Step 2: Find out if anything will stop your bank from negotiating

So what allows you to get a lower interest rate?

- The bigger the loan, the lower the rate!

- Borrowing under 80% of the property value will get you a better rate with some lenders.

- Banks offer better deals on home loans than investment loans.

- Banks will offer a better rate to win a new customer which is why people refinance.

When will you pay a higher interest rate?

- Investment loans and interest only loans tend to have higher rates but some banks will still negotiate

- Some banks refuse to negotiate if you owe over 80% of the property value.

- Most banks will not negotiate the rate for low doc loans so it's often better to refinance.

- The bank may not have an appetite for your customer type, for example, if you're a non-resident, self-employed or you're a property investor.

- If you've missed payments on your debts, they'll refuse to negotiate so it's better to refinance.

- Banks don't offer their existing borrowers the best rates. They actually punish loyalty!

Do you need help to get a better interest rate? There are ways you can lower your repayment without refinancing. Give us a call on 1300 889 743 or fill in our free assessment form and our mortgage brokers will do the negotiating for you!

) [7] => stdClass Object ( [post_id] => 78510 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>At Home Loan Experts, we have mortgage brokers who are specialists in all niches. Plus, they’re legally obligated to act in your best interest. This means they’ll consider your financial situation and recommend loan products that are suitable for you. Our expert brokers regularly answer consumers’ most frequently asked questions about home loans. Check them out to get all the answers you need.

1. What Interest Rate Am I Eligible For, And What Is The Maximum Amount I Can Borrow?

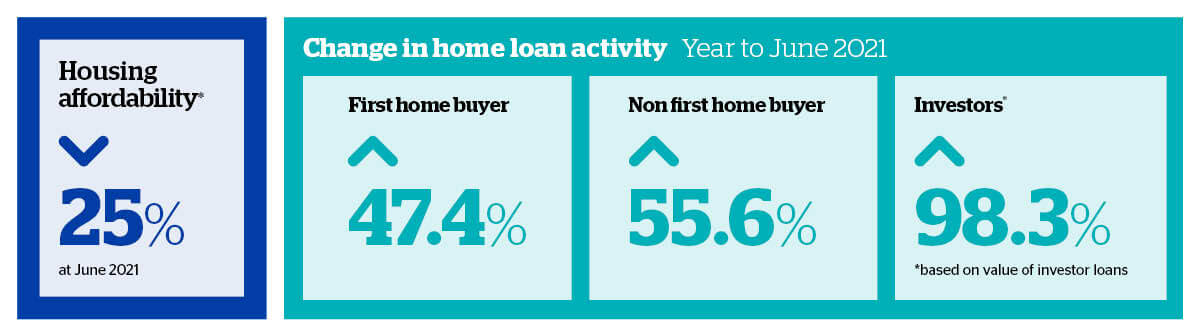

The interest rates a lender will offer you and the amount you can borrow are affected by some of the same factors. Interest rates are affected by the official cash rate set by the RBA and each lender's own rates and lending policies. The stronger your home loan application, the better the rates lenders will offer you. The strength of your loan application is determined by how much deposit you can pay, your Loan-to-Value Ratio (LVR, the lower the better), what kind of credit rating you have, and other factors. How much you can borrow is also affected by the RBA’s decisions. The lender will assess your serviceability – your ability to repay the loan. Higher interest rates mean higher repayments and that means the more rates go up, the less you’ll be able to borrow. Other factors lenders will use to determine your serviceability include your credit history, income, expenses and other financial commitments. Check how much you can borrow through our borrowing capacity calculator.If you want to know how much money you can borrow from a certain lender, please get in touch with our mortgage brokers at 1300 889 743 or fill out our free assessment form.

