migration.

Hobart

House Market

Median house prices in Hobart are forecast to reach $845,000 in June 2024, an increase of 24% from June 2021. Most of that growth is expected to occur before the end of calendar year 2021, before the rate slows down due to low international migration, rising interest rates and low affordability.

Unit Market

Hobart is projected to experience unit price growth of around 20% in the three years to June 2024, taking into account renewed investor interest and consistent growth. This would raise the median unit price in Hobart to $701,000.

Canberra

House Market

Despite rising interest rates, Canberra is predicted to experience growth in median house prices, which are expected to reach $1,157,000 in June 2024, an overall rise of 29% above the June 2021 level.

Unit Market

In 2022, as international students begin to flow back in, investor activity is expected to grow. Following this, the median unit price is anticipated to rise to $714,000 by June 2024. This represents an increase of 26% from prices in June 2021.

Darwin

House Market

Thanks to a rebound in mining investment, a strong pipeline of defense projects and the Darwin City Deal (a 10-year plan for the Darwin City Centre), a total house price gain of 14% is expected over the three-year period to 2023/24, leading to a forecast median house price of $696,000.

Unit Market

For Darwin, tourism returns, interest rates remain low and an oversupply erodes, causing prices to continue rising. A median unit price increase of 18%, to $446,000, is expected in the three years to June 2024.

Looking For A Home?

With expats and international students migrating to Australia and interest rates in homebuyers’ favour, it’s time to dive into the housing market. Whether you’re a first home buyer or seeking another investment, the forecast is looking good for the Australian market.  Our mortgage brokers know exactly which banks have flexible lending policies and can work with you to get the amount you need. We have 50+ lenders on our panel, so you’re bound to get the best deal based on your situation. Reach out to us on 1300 889 743 or fill in our online assessment form today to find out if you qualify.

Our mortgage brokers know exactly which banks have flexible lending policies and can work with you to get the amount you need. We have 50+ lenders on our panel, so you’re bound to get the best deal based on your situation. Reach out to us on 1300 889 743 or fill in our online assessment form today to find out if you qualify.

Disclaimer

This article is general information only and shouldn’t be considered financial or investment advice.