Updated: 23 Jul, 2024

Refinance an outstanding tax debt

For self-employed people completing a tax return can be complex and time-consuming. It doesn’t always get done on time, mistakes can be made and come tax time you may be hit with a tax debt from the Australian Taxation Office (ATO).

Getting a bill from the ATO can come as a big surprise to most people because even if you’re super organised and keep good business records and receipts, it could all come down to an accounting error.

If you’re making $80,000 a year, you may have to pay back around $20,000 or more to the government! That’s a large amount of money most people don’t have just lying around, especially if you have a mortgage to pay.

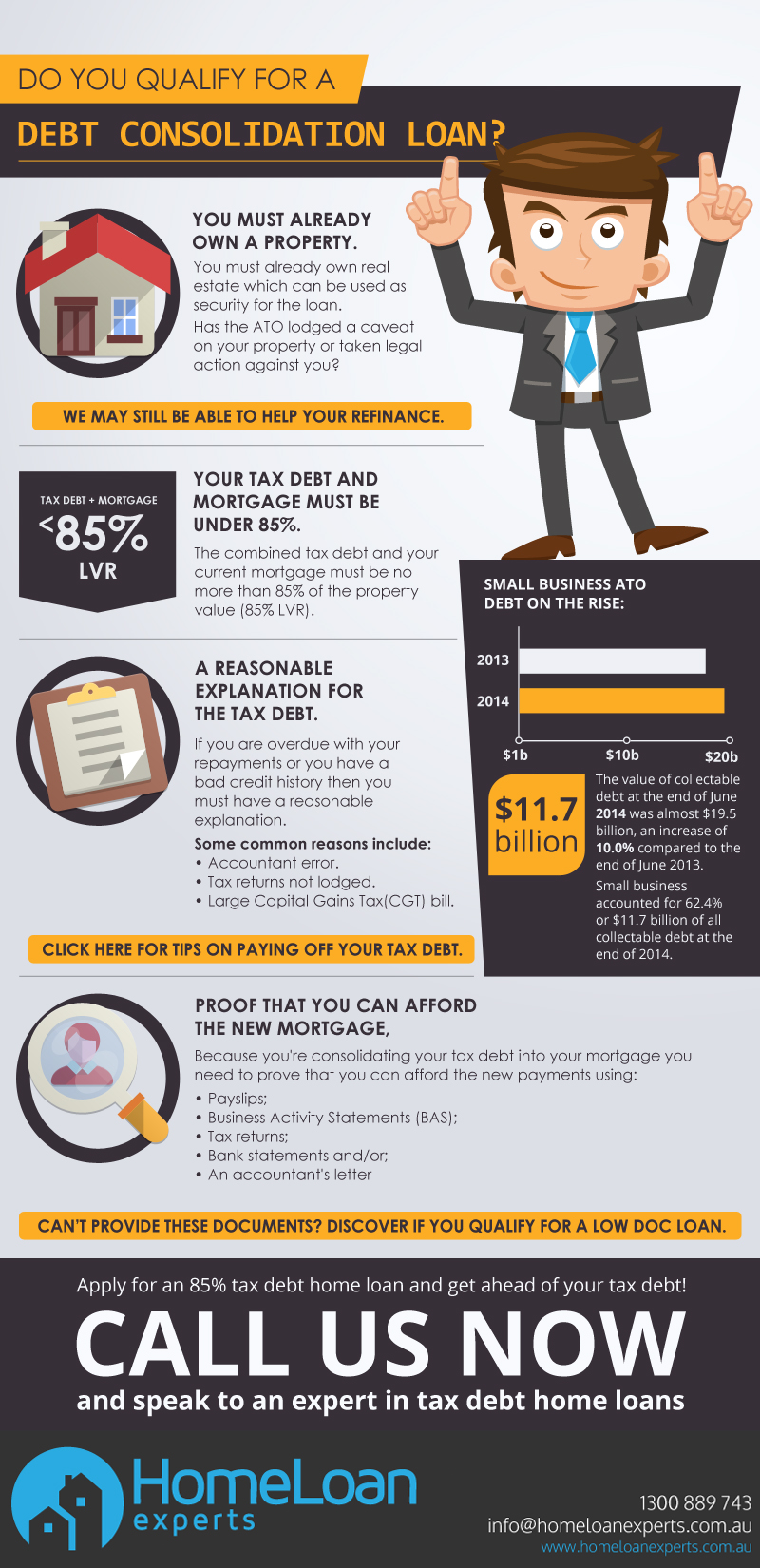

Rolling your debts into one loan is a great way to easily manage your debt and reduce your overall repayments. Unfortunately, most banks won’t approve a loan to refinance an outstanding tax debt.

Luckily though, we’re experts in tax debt home loans and we know specialist lenders that will refinance your mortgage as long as you already own real estate to use as security for the home loan and the combined tax debt and home loan (loan to value ratio) is no more than 85% of the property value.