2. What Government Grants Are Available? Can I Qualify For Any?

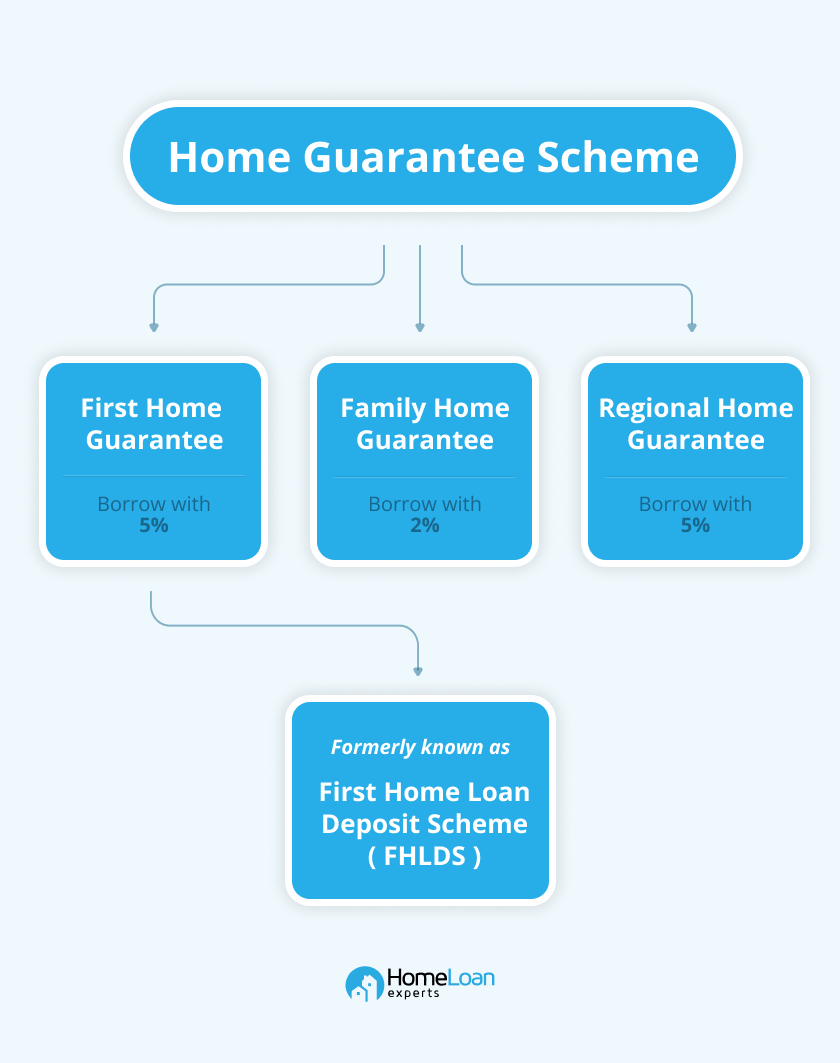

There are several government grants available to assist first-home buyers in Australia. As of 2023, some of the major national government schemes for first-home buyers include the Help to Buy Scheme, First Home Guarantee (previously known as First Home Loan Deposit Scheme), Family Home Guarantee, Regional First Home Buyer Support Scheme, and the First Home Super Saver Scheme. Eligibility for these schemes can depend on various factors, including your income, the property's value, the location of the property and whether you are a first-home buyer.

3. What Refinance Or First-Buyer Cashback Can I Get?

Lenders may offer cashback incentives to those who refinance. The amount of cashback offered can vary by lender and may depend on the amount you are refinancing. You can find all of the current offers on our refinance rebates page. Cashback offers are also available for first-home buyers. You can check for offers on our purchase cashback page.

4. Do I Have Any Equity In My Home?

This question is a common one for homeowners who are curious about the current value of their property and how much equity they have built up over time. Equity is the difference between the market value of your home and the amount you owe on your mortgage. To determine how much equity you have, you can have an appraisal done on your property or use our property equity calculator to estimate the value.

5. I Have Recently Been Employed. Do I Need To Be Three Months In This Job To Be Eligible For A Home Loan?

Many lenders prefer to see at least three months of continuous employment in the same job or industry before considering an application for a home loan. However, some lenders may consider less than three months if you can provide evidence of strong employment history and stability. It is important to note that each lender has its own criteria for assessing loan applications, and meeting the employment requirement does not guarantee approval.

6. Should I Consolidate My Personal/Car Loan Into My Home Loan?

Consolidating your personal or car loan into your home loan can simplify your debt repayments and lower your overall interest rate, but you may end up paying more interest in the long run. There may also be cashback options available depending on the type of debt.

7. Can I Buy/Build Property On A Temporary Visa?

In most cases, temporary visa holders will need to pay additional fees, such as foreign buyer surcharges and stamp duty, on top of the property price. Some lenders may require you to have a specific type of visa and a minimum period remaining on your visa before they consider your application. You may also need FIRB approval. Some temporary visa holders may not have a large enough deposit to purchase a property. In these cases, a mortgage broker can help them with a ‘prepare to buy’ plan.

8. Can I Get A Cheaper Rate As A Foreign Investor?

No, as a foreign investor, you may actually end up paying higher interest rates than Australian citizens and permanent residents. The Australian government imposes additional fees and taxes on foreign property investors, which can make it more expensive to obtain a mortgage.

9. Should I Go For Fixed Or Variable?

Whether a fixed or variable interest rate is best for you depends on your financial goals and current interest rate trends. A fixed interest rate provides certainty on repayments, while a variable interest rate can allow you to reap the benefits if interest rates fall. Additionally, variable-rate home loans often allow for unlimited extra mortgage repayments, whereas fixed rates generally allow, at most $5K-$10K a year.

10. Can I Apply For A Loan If I Have Been Part IX Debt Discharged?

If you've been Part IX (9) debt discharged, you may still be eligible to apply for a loan, including a land and construction loan. However, it's important to note that you may face higher interest rates and have fewer lender options available to you. In most cases, specialist lenders are the only ones who offer loans for individuals with a history of debt discharge.

) [8] => stdClass Object ( [post_id] => 33308 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>Yes, you can. It’s quite common for couples to come into a relationship with one of them already owning a property.

Other couples choose to buy a property in just one name for asset protection reasons.

The problem is some banks won’t accept two borrowers, one owner and may knock back your home loan.

"Example of two owners, one borrower"

- A couple's home can be in just one name.

- A couple's investment property can sometimes be in just one name.

- Your business can borrow against a home owned by your partner.

- You can't borrow against a property owned by someone unrelated, except with a guarantor loan.

Do you need help finding a lender that will accept your loan structure?

Call us on 1300 889 743 or complete our free online assessment form and one of our specialist mortgage brokers will go through your options.

) [9] => stdClass Object ( [post_id] => 31076 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] => Use the interest only loan calculator to work how much more in interest you’ll pay over the life of your home loan by choosing interest only. This can help you make a better decision when choosing an interest only term.

By only having to make interest repayments for a period of your loan term, you can reduce the size of your mortgage repayments significantly.

Unfortunately, the industry regulator has forced banks to slowdown on approving interest only home loans so is it still possible to make just interest payments?

If you need help with getting a home loan, call 1300 889 743 or complete our free assessment form to speak with one of our mortgage brokers.

) [10] => stdClass Object ( [post_id] => 3378 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>

Yes! There are some lenders who will use all of your shift allowances, weekend penalty rates and night work penalty rates as long as you can show consistency over time.

- You can borrow up to 95% of the property value or up to 100% using a guarantor.

- 3 months in your job: Some of our lenders will use 80% of your overtime income.

- 2 years in your job: Some of our lenders will use 100% of your overtime income if it is consistent.

- Other allowances: Many employees receive other allowances for meals or transport which are generally not taken into account. If these allowances are not to reimburse you for an expense that you incur, we can get some of our lenders to consider this income on a case by case basis.

