Updated: 04 Mar, 2025

Real estate agents stretching the truth?

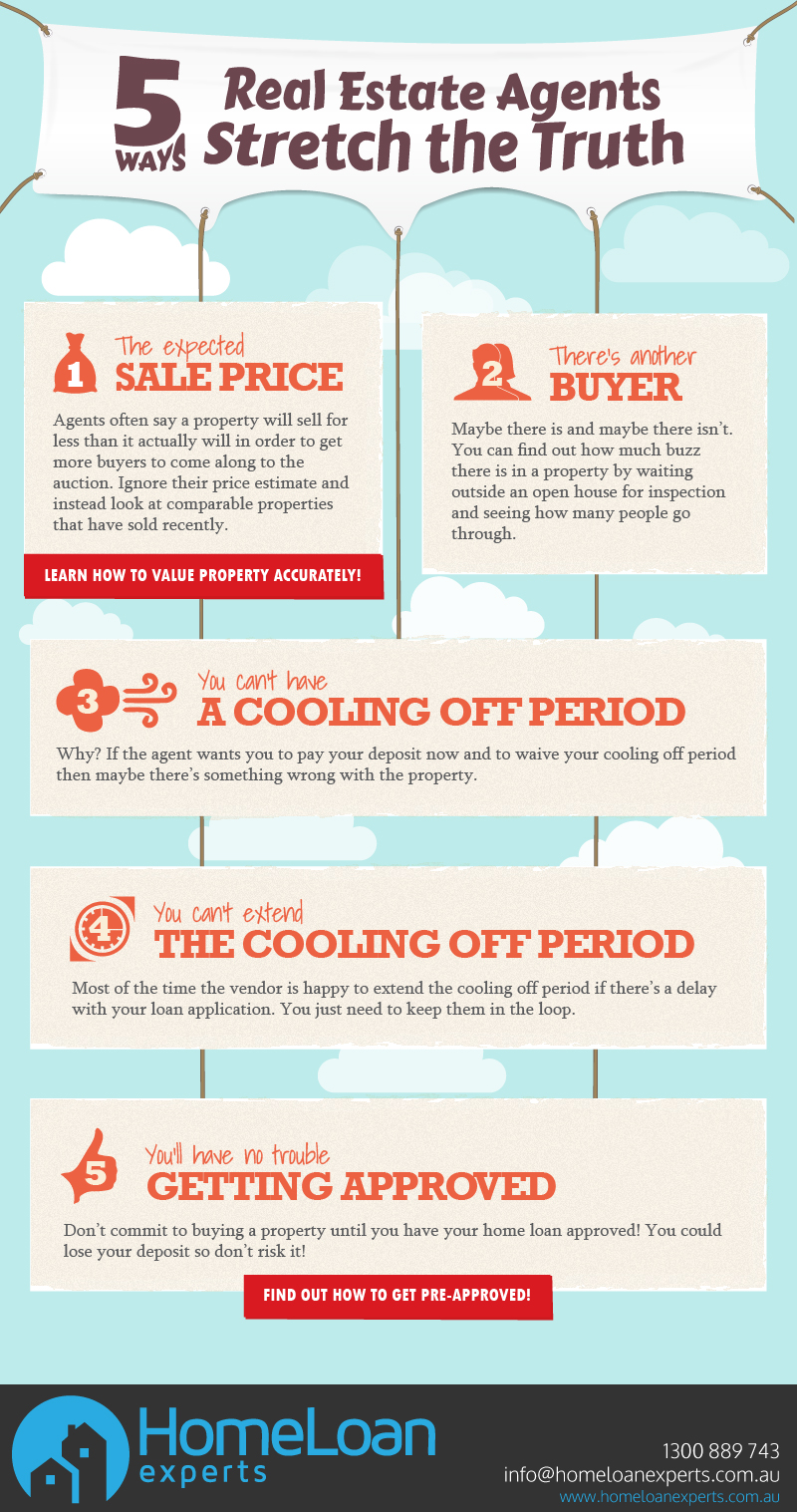

So you’ve found a house that you might be interested in and you have some questions for the real estate agent. The question is can you really trust everything they tell you?

Of course, not every real estate agent is the same but it’s safe to say that even the best of them may stretch the truth sometimes in order to make a sale. So what are these fibs that you should watch out for?

1. The unexpected sale price

Firstly, beware of the sale price they tell you! Agents may try to decrease the price of a property to attract more potential buyers. After all, everyone loves a good deal!

You can avoid getting sucked into this trap by looking up similar properties that have sold in the area recently and comparing their prices. This helps you to make better decisions and determine whether the price of the property has been inflated by the agent.

Check out this guide to accurately estimating the value of real estate.

2. There's another buyer

The second way real estate agents try to bamboozle you is by telling you that there is another buyer. They do this to scare you into buying quickly. A simple way to outsmart them is by spending some time outside an open house and seeing for yourself how many people actually show up. Just don’t get arrested for stalking!

3. You can't have a cooling off period

Cooling off periods can also be used by agents to put one over you. Some agents try to make you pay your deposit right there and then and suggest that you waive your cooling off period. This really isn’t a good idea because there may be something wrong with the property that you haven’t noticed. You may even lose your deposit if you try to back out of the deal later.

4. You can't extend the cooling off period

Agents can also tell you that you cannot extend your cooling off period but don’t get fooled! Vendors are usually happy to extend the period just in case your loan application gets delayed. Just remember to keep them well-informed of the status of your application and you shouldn’t have any problems.

5. You'll have no trouble getting approved

Speaking of deposits, don’t commit to buying a property until you are sure that your home loan has been approved! The best approach is toapply for a pre-approval before you make any decisions.

Be wary when applying for a pre-approval though because not all of them are reliable. Speak to your mortgage broker and they can tell you whether your pre-approval has been given the green light. On-the-spot or online pre-approvals are basically worthless!

Some real estate agents are more “honest” than others, nonetheless as a buyer it is your duty to be informed and prepared for all eventualities in order to make the right decision when buying a home. Check out our Home Buyer Learning Centre for more tips on how to buy a home.

If you have had any good or bad experiences dealing with real estate agents, please share them below! If you are ready to apply for a home loan or need help with your pre-approval, call us on 1300 889 743 or fill in our free assessment form to speak to one of our expert mortgage brokers.