How does a 85% tax debt home loan work?

When you get a tax debt, you generally have two options available to you: you either pay it all out or you pay out a portion of the debt and repay the rest in installments.

For example, for an ATO debt of $150,000, you may agree to pay out $100,000 and go on a payment plan for the remaining $50,000. Keep in mind though that you will potentially have to pay interest and other fees when you enter into a payment plan.

In order to consolidate that $100,000 when you refinance your home loan, you need to provide evidence in the form of payslips, business activity statement (BAS), tax return bank statements and/or an accountant’s letter that you can service the payment plan that’s being proposed by the ATO. If you can’t provide this income evidence, low doc loans are available on a case by case basis.

Despite having a reputation of being quite aggressive with taxpayers, the ATO will usually negotiate the debt if you pay a lump sum. In addition, if you have had a pending debt for a while you can negotiate to have fees and interest already charged on the debt reduced or even waived.

“I once negotiated a business debt down from $150,000 to $90,000 saving a client $60,000 in fees and interest,” Home Loan Experts senior mortgage broker Matthew Trad said.

“With his debt at $90,000, the ATO received around $20,000 in interest and fees instead, but if they wound up his business, they would have received nothing.”

If you already have a property to use as security, an 85% tax debt home loan is the best way to reduce your ATO debt repayments. Now, trying to get money back from the ATO, that’s a different story!

The tax office is also very slow to move so although our brokers can’t keep them at bay for you, we can help you demonstrate to them your intention to pay your debt with an indicative approval from a lender, buying you more time and saving you from paying even more in interest.

We’re experts in tax debt home loans so please call us on 1300 889 743 or complete our free assessment form today and we can find the best home loan solution for you.

Will I pay a higher interest rate?

We’ve got a few prime and non prime lenders that will refinance tax debt. That means, depending on your overall credit worthiness, you may be able to get the same interest rate as someone without a tax debt!

How do I prove that I’m a good borrower?

Accruing a tax debt is a sign of bad character and financial stress for most banks. Applying to refinance itself already demonstrates a lack of financial stability and a greater chance of being hit with another tax debt in the future.

By providing printouts from the ATO portal showing that you have made your repayments on time for the last six months, your application will be viewed more favourably. However, you may be able to provide evidence showing your capacity to repay the home loan in different ways, even with an outstanding ATO debt.

We will review your overall situation and help devise a strategy based on your individual scenario. We can present a good case on your behalf to the lender and we have a strong success rate with these types of home loans.

If you’ve been satisfying other debts like a mortgage, credit cards and a personal loan and your total repayments are $6,000 a month, while the proposed new repayments for your refinanced loan is $5,500 a month, you’ve demonstrated capacity with your other debts. Of course, this is on a case by case basis, so please complete our free assessment form explaining your situation to one of our mortgage brokers.

Some self-employed people find out that they’ve gotten a tax debt and freak out. They’ll go and write off their tax bill and when they go to the bank to get a home loan it looks like they’ve earned no money. This is even worse than having a debt from the ATO!

We have intimate knowledge of the credit policies of close to 40 lenders on our panel. It’s not a matter of shopping you around. We know, based on your situation, where we can go to get you approved.

What if the ATO has placed a caveat on my property?

Some lenders will refinance your home loan despite having a caveat on your property!

Depending on the size of your debt and whether or not you’ve missed your debt repayments, the ATO may move quickly to place an interest or caveat on your property, preventing you from selling the property until you pay your debt.

In most cases, your loan will be approved upon the condition that the full debt is satisfied at settlement.

What usually happens is that the ATO, the new bank and your old bank will all attend settlement and your new lender will hand over the outstanding funds to the tax office. Upon receipt of the cheque, the caveat will usually be removed.

You may even be able to get refinanced even if the ATO has taken you to court! We know specialist lenders who can refinance your mortgage and pay the full debt including the General Interest Charge (GIC) and legal fees.

Call us on 1300 889 743 to find out if you can get approved.

How do people get a tax debt?

Although a good accountant will advise you to account for GST and pay a portion of your income tax in an ATO account when completing your BAS, a lot of people don’t make PAYG installments.

For business activity statement debt more than $25,000 or income tax debt over $50,000, your accountant may be able to arrange with the ATO to repay your debt in installments.

Keep in mind though, arranging to pay back $2,000 a month, for example, may very well mess with your cash flow. What if that works out to be part of your wages that you pay yourself?

In addition, if the debt isn’t paid before the agreed due date, GIC will be accrued on the unpaid debt from the original due date.

You’re not likely going to be able to pay off $50,000 in tax debt within the agreed time frame, especially if you’ve got a business to run and a mortgage to pay.

With an 85% tax debt home loan you can get ahead of your tax debt! Please call us on 1300 889 743 or complete our free assessment form and our brokers can tell what options are available to you.