If you are not employed on a full time basis then please refer to our casual job page.

Please enquire online or call us on 1300 889 743 to discuss the nature of your allowances with one of our mortgage brokers.

) [11] => stdClass Object ( [post_id] => 446 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>Different lenders will consider different types of multiple dwelling complexes including townhouses, houses, villas, semi-detached and fully-detached housing developments.

Duplex / dual occupancy

- First home buyer: 95% of the property value on a case by case basis.

- Investor:95% of the property value.

- Low doc: 80% of the property value.

- Construction:95% of the property value.

- 100% loans:Available with some of our lenders if you have a guarantor.

- Discounts:Competitive professional package and basic loan discounts are available.

Note: Many LMI (Lenders Mortgage Insurance) providers restrict lending for duplexes even though they are readily saleable and are excellent security for a loan.

We have access to lenders that can consider loans over 80% of the property value.

Call us on 1300 889 743 or complete our free assessment form to discuss your investment plans with one of our mortgage brokers.

) [12] => stdClass Object ( [post_id] => 99 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>

- We are approval experts, not just a normal mortgage broker.

- Our services are free for most types of residential loans.

- Australia wide services.

- Access to almost 40 lenders including the major banks.

- A full member of the FBAA and AFCA, ensuring professional and ethical lending practices.

Using us as your mortgage broker

The team at Home Loan Experts are mostly former credit managers who approved difficult loans for both major banks and specialist lenders. What that means for you is that we know how to present your loan to make sure that it gets approved!

We also specialise in helping people in tricky situations. If your situation is unusual then most bank managers and mortgage brokers will not have the knowledge, experience and contacts to get your loan approved. We know exactly which lenders can help and how to present your loan application!

We are a friendly, young and enthusiastic team who aim to build strong relationships with our customers and help them realise their goals of home ownership. We don't charge any fees for most of our loans and we help individuals Australia-wide.

You're our customer and we will work with you to make sure your experience is positive and memorable. As a testament to our success as a team, we receive a large amount of referrals from satisfied customers, many of whom were originally declined by the banks.

Do you hold a credit licence?

Yes, we hold an Australian Credit License (ACL) as required under the National Consumer Credit Protection Act.

We are also a member of both the Finance Brokers Association of Australia (FBAA) and the Australian Financial Complaints Authority (AFCA).

We maintain the highest standard of training and education, as well as compliance with government regulations.

Will you charge a brokerage fee?

There are no fees for most of the loans we deal with. The very limited circumstances in which a fee may be applicable can be found on our Mortgage Broker Fees page.

To speak to a mortgage broker about your situation, call 1300 889 743 or complete our free assessment form and we will help you get approval.

) [13] => stdClass Object ( [post_id] => 45324 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>

Physicians and select medical professionals are eligible for special discounts on their home loan:

- Borrow up to 100% of the property value and avoid Lenders Mortgage Insurance (LMI).

- Get access to Interest rate discounts that aren’t available to the general public.

- Reap the rewards for high exposure limits if you're planning to rapidly grow your property portfolio.

- Benefit from flexible lending criteria thanks to the strong relationships that we have with on our panel, particularly if you're a recent graduate.

Call us on 1300 889 743 or fill in our free assessment form and find out if you're eligible for physician home loans.

) [14] => stdClass Object ( [post_id] => 242 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] => Did you know that most major lenders will no longer approve low doc loans that are used to refinance an existing home loan? This leaves many people high and dry when they need money the most and leaves others stuck on older loans at much higher interest rates. Thankfully some lenders will still refinance a low doc loan! Please call our mortgage brokers at 1300 889 743 or fill in our online enquiry form to see if you should refinance your home loan during the COVID-19 pandemic. ) [15] => stdClass Object ( [post_id] => 33246 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>Are you a foreign citizen wanting to live and work in Australia as a permanent resident?

Every year, the Australian immigration department releases its new Skilled Occupations List (SOL) and Consolidated Sponsored Occupation List (CSOL).

What skilled occupations make up the list and will the bank accept your visa type when it comes time for you to apply for a mortgage?

How much can I borrow?

The skilled occupations listed in SOL and CSOL fall under a few different visa subclasses which vary depending on the profession.

Under the permanent resident mortgage policy for some of our lenders, the following visa holders can qualify for a mortgage and borrow up to 95% of the property value:

- Employer Nomination Scheme (subclass 186)

- Skilled Independent visa (subclass 189)

- Skilled Nominated Visa (subclass 190)

The following visas are also classed as permanent resident but your borrowing power may be restricted due to the short-term restrictions applied by the government:

- Skilled Regional (Provisional) visa (subclass 489): A 4-year visa similar to a 457 visa. You can borrow up to 90%.

- Skilled – Regional Sponsored visa (subclass 487): A 3-year visa that then allows you to apply for permanent residency. You can borrow up to 80%.

Call us on 1300 889 743 (+61 2 9194 1700 if you’re outside Australia) or complete our free assessment form to find out if you qualify for a skilled occupation mortgage.

Can I get the same interest rates as an Australian citizen?

Yes!

Since you’re living and working in Australia, you won’t be charged a higher interest rate just because you’re a foreigner.

Check out the lowest interest rates on offer from the nearly 40 lenders that we have on our lending panel.

You won’t be charged extra fees and you can get all of the same mortgage features as an Australian citizen.

What if I’m a temporary resident?

Like being a permanent resident, you’re borrowing power depends on your visa type, your occupation, and the strength of your overall financial situation.

If you’re on a Temporary Business (Long Stay) – Standard Business Sponsorship visa (subclass 457), 494 visa or on a Temporary Skill Shortage visa (482 visa) you may be able to borrow up to 90% of the property value as a special exception.

