Updated: 12 Aug, 2024

Be prepared!

If you missed it, we recently gave you a prediction of what a house in Sydney may be worth in the next 50 years and believe us, we’re not trying to scare you. We just want potential home buyers to be prepared for the Sydney of the future, a property market that is still tipped to grow at a rate of 9 per cent over the next three years.

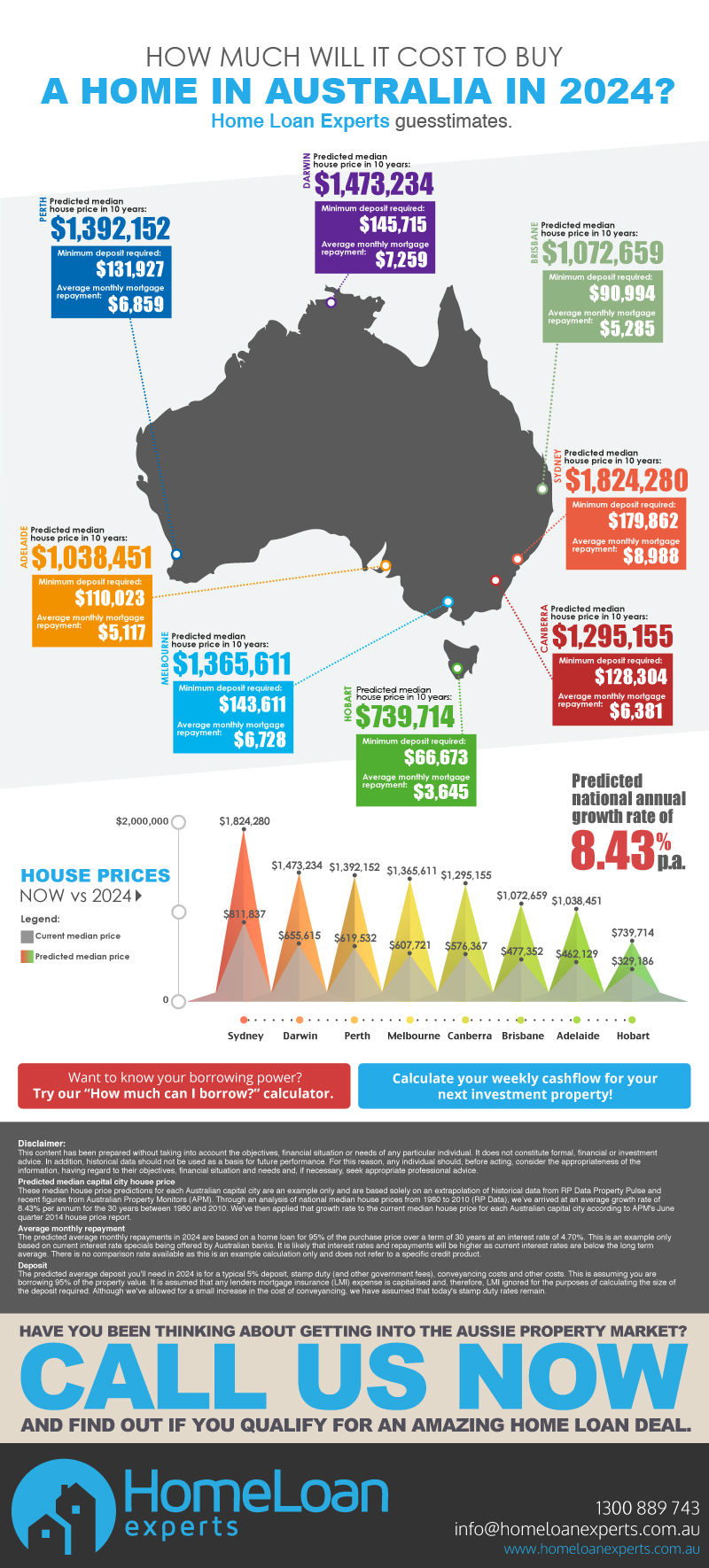

What about the next ten years though? What will you be expected to cough up for a house in not only Sydney but the rest of the Australian capital cities in 2024?

In our latest round of number crunching, we’ve not only guesstimated that the median price for a house in almost all capital cities will be over $1 million, but we’ve also worked out what kind of deposit you’ll need and how much you’ll be expected to pay in mortgage repayments. All this for the privilege of having a roof over your head!

“Owning property is one of the biggest dividers of wealth in Australia,” Home Loan Experts managing director Otto Dargan says.

“If it continues to grow into the future then anybody without property is going to get left behind by their friends who purchased.”

It’s not that far out of left field considering the fact that Australian house prices have risen by 221.4 per cent in the past 30 years, the second biggest house price increase in the world behind the UK (231.9 per cent), according to a recent report from real estate company CBRE Commercial Real Estate Services.

Before you ask your parents to start peddling drugs to help you with your deposit (see: Walter White), have you worked how much you can borrow? It may be more than you think.

Alternatively, are your parents in a position to act as guarantors on your home loan? It’s currently the only way in Australia to borrow 100% or more of the property value.

If you’re looking to get your foot into the property market today and are struggling to save up a deposit, speak with one of our mortgage brokers so they can assess your situation and recommend a no deposit home loan option that works best for you. Call 1300 889 743 or fill in our free assessment form today.

