Tasmania’s shared-equity scheme, MyHome, is directly administered by Bank of us. If you’re interested in applying, please contact them directly. These schemes are not available through a mortgage broker.

What is MyHome?

MyHome is the Tasmanian Government program that assists eligible applicants with obtaining their own homes by building or purchasing one. With the support of Homes Tasmania, eligible homebuyers can jointly purchase a home, allowing them to become homeowners sooner.

MyHome is Tasmania’s shared equity scheme that has replaced HomeShare from 1 April 2022. With the income threshold increased, it is now available to more people and offers more assistance compared to its predecessor.

Under this scheme, you share the cost of purchasing a home with Homes Tasmania. The percentage of the home that you own and the amount of Homes Tasmania’s contribution vary depending on the type of property you are looking to buy.

What Are The Different Levels Of Equity Contributions?

| Type Of Property | Equity Contribution By Homes Tasmania | Property Price Cap |

|---|---|---|

| New homes (never been lived in), construction on own land, or house and land packages | maximum of $200,000 or 40% of the purchase price, whichever is lower | None |

| Existing Homes Tasmania property | maximum of $200,000 or 40% of the purchase price, whichever is lower | None |

| Existing homes (not Home Tasmania’s) | maximum of $150,000 or 30% of the purchase price, whichever is lower. | $600,000 |

You will have to pay off Homes Tasmania’s share of the property within 30 years. This can be done by either purchasing Homes Tasmania’s share or selling the house, after which each party will get paid their share of the equity. This program is open to all eligible homebuyers in Tasmania.

Am I Eligible?

This program is open to eligible home buyers in Tasmania. To qualify for MyHome, your application must be approved based on certain lending criteria. These include income, property ownership, citizenship, age, the amount of your deposit. You and the property you intend to purchase must also meet the program’s eligibility requirements.

- Citizenship and legal age

- You must be an individual (not a business or organisation)

- You must be at least 18 years old.

- You must be an Australian citizen or permanent resident living in, or intending to live in, Tasmania.

- Assets

- Your financial assets, which may include cash, savings, lump-sum payments other than compensation payments, net fixed assets of a business, funds received from superannuation and shares, bonds and investments, must be less than $105,800.

- Net equity in the property you may build under MyHome, and standard household assets are excluded unless they are deemed luxury items.

- Income

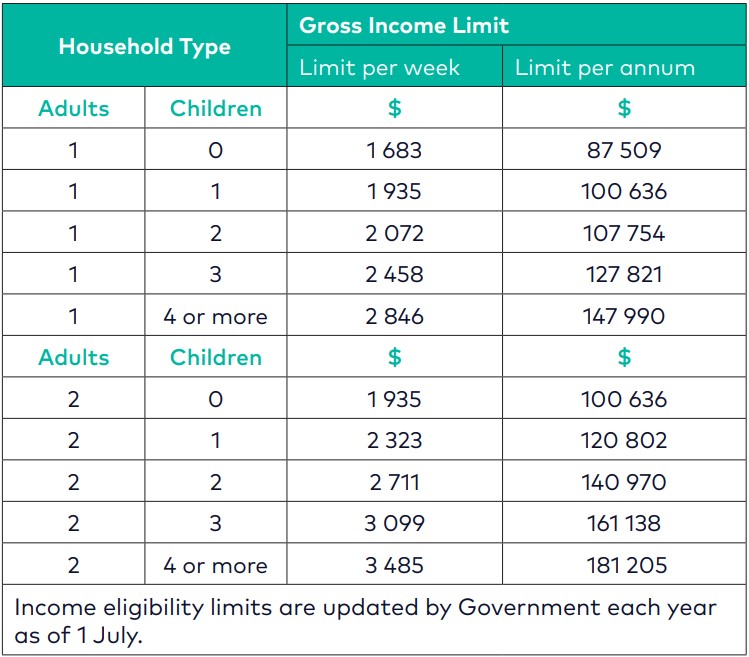

- Income has to be under certain limits, depending on your household type.

- Your income from all sources will be used to determine your eligibility for MyHome.

- The Bank of us will apply the income test and you also must be approved under the bank’s standard loan application process, along with getting approval from the Tasmanian Government.

-

Income Limit as of 1 July 2022

Source: Bank of us MyHome information guide - Deposit Requirements

- You must have at least 2 per cent of the purchase price or property value as a deposit.

- If you qualify for the First Home Owner Grant(FHOG), that can be used as a deposit or to cover other costs.

Other Eligibility Requirements

You must:

- Reside in the purchased house as your primary residence.

- Have the means to pay legal and establishment fees associated with purchasing a property.

- Have the means to pay loan establishment fees and meet ongoing loan repayment requirements with Bank of us.

- Not own or have an interest in any real-estate property other than the land you want to build on under the program.

- Be neither undischarged nor have been discharged, from bankruptcy within three years preceding the application date.

- Not have any outstanding debts to Homes Tasmania.

- Must not have received help under the Home Ownership Assistance Program, Streets Ahead or Homeshare.

Important Note

You are exempt from income and assets test requirements if you:

- Are a current tenant of Homes Tasmania property.

- Qualify for the FHOG from the Tasmanian Government.

- Are a first homebuyer and qualify for the first-home buyer stamp duty concession.

- A home or unit that is a newly constructed dwelling.

- Building a new home under a house and land package.

- Building a new home on land currently owned by you with a separate contract to build.

- An existing home or unit.

- An existing Homes Tasmania property

- An ‘off-the-plan‘ purchase.

FAQs About MyHome Shared Equity Scheme

Are All Properties Eligible For MyHome?

No, not all properties are eligible. Below is the list of eligible properties.

Which Lenders Are Available?

How Can I Pay Out Homes Tasmania's Share Of Equity?

What Happens If I Sell The House?

What If I Have A Current HomeShare Mortgage?

Can I Refinance My Existing HomeShare Loan?

How To Apply

Tasmania’s shared-equity scheme, MyHome, is directly administered by Bank of us. If you’re interested in applying, please contact them directly. These schemes are not available through a mortgage broker.