You can potentially borrow up to 95% if you’re married or in a de facto relationship with an Australian citizen or Australian permanent resident.

For other temporary visa types, including subclasses 417, 165, 160 and 422, you can borrow between 80-90%.

We’re experts in non-resident mortgages!

Please fill in our online enquiry form and let our mortgage brokers about your situation and what type of loan you need.

) [16] => stdClass Object ( [post_id] => 942 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>Lending policy varies for each type of borrower:

- Investment loans: 95% of the property value.

- Low doc (no income evidence): 80% of the property value.

- Discounts: Competitive professional package and basic loan discounts are available.

We are specialist mortgage brokers and can help you find a lender that will approve your mortgage.

Please contact us on 1300 889 743 or enquire online and a member of our team will contact you to discuss your situation.

) [17] => stdClass Object ( [post_id] => 45028 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>Police officers and other law enforcement professionals are able to qualify for special home loan exceptions, including:

- Borrow up to 95% of the property value: You'll need a clear credit history, stable employment, good income, minimal debts and must not be buying an unusual property type or a property in non-metro location.

- Borrow up to 110% of the property value: By asking your mum and dad to act as a guarantor on your mortgage, you can borrow the property value plus the costs of completing the purchase.

- Negotiated interest rates: We have special relationships with our panel of lenders that allow us access to special discounts, particularly if you have stable employment in law enforcement.

Call 1300 889 743 or fill in our free assessment form to discover if you qualify for a police home loan.

) [18] => stdClass Object ( [post_id] => 13790 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>We've compiled a list of the common reasons why people fail a bank's credit score.

We've broken it into three sections: your situation, your credit file and your application.

The good news is that not every lender credit scores. If you need help applying for a mortgage then please call us on 1300 889 743 or enquire online to speak to one of our mortgage brokers and see which lenders you will qualify with.

) [19] => stdClass Object ( [post_id] => 33319 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>Income from investments isn’t just secure and ongoing – it shows that you’ve got funds on standby and you’ve got the financial aptitude to manage your money well.

Unbelievably, not every lender will accept investment income when assessing your home loan application!

What investment income types will the banks accept?

- Dividends – ASX listed companies

- Dividends – Private company (conditions apply)

- Managed fund income

- Interest income

- Royalties

- Annuities

- Rent income

Not every lender accepts each income type!

Each will accept a certain percentage of that income and will have different verification requirements.

Do you need help getting your home loan approved? Call us on 1300 889 743 or fill in our free assessment form and our mortgage brokers will help you to get approved!

) [20] => stdClass Object ( [post_id] => 50980 [meta_key] => add_site_layouts_0_post_editor_option [meta_value] =>

Buying an investment property is not an easy task.

And things get trickier when you have to choose a location.

Finding the right location for your property can be crucial to the success of your investment.

Why is location important for investment?

The location of your investment decision can determine the types of tenants you'll get.

If you want an investment property that will gain high rental yields for the foreseeable future, then you’ll need to choose a location that is popular with tenants.

If you're opting to buy vacant land, you'll need to choose a location that will increase in value in the future as you won't be earning any rental income from it for a while.

How To Choose A Location For An Investment Property

Here are some tips you can follow to get started on choosing where to buy your investment property:

- Invest where you know: Consider buying in markets you're familiar with first so you spend less time researching areas or suburbs you're not familiar with. This also means you have an intimate know-how of the types of tenant residing in the area. If you’re considering buying interstate, we recommend hiring a buyers’ agent.

- Get a team ready: Get in touch with a buyer's agent of the area you're looking to invest in. It's beneficial to go with the local buyer agent as he/she would have intimate knowledge of the area. Talk to the real estate or buyer's agent to find out what people liked or disliked about the property or location. You should even have an accountant on your team to give tax advice.

- Empathise with your tenants: Go for locations that tenants favour, instead of just what looks good to you. If the goal of your investment property is to earn a strong rental income and minimising vacancy, then opting to choose locations that tenants prefer is a must.

- Stay updated about development changes: Find out if any infrastructure improvements might happen in the area. This might determine the type of tenants and the value of the location in the future. Get in touch with the local council to check if there are any planned developmental projects. Talk to the locals to get their feedback on how they feel about those projects.

- Desirable features for tenants: Look into the features that are desirable to tenants like a garage, swimming pool, etc. While renters in Melbourne need transportation facilities, the same principle does not apply to renters in Perth or Adelaide who prefer to drive. For them, a garage is more important than having good public transport.

- Costs involved: Take into consideration the maintenance costs of the property. If you're buying an older property, then you might need to set aside some funds for renovations or repairs.

- Vacancy rates: Review the latest vacancy rates of the location you've chosen. It's good to invest in areas where vacancy rates are low as it means that your property will not be empty for long between tenants. A location with high vacancy rates makes it harder to sell it in the future. Information on vacancy rates can be found online on Corelogic and other websites.

- Compare sales information: Check the recent sales figures for the locations you're buying in. You can get sales data on how the property is performing online, or by talking to real estate agents and buyer agents. Look into the average prices of the surrounding areas. If there are huge margins of differences within the area, think twice before investing. If the prices are comparable, then it's a safer bet.

- Access to amenities: The proximity to amenities like shopping centres, schools, gyms, etc. determines how much demand there is for rental properties.

- A building inspection is a must: Always do an independent pest and building inspection. An independent inspector will provide a detailed report about your property.

- Take note of scarcity, demand and supply: The availability of rentals around the area determines the demand and supply. If your potential location is rife with rental properties, the oversupply might lower your rental yield. If it's too scarce, then the rent might be high, but the tenant pool is limited. You have to choose a location that strikes the perfect balance between the demand and supply of rentals.

- Decide on your investment strategy: Are you looking for capital growth potential or choosing a property to get the benefits of rental yields? If you’re looking to earn from rental yields, then the location of your investment property should be one favoured by renters.

