Updated: 13 Jan, 2025

Table of Contents

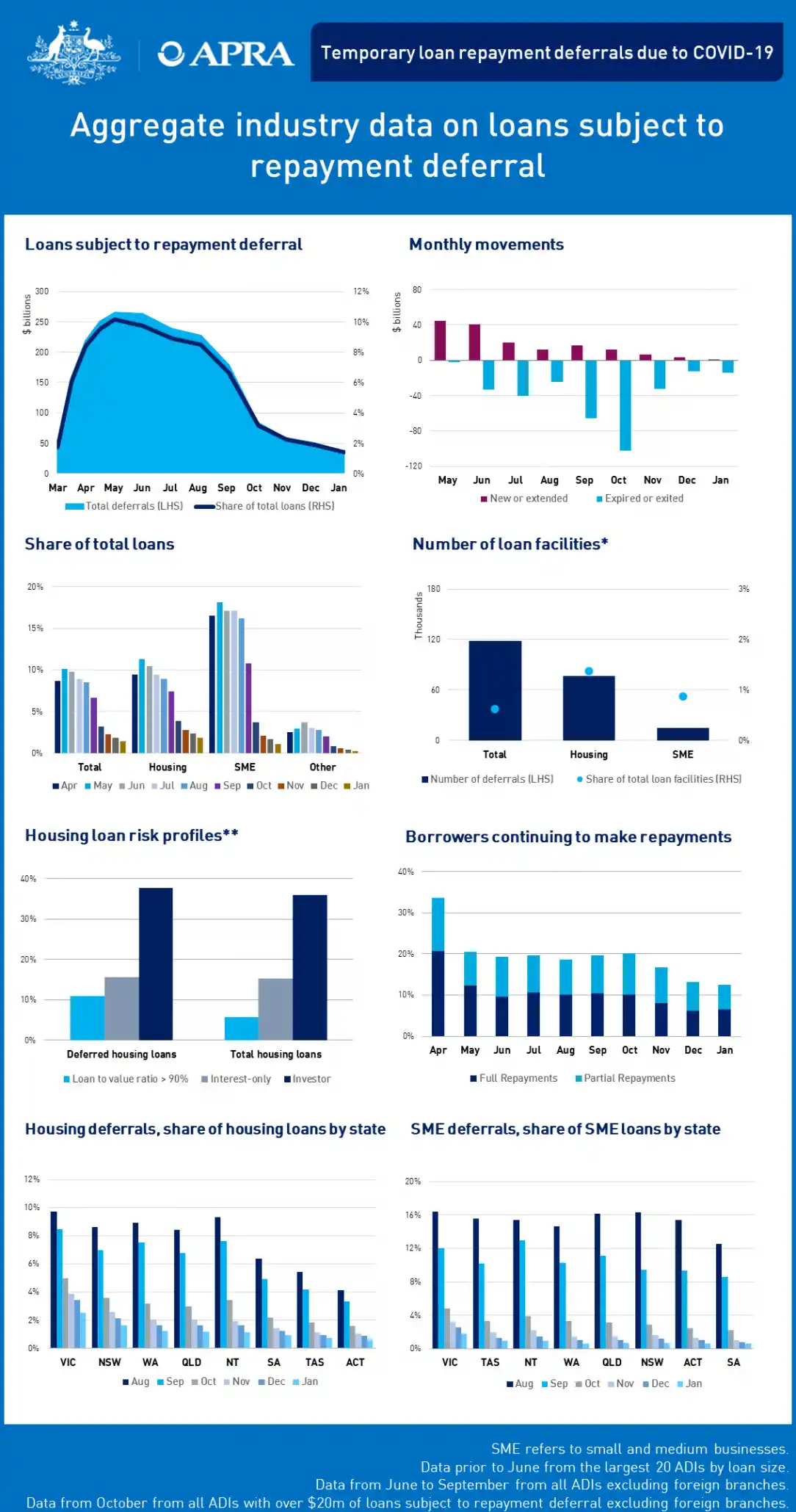

The economic crisis brought by the COVID-19 pandemic last year prompted lenders to grant a mortgage deferral to borrowers. The mortgage ‘holiday’ acted as a relief for many.

Of the total home loan takers across lender banks, 10% accepted the offer and paused their repayments.

Further, the lender banks were allowed to give extensions of up to four months to their customers for repayments.

The new deadline was now ten months from the start of mortgage deferral or until March 31st.

Below is a comprehensive chart to summarise the loans subject to a repayment deferral.

The most recent stats published by the Australian Prudential Regulation Authority (APRA) show the total mortgage deferral at $32 billion.

The sum now being quite large, and with the deadline approaching soon, lenders have started to pull back deferrals according to their terms and policies.

The lender bank with the highest mortgage deferral of 10% on April 31st was down at 3% by December 31st.

Similarly, the lender bank with the least mortgage deferral of 4% was down by 1% during the same time interval.

Mostly, the decline was because banks stopped giving automatic repayment holidays to their customers. And, by now, they are even asking borrowers to start making repayments.

So, given the circumstance, if you are yet to recover from the economic crisis, here are some solutions:

Extending the mortgage deferral period

If your mortgage deferral period ends before March 31st, you can extend it.

However, since it is March already, many lenders will be reluctant towards the idea.

This instance is where your broker can step in.

As they have access to Business Development Managers of lenders, they can always liaise with them for the extension.

Once the lender is assured of your capability to make repayments after the deferral period, you will get the extension.

Extending the term of your loan

Extending your loan term buys you more time to pay off your loan, and the repayment instalments will decrease.

Note: You must be aware that the total interest to be paid will also increase due to the extension.

Consolidating your loans

If you have multiple loans to make repayments, you should consider consolidating them into a single loan.

Consolidating them to a single mortgage loan reduces the total repayments you would have to make separately.

Interest-only payment

You can switch over to an interest-only payment option temporarily to avoid making principal repayments.

Doing this will help you:

- Avoid making principal payments for up to 5 years

- Come over your financial crunch

However, it has some cons, including:

- Not gaining equity to the property

- Having to pay more interest over the years

Of all the solution, you must go with the once that best compliments your case.

Are you looking to change the terms of your loan? Our mortgage brokers are here to help. Call us on 1300 889 743 or enquire online.