Updated: 06 Aug, 2024

How much of your home loan repayments are actually reducing your mortgage balance and how much is going to your bank as interest and administration fees?

Unless you’re paying interest only, it can be a little tricky trying to figure out the exact amount of interest that makes up each of your mortgage repayments.

On top of that, depending on the type of home loan you have, there are other ongoing costs that you’ll have to pay such as home loan start-up costs and fees related to offset accounts, credit card facilities and lines of credit.

Luckily, there are ways to reduce the amount of interest and ongoing that you’re paying.

How do I work out how much interest I’m paying?

The easiest way to explain this is with an example.

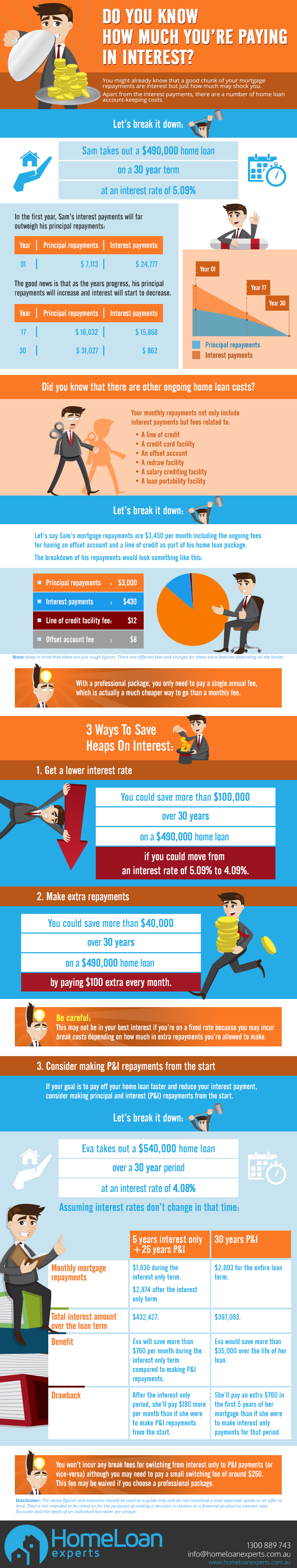

Brad is in the market to buy a property and, after applying with his bank, he’s approved for a $490,000 home loan over a 30 year term at an interest rate of 5.09%.

As a first home buyer, he decides he wants to make things a little easier for himself in the first years of home ownership and sets up his mortgage to just make interest only payments for the first 5 years.

In this scenario, it’s easy for Brad to track exactly how much interest he’s paying on his mortgage, at least during the interest only period.

If you’re making fortnightly principal and interest (P&I) repayments, you won’t be paying the same ratio of P&I over the loan term.

So how can you work this out?

You can use the loan repayment calculator to work out your estimated repayments over a 30 year term.

So if Brad were to make P&I repayments instead of interest only, he’d only pay off around $7,113 in principal payments and a whopping $24,777 in interest in the first year. As the years progress, he’ll gradually pay less in interest and more in principal payments.

By the seventeenth year, he will have started paying off more of the principal component than the interest component of his mortgage, that is, roughly $16,032 in principal repayments and $15,858 in interest repayments.

In the final year (year 30) of Brad’s mortgage, he’d have paid off almost the entire principal amount and have only a small amount of interest left to pay.

As a rough estimation, Brad would have $30,000 left to pay in principal repayments and less than a $1,000 to pay in interest.

What other costs are there?

Aside from the principal and interest, your mortgage repayments may also include ongoing costs depending on the extra features you decided to get with your loan. For example, the bank will charge you a fee for having a line of credit, a credit card facility, an offset account or a redraw facility.

So how does this break down in your mortgage repayments?

Let’s say you have a home loan with an offset account and a line of credit facility, and your mortgage repayments are $3,450 per month. In this scenario:

- $3,000 would be going towards paying down your loan.

- Around $430 would be going towards interest.

- The remaining $20 would be for the use or administrative costs of the above additional home loan features: $12 for the line of credit facility and $8 for the offset account.

Keep in mind that these are just rough figures. Every lender charges different fees for each of these extra features.

Did you know that with a professional package, you’ll simply have to pay a single annual fee, which includes all ongoing payments?

Paying an annual fee instead of a monthly fee is actually a much cheaper way to go.