Take A Look At The Broader Picture

Macro- and microeconomic factors also have an impact on where you want to invest in property. Look at the information related to the state and then home in on the suburb, neighborhood and street. Macro factors include population growth, employment and infrastructure investment, while micro factors include amenities and transport. Let’s take Melbourne as an example. Melbourne experienced population growth of over 2% in 2018 with a demand of over 110,000 new jobs. There are plans afoot to build over 1.6 million dwellings by 2050 to accommodate the growing population and employment opportunities.What To Avoid When Choosing Investment Property Locations

While there are a plethora of things you can do to ensure that you've invested in the right location, here are some things you should keep in mind.

- Don't get your emotions involved: Getting emotionally attached to the property will cloud your decision. Use analytical data and the knowledge of experts and local people instead of going with your heart. Going to look for a property when you're in a bad mood is a disaster too.

- Don't buy a property with cheap strata levies: This is an indication that the building might not offer facilities that tenants want.

- Don't go property hunting or to open houses alone: Get a team of experts to go with you. These experts don't always have to be a real estate agent or buyer's agent. It can be your family or friends who will point out things that you were not aware of.

- Don't lowball the figure: If the investment property is really favourable to you, don't offer a low figure, as someone else will buy the property before you.

- Try to avoid buying off-the-plan units: While these units might be cheaper to invest in, you'll have to consider that these properties are usually clustered together and built by the same developer. There's just too much competition to get the right tenant into the property.

- Buy in the location that suits the tenants, not you: You have to take the requirements of the tenant when you're choosing a location. Do not make a decision to buy just because you love the location. Your investment property must be one in which you want your ideal tenant to reside in.

New Unit Or Established Property?

While investing in either a new unit or buying an established property have their benefits, investors are known to prefer established properties to new ones.

By buying an established property, investors benefit from:

- Insights and data like comparable sales figures, vacancy rates, demographic profiles, types of tenants, etc.

- Adding value to the property by renovating and refurbishing and making it more appealing to tenants.

- Having a property close to a CBD as newer properties are situated on the outer suburbs due to unavailability of land. However, in some cases, new apartments can also be located close to a CBD.

However, investing in a new property is not without its benefits:

- Investors can get tax write-offs and take advantage of depreciation benefits. You can get tax breaks on rental advertising costs, council rates, land tax, etc.

- You are investing in a property that is attractive to the tenant as it has modern amenities and smart appliances that tenants currently want. This might help you get a tenant who is willing to pay a higher rent.

- New properties generally have lower maintenance costs, and in most cases, if anything needs renovation or replacement, it can be done easily.

- Stamp duty

- Conveyancing fees

- Legal fees

- Search fees

- Pest and building reports

- Council and water rates

- Land tax

- Property management fees

- Repairs and maintenance

- Agent fees, and more.

- Get a deposit of at least 20% of the property value ready to avoid paying Lenders Mortgage Insurance (LMI). If you own property already, you can use the equity from it as well. We also have no deposit investment loan options available.

- You will need at least three months of genuine savings in your account. This is a good indicator to lenders of your ability to save and manage your finances.

- It’s always better to have a good credit score on your file.

- You will need to be employed and earning a good income to prove to the lender that you can afford the mortgage.

- Try to reduce your expenses, as they do affect your borrowing power.

- Limit the number of credit cards you used and cancel any unused credit cards.

- Make sure you're making timely repayments on your commitments, like car loans, and buy now pay later services like Afterpay and ZipPay.

- Getting a pre-approval for your investment loan so you know how much you can afford. Once you know your budget and how flexible you can be, you can narrow down your options on where you can buy.

- We can even provide you with property reports and suburb reports since we have access to CoreLogic RP data and AMV.

- Once you've decided to buy the investment property, send it to your mortgage broker so they can help you get your financials in order.

- Use our investment property calculator to predict your weekly cash flow for your investment property.

- If you’re thinking of turning your home into an investment property, the rental income has to be declared on your tax return. Furthermore, the cost involved with an investment property, like advertising for tenants, maintenance, etc might be tax deductible. However, when you sell your property, you need to consider capital gains tax and real estate agent fees.

- The valuation comes in lower than the purchase price but you still have enough funds to complete the purchase.

- You change your mind and don’t want to buy the property.

- The lender approves your loan at a higher rate than you’d like.

- Borrow up to 95% with waived LMI: Borrow up to 95% of the property value and avoid Lenders Mortgage Insurance (LMI).

- Borrow up to a maximum loan size of $4.5 million.

- Access signficantly reduced interest rates that aren’t available to the general public.

- Rapidly build an investment property portfolio thanks to higher exposure limits for high net worth investors.

- Take advantage of flexible approval criteria for new graduates.

- A high income to afford both repayments.

- Little existing debt (car loans, high credit card balances, etc).

- A clear credit history.

- Some savings to make up any shortfall.

- A proven rental history (preferred).

- Avoid making principal payments for up to 5 years

- Come over your financial crunch

- Not gaining equity to the property

- Having to pay more interest over the years

- Freehold storage unit: Borrow up to 70% of the property value or up to 100% by using a commercial property guarantor loan.

- Leasehold store unit: Considered on a case by case basis with a business plan.

- Loans over $5 million: Considered on a case by case basis.

- Maximum loan term: 25 years.

- Maximum interest only term: 5 years.

- Low doc and bad credit options: Case by case when buying just the freehold and borrowing may be restricted.

- Discounted interest rates: Available by negotiation by your mortgage broker and based on your application strength.

- You must owe less than 80% of the property value on your home loan.

- Your home loan repayment history must be perfect.

- You'll need to provide your last two payslips.

- You'll need to provide your most recent group certificate.

- Low doc options are available for self-employed borrowers who can't prove their income through traditional means.