Sydney creeping towards the $2m mark

It’s no great surprise that the research we’ve compiled from RP Data and Australian Property Monitors (APM) is pointing to a Sydney median house price that will continue to outstrip the other state capitals in 2024 at well over $1.8 million.*

Of course, that’s if prices continue to grow at a predicted 8.43% per annum. How do the other state capitals stack up?

- Darwin – $1,473,234

- Perth – $1,392,152

- Melbourne – $1,365,611

- Canberra – $1,295,155

- Brisbane – $1,072,659

- Adelaide – $1,038,451

Hobart ($739,714) is predicted to be the only capital to not crack the $1 million mark in the next ten years which is great if you’re a first home buyer but not so much if you’re an investor trying to build a strong property portfolio.

“We’re seeing a lot of investors buying in capital cities that they think will outperform the other markets,” says Otto.

“Many of our customers who bought their first home only two or three years ago now have the equity to buy their first investment property.”

Otto also adds that recent heated debates about allowing negative gearing benefits to continue for current property investors and banning it going forward (grandfathering) means it may well be a good time to buy now.

Can you afford the deposit?

It’s a little unnerving to think that the minimum 5% deposit required for a house in Sydney in 10 years’ time will amount to almost $180,000. Keep in mind, that’s on the basis that the costs associated with a home loan including stamp duty and conveyancing remain stable.**

To put that into perspective, you could have bought two houses in Sydney in 1984 for that price, based on historical median house price figures from Dr. Nigel Stapledon’s 2007 research report titled ‘Long Term Housing Prices in Australia and Some Economic Perspectives’.

On top of that, you’ll save more than $30,000 on your deposit if you buy a house in Darwin ($145,715) instead.

For the other capital cities, the minimum deposit required for the predicted median house price in 2024 will be :

- Melbourne – $143,611

- Perth – $131,927

- Canberra – $128,304

- Adelaide – $110,023

- Brisbane – $90,994

- Hobart – $66,673

Did you know that most banks require you to show proof that you have 5% deposit saved before they’ll approve your loan?

We have three lenders on our panel that will approve loans for up to 90% of the property value (90% LVR) no matter the source of your deposit, and one that will approve a loan for 95% LVR even if you don’t have genuine savings.

Call 1300 889 743 and discover if you qualify.

Can you afford your loan repayments?

So you’ve saved enough for a deposit or you’ve asked your parents for a helping hand. Do you have the ability to pay off the mortgage though?

With mortgage stress on the rise in Australia, according to Genworth’s March 2014 Home Buyer Confidence Index (HCI) report, it is essential that you use our loan repayment calculator to get a rough idea of how much you will be paying on a monthly basis.

Can you afford to buy a high end dinner suit every month? If you’re James Bond then MI6 has you covered, but for the non-spy borrower, that’s about how much you’d be paying for a median priced house in Melbourne in 2024, roughly $6,728 a month.

Now this predicted average monthly mortgage repayment is based on a 95% home loan on a 30 year term at a 4.70% interest rate. With interest rates currently at historic lows, these payments are really a best case scenario for hopeful home buyers.

If pricey loan payments are your biggest concern then perhaps you should steer clear of Sydney, where repayments are predicted to be a whopping $8,988! Wages are going to increase, right?***

In descending order, predicted monthly mortgage repayments for the other capital cities are as follows:

- Darwin – $7,259 per month

- Perth – $6,859 per month

- Canberra – $6,381 per month

- Brisbane – $5,285 per month

- Adelaide – $5,117 per month

- Hobart – $3,645 per month

Why wait for a house price drop?

Do you want to own your own home but aren’t sure if you can afford to? Speak with one our mortgage brokers today by calling 1300 889 743 or filling in our free assessment form.

We can assess your situation and tell you how much you can borrow, how much you’ll need for a deposit and find a home loan that’s perfect for you.

Many of our brokers are property investors with healthy portfolios so we understand the market. Our Home Buyer Centre contains useful calculators, guides and tips that will help you prepare to buy a property.

Disclaimer

This content has been prepared without taking into account the objectives, financial situation or needs of any particular individual. It does not constitute formal, financial or investment advice. In addition, historical data should not be used as a basis for future performance. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to their objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

*Predicted median capital city house price

These median house price predictions for each Australian capital city are an example only and are based solely on an extrapolation of historical data from RP Data Property Pulse and recent figures from Australian Property Monitors (APM). Through an analysis of national median house prices from 1980 to 2010 (RP Data), we’ve arrived at an average growth rate of 8.43% per annum for the 30 years between 1980 and 2010.

We’ve then applied that growth rate to the current median house price for each Australian capital city according to APM’s June quarter 2014 house price report.

**Deposit

The predicted average deposit you’ll need in 2024 is for a typical 5% deposit, stamp duty (and other government fees), conveyancing costs and other costs. This is assuming you are borrowing 95% of the property value. It is assumed that any lenders mortgage insurance (LMI) expense is capitalised and, therefore, LMI is ignored for the purposes of calculating the size of the deposit required. Although we’ve allowed for a small increase in the cost of conveyancing, we have assumed that today’s stamp duty rates remain.

***Average monthly repayment

The predicted average monthly repayments in 2024 are based on a home loan for 95% of the purchase price over a term of 30 years at an interest rate of 4.70%. This is an example only based on current interest rate specials being offered by Australian banks. It is likely that interest rates and repayments will be higher as current interest rates are below the long term average. There is no comparison rate available as this is an example calculation only and does not refer to a specific credit product.