How can you save heaps on interest?

Firstly, when shopping for a home loan, finding a lender with a lower interest rate can actually save you thousands over the loan term.

So for Brad’s $490,000 home loan, he could save more than $100,000 over 30 years if he could qualify for a 4.09% interest rate compared to 5.09%.

Most mortgage brokers can help you get a good deal with at an advertised rate but a mortgage broker with exceptionally strong lender relationships can actually build a strong case with the right lender to negotiate special pricing for you.

Make extra repayments!

Yes, negotiating a great interest rate is an important first step but the best way to reduce your interest is to make as many additional repayments as your lender will allow.

Not only will you pay off your mortgage faster but you may potentially save thousands in interest.

For example, if you were to pay just $100 extra every month on a $490,000 home loan over 30 years, you’d save more than $40,000 in interest!

Not only that, you’ll have paid off the entire 30 year mortgage in about 28 years!

You can use the extra repayment calculator to discover just how much you can save.

As mentioned above though, your lender may not allow you to make extra repayments or may simply not be in your best interest to make additional repayments, especially for:

- Fixed rate home loans: Most fixed rate home loans have a limit on the amount of additional repayments you can make during the fixed rate period, which is usually 2, 3 or 5 years. In most cases, this may be around $10,000 a year and if you exceed this amount, you’ll likely have to pay some amount in break costs to the lender.

A mortgage broker may be able to negotiate with your lender to allow you to pay up to $750 extra per month without risking going over the limit.

- Investors: In general, most investors would rather save money to invest in something else rather than pay back their investment loan.

It’s advised that if you’ve got non-tax deductible debts like a home loan or a car loan then pay them first. You can make additional repayments into your offset account if you have one, if the only debt you have left is an investment loan.

- Interest only loans: Interest only loans free up your cash flow and give you a more flexible payment schedule. You pay interest only to reduce your monthly repayments, not increase them so it’s likely your intentions conflict directly with making extra repayments.

Despite that, you can still make extra repayments on an interest only home loan but the additional repayments will only pay off the principal and not the interest.

Consider making P&I repayments from the start

Interest only is a very appealing option for many borrowers, particularly investors, because it allows them to reduce their mortgage repayments in the short-term in the expectation that they can later reap the capital growth benefits of their property over the long term.

First home buyers don’t tend to take this strategic approach with interest only loans and simply see it as a way of easing their repayments in the first few years to help them cope with their new (big) financial commitment.

It’s important to bear in mind that although paying P&I will increase your monthly mortgage repayments, you’ll generally be saving thousands in interest over the life of the mortgage compared to interest only.

Suppose you take out a $540,000 home loan over a 30 year period at a 4.08% interest rate.

If you pay interest only for 5 years, your monthly mortgage repayments would be $1,836 over the interest only term and $2,874 a month at the end of the interest only period.

If you chose P&I repayments from the start of your home loan, your monthly repayments would be around $2,603 for the entire 30 year term assuming the interest rates don’t change.

So what does that mean over the life of your home loan?

Well, by choosing interest only for the first 5 years of your mortgage, you’d be paying around $432,427 in interest compared to $397,083 in interest with P&I. That’s a saving of more than $35,000!

If your goal is to pay off your home loan faster and reduce your interest payment, consider making P&I repayments right from the get go. You can even switch to P&I repayments early if your interest only term isn’t completed.

Do I need to pay any break costs?

You won’t need to pay any break costs for switching from interest only to P&I or vice-versa as long as the loan isn’t fixed. However, there may be a small switching fee of around $250 that you’ll have to pay.

This switching fee varies from lender to lender but it will likely be waived if you have a professional package.

Need help with your home loan?

Whether you’re a first home buyer taking out a home loan to buy your dream home or you’re looking to refinance an existing home loan, we can help you set up a home loan that’s right for your needs.

How?

We’re credit specialists and our brokers have considerable knowledge on a wide range of home loan products from over 40 lenders all over Australia!

Because of the relationships that we have with the decision-makers at these lenders, we’re often in position to negotiate a competitive interest rate and even get some mortgage fees waived. This comes down to the strength of your application.

Call us on 1300 889 743 or complete our free assessment form and one of our mortgage brokers will contact you within 24 hours to discuss your situation.