- Your credit file should be clear of bad marks.

- ABN search

- ASIC article - Low-doc loans: are they for you?

- What is on a credit file and how does this affect a low doc loan?

- Learn more about the National Consumer Credit Protection Act (NCCP)

- Low doc loan calculator

- Most lenders will typically use 80% of your dividend income from an employee stock ownership plan.

- Some lenders use your current shareholding not an average of your last two years, which makes sense if you decide to increase your shareholdings.

- Some lenders give discounted home loan rates for a home loan to buy shares in your employer that is secured on a residential property.

- Borrow up to 95% of the property value to buying a property using employee shares.

- Some banks assess you as self-employed if over 25% of your income comes from your employer.

- Some lenders want to see financials and tax returns for your employer.

- You can borrow up to 95% of the property value or up to 100% using a guarantor.

- 2 years in your job: Some of our lenders will use 100% of your bonus income if it is consistent.

- 3 months in your job: Some of our lenders will use 80% of your bonus income.

- You may need to provide a letter from your employer confirming the consistency of this additional income.

- Performance-based and irregular bonuses: Considered on a case by case basis depending on the consistency of this income. Generally, this is acceptable if you have a 2-year history of receiving these bonuses.

- One-off bonuses: Cannot be considered as additional income.

- Two current consecutive payslips.

- Letter of entitlement from your employer / letter confirming your bonuses are likely to continue.

- Your most recent tax return or group certificate, in some cases, two years of tax returns may be required.

- You can borrow a maximum of 80% of the value of the land plus the cost of construction.

- It’s possible to borrow 100% of the land and construction costs with a guarantor.

- Large scale renovations of existing properties are also acceptable.

- You must have contingency funds in case you go over your budget.

- Some of our lenders offer competitive interest rate discounts.

- Most banks do not lend to cost plus building contracts.

- 1% AEP (1:100 year flood zone): 95% of the property value.

- 2% AEP (1:50 year flood zone): 80% of the property value on a case by case basis.

- 5% AEP (1:20 year flood zone): In most cases we cannot assist with these properties.

- 100% loans: Available with some of our lenders if you have a guarantor.

- You must be allowed to build on the property or there must already be a house on the property.

- You must be able to insure the property.

- The maximum flood height must be lower than the floor height of the house.

- The bank valuer must agree that the property represents an acceptable risk to the bank.

- High rainfall which causes nearby rivers to overflow, creating a flood which damages your home.

- High river and dam levels which cause flooding to your home.

- May cover flooding that occurs as a result of rising sea levels caused by severe storms.

- We know which banks will accept your home as security for a loan

- Our mortgage brokers are credit experts who know the lending policies of over 30 financial institutions

- We offer nationwide services

- Free financial services for most loan types

- The credit type and loan amount you applied for, previously it only showed up as a credit enquiry.

- The nature of the credit account – Personal loan, home loan, overdraft or credit card.

- The financial institution where the account is held – NAB, Westpac etc.

- Maximum credit amount available for each account.

- The date a credit account is opened and closed.

- New and previous credit amounts.

- 24 months account payment history: Monthly repayment history will reflect whether you paid the minimum amount required on your financial commitments each month or not.

- Conditions related to your repayment.

- Default agreement details.

- Special pricing, including a significantly reduced interest rate.

- An LMI waiver.

- The opportunity to with a bank that will support your future business and personal goals.

- New home buffer: You can choose interest only for a year in order to buy furniture or to renovate your new home.

- Property investment: You can maximise your cash flow position and reduce your opportunity cost, although it depends on whether your long term goal is to have a positively-geared portfolio.

- Business investment: You can leverage funds that aren’t tied up in your property to invest in your business

- Buying shares and equities: Using a residential property to secure your shares is acceptable to some banks and a short-term IO period can give you a bit more leg room to continue growing your portfolio.

- Turning a home into an investment: Save thousands in mortgage repayments if your plan is to switch your home to be an investment property.

- Buying a new home before selling the old one: A short-term IO will reduce your home loan repayments on a new property purchase so you can focus on paying down your old mortgage and maximise your equity growth.

- Retirement planning: With the right exit strategy in place, you can drastically reduce your mortgage repayments when downsizing for your autumn years.

- Covering a temporary shortfall in income: Having a baby, relocating overseas or switching to part-time work are very common life events and a short-term IO period can help manage the fall in your normal income.

- You want lower monthly repayments

- You want to use your home’s equity for cash-out

- You want to pay off your mortgage sooner

- Interest rates are falling

- Your home has significantly gone up in market value

- You are looking to renovate your home or invest in a property

- Recent payslips to verify your income

- Latest tax assessment notice

- A letter from your employer confirming your salary

- Identification certificates, like your passport or driver’s licence

- Complete financial and credit documents (credit card statements, your current mortgage documents, bank account statements, etc.)

- Switching to a home loan with lower interest rates over the same term will save of you thousands of dollars over the life of the loan.

- Switching to a longer loan term will lower your monthly repayments but you’ll end up paying more overall.

- New or existing juice bar: Borrow up to 50-70% of total business costs or 100% with an existing residential property as security.

- Loan term: 7 years (as per the franchise agreement).

- Loan term with property as security: 25 to 30 years (standard loan term).

- Interest only: Around 2 years or more depending if you're using property as security.

- Low doc options not available.

- We can help negotiate strong interest rates.

- Existing store: If you're buying an existing store from the current franchisee, you'll generally need to provide 3 years financials for the business in the form business tax returns and profit and loss statements.

- Experience: No matter whether you're buying a greenfield or existing juice bar, you'd need to show evidence of at least 3 years experience in a similar industry and in a managerial or supervisory role. This shows that you have the skills to keep the business afloat for the long term.

- Good financials and credit history: Having capital to contribute to the first 6 months of operations is a typical requirement while having a clear credit history reflects your character as a borrower, which is important in painting a good picture with the bank.

- Business plan: Apart from your past experience, the bank will usually want to see a business plan that you've drafted up with a financial professional that shows cash flow and revenue forecasts for the next few years.

- Completing the expression of interest on the Boost Juice franchise page.

- Filling out their application form and sending it back along with a refundable $2,200 deposit.

- This is be followed by an interview over the phone.

- If you're successful, you will then be given a confidentiality agreement to sign and a Deed of Undertaking and Acknowledgement.

- At this point, you'll be provided with sales figures along with a financial planning guide and an operational questionnaire.

- This is followed by a face-to-face interview with one of their franchise business development managers.

- A day of work experience in a real store.

- You'll then be given a franchise kit which contains an example of the disclosure document and franchise agreement. Ask if you can see this up front before providing your deposit or undertaking training!

- Signage.

- Fit-out.

- Equipment.

- Deposit of $2,200 (refundable).

- Royalty fee: 4-6% of monthly turnover.

- Advertising and marketing: 3% of gross monthly turnover.

- A 4-week training program in Melbourne covering smoothie and juice preparation, operational health and safety requirements and sales training.

- You'll have a dedicated business development manager assigned to you.

- Access to Boost's national and local area marketing capabilities.

- Shop fit-out and site selection.

- As part of a head lease agreement, Boost Juice will handle initial negotiations and ongoing management of the lease agreement between you and the landlord.

- You'll be able to leverage Boost Juice Bar's buying power with suppliers meaning cheaper outgoings than running an independent store.

- Borrow up to 100% of the property value plus the costs of completing the purchase (depending on the deposit amount).

- This amount is used as security in the event that your default on your home loan.

- The funds will need to be deposited with the bank that you are using for your home loan.

- The bank will hold the term deposit and roll it over (start a new fixed term) until the guarantee is released.

- The State and Federal Government incentives grants and stamp duty relief

- People returning to WA from interstate and overseas

- Record-low interest rates

- Rental supply shortage

- Debt is currently very cheap

- Your loan is over $300,000,

- Your situation is not complex, and

- You are keeping the loan for over two years.

- First home buyer: 95% of the property value (restrictions apply).

- Investor: 95% of the property value.

- Guarantor loans: Borrow up to 100% with select lenders only.

- 100% home loan with no LMI: Borrow up to 100% if you’re an eligible professional (stricter lending criteria applies).

- Low doc: 80% of the property value.

- Discounts: Competitive professional package and basic loan discounts are available.

- Borrow up to 95% with waived LMI: Borrow up to 95% of the property value and avoid Lenders Mortgage Insurance (LMI).

- Borrow up to a maximum loan size of $4.5 million.

- Access significantly reduced interest rates that aren’t available to the general public.

- Rapidly build an investment property portfolio thanks to higher exposure limits for high net worth investors.

- Take advantage of flexible approval criteria for new graduates.

- Clean credit history: Having blemishes such as defaults, judgments and bankruptcies on your credit file can work against you when applying for a 90% investment loan but not with all lenders depending on your case.

- You’ll need a deposit: In most cases, you’ll need 5-10% of the purchase price in genuine savings or a deposit that you’ve saved over a period of 3-6 months. There are exceptions to this with some lenders and you may be able to use equity in an existing property your own or a gift.

- Negative gearing may be accepted: Only applicable with some lenders and only if you have a strong income.

- Employment: Although there are exceptions to this policy, you’ll usually need to have an employment history of 3 to 6 months in your current job role.

- Standard properties more likely accepted: Unusual or non-traditional property types located outside of capital cities or major regional locations are not usually accepted by lenders.

- First home buyer: 95% of the property value (restrictions apply).

- Investor: 95% of the property value.

- Low doc: 80% of the property value.

- Discounts: Competitive professional package and basic loan discounts are available.

- Guarantor loans: Borrow up to 105% of the property value by using a guarantor.

- Pay extra: On a $490,000 home loan over 30 years, you can save more than $40,000 in interest by paying just an extra $100 every month. You'll also get an added bonus of paying off your mortgage faster. Try our Extra Repayments Calculator and check it out for yourself. Bear in mind, it's best to only do this with a variable rate home loan. You're ability to make extra repayments on a fixed rate home loan will be restricted and, at worst, you'll break costs by doing so.

- Increase repayment frequency: If you pay monthly, you'll be making 12 payments a year. If you pay fortnightly, the number goes up to 26 because there are 52 weeks in a year. So by paying weekly or fortnightly, you're essentially making extra repayments.

- Switch to P&I repayments: You can pay interest only if you want more cash in your hand but understand that paying Principal and Interest (P&I) is actually more cost-effective. Suppose you have a $540,000 home loan over 30 years at 4.08%. If you pay P&I from the beginning, you'll be saving more than $35,000 in interest over the life of the loan than if you paid interest only for just 5 years and then switched.

- Use an offset account: You can reduce your mortgage costs by using an offset account. This is an account linked to your home loan. Any money you keep here directly offsets your mortgage. For example, if you have a $400,000 mortgage and have $20,000 balance in your offset account, you'll only pay interest on $380,000, as opposed to the full mortgage amount. Therefore, you'll want to keep your balance as high as you can. This way, as your offset balance grows, your interest payments will steadily decrease.

- First home buyer: 85% of the property value.

- Investor: 85% of the property value.

- Guarantor loans: Borrow up to 100% with select lenders only.

- Low doc: 80% of the property value (case by case basis).

- Discounts: Some interest rate discounts may be available depending on the lenders that will accept your hotel unit as security.

- Borrowing up to 95% of the property value with waived Lenders Mortgage Insurance (LMI)

- Interest rates even lower than the already discounted rates offered on a professional home loan package.

- Higher exposure limits for those with a substantial property portfolio.

- Your home loan rate: You could be getting a better interest rate by refinancing to another lender.

- Switching between fixed and variable: Whether you started on a variable rate or a fixed rate, a home loan health check can help you make an informed decision.

- Your property value: We can provide a free property valuation and let you know if you are in a position to access equity in your home.

- Debt consolidation: If you're struggling with mortgage repayments because you're juggling multiple debts and bills, you can consolidate your debts into your home loan.

- Refinancing back to a prime lender: If you are currently on a low doc, bad credit or any other type of specialist home loan, you're paying a higher interest rate and may be in a position to refinance back to a major lender at a sharper rate.

- Home loan features:You may not be getting the most out of your home loan features, especially if your personal situation will or has recently changed, such as starting a family, renovating your home or buying an investment property.

- Borrow 90% with no genuine savings: You can borrow 90% from most of our lenders, irrespective of the source of your deposit.

- Borrow 95% with no genuine savings: Some lenders can approve a home loan for up to 95% of the purchase price with no genuine savings (specific conditions apply).

- Borrow 100% with no genuine savings: With a guarantor, you can borrow 100% of the purchase price plus the costs of completion.

- The developer’s quality and ability to finance the construction are among the most significant uncertainties you will face.

- Not all developers can deliver the property to the standards you may expect and the timeframe you want, so you need to choose the developer carefully.

- If you are one of the first to buy in a project, you can often get a better price. You can also choose the best unit in the block.

- Working with a good solicitor will also ensure the contract protects you from potential changes.

- Valuation is an opinion and can vary, so if a valuation does come in short, you can choose to find a valuer who understands the value proposition of the specific property.

- Desktop Valuation: Fully remote, relying solely on property data and market trends.

- Kerbside Valuation: Involves a physical inspection of the property’s exterior.

- Full Valuation: A thorough internal and external inspection.

- Buy now and choose First Home Buyer Choice’s stamp duty option

- Buy now and choose First Home Buyer Choice’s annual land tax option

- Wait until 1 July and buy under Fresh Start.

- Under $650K purchase price: Buy whenever you like

- $650K-$800K: You'll pay no stamp duty after 1 July, so best to wait

- $800K-$850K: It's probably best to wait until July

- $850K-$950K: For a unit, it's probably best to buy now and choose the NSW property tax. For a house, it may be best to wait. The best option changes, depending on how long you are going to keep the property – if you keep it long enough, you’ll pay more in property tax than you would have in stamp duty – so it's important to do the maths.

- $950K to $1.5M: It's almost certainly better to buy now and select the property tax if you expect to keep your home for the average period of time (about 10 years). It may be better to wait if you plan to keep the property forever.

- Low risk properties: You may be able to borrow up to 95% of the value of a property up to BAL-29.

- Medium risk properties: You may be able to borrow up to 90% of the value of a BAL-40 zoned property.

- High risk properties: You may be able to borrow up to 80% of the value of a flame zone property.

- Construction loans: You can borrow based on the the cost of the land and the building or the on completion valuation, whichever is less.

- Guarantor loans: Borrow up to 100% with select lenders only.

- It can protect yourself from sudden interest rate hikes.

- It provides security and stability as you are able to organize your finances effectively.

- It allows you to take advantage of the low fixed interest rates.

- Standard home: Borrow up to 95% of the purchase price or Loan to Value Ratio (LVR).

- Standard home being used as a boarding house: 70% LVR. Borrow more depending on the strength of your case.

- Commercial loan: 60-70% LVR. Typically for boarding houses with 6 or more bedrooms.

- Borrow 95% with waived LMI: You can borrow 95% of the property value and avoid the cost of Lenders Mortgage Insurance (LMI).

- Borrow up to a maximum loan size of $4.5 million.

- Rapidly build an investment property portfolio thanks to higher exposure limits for high net worth investors.

- Relaxed credit criteria for new graduates.

- Borrow up to 105% of the property value with a guarantor loan.

- Your parents can use the equity in their home to secure your mortgage so you can buy a home with no deposit.

- Avoid the high cost of Lenders Mortgage Insurance (LMI).

- Cover the extra costs of purchasing a property including stamp duty, mortgage set up costs and conveyancing and legal fees.

- Qualify for a low interest rate.

- Your income must be sufficient: You do need to be earning enough to afford the home loan as well as your other commitments like bills and existing debt without hardship. This is otherwise known as meeting the bank's 'serviceability ratio' requirements.

- You need a strong employment history: A stable job that you've been in for the past 6 to 12 months is a general requirement for 97% home loans although some lenders aren't as strict with this policy.

- Your credit history must be clean: Your bills, rent, credit card repayments and other commitments must have been paid on time for at least the last 6 months and your credit file must be clear of black marks.

- You have little to no debt: Having a lot of debt such as multiple credit cards or personal loans is generally not accepted. Anything less than 5% of the purchase price for the property you're looking to buy may be accepted on a case by case basis.

- You must have a sufficient asset position: You should have a level of assets comparable to your age such as a car, shares or a term deposit.

- There are postcode and property restrictions: The property type and its location will also have an affect on getting approved. Banks are reluctant to approve mortgages for properties that will likely be difficult to sell in the event that you default on your repayments.

- You need at least 5% genuine savings: You need at least 5% of the purchase price in regular savings into a bank account over a period of 3 months. Luckily, not all lenders have this genuine savings requirement and may accept a gift from your parents instead (conditions apply).

- You must owe less than 80% of the property value on your investment loan.

- You can refinance at any time (if you owe less than 80%) if you're on a variable interest rate.

- You can refinance on a fixed rate if you find that you're likely to recoup the cost of early exit fees within the first two years of refinancing (applies to borrowers releasing equity to purchase another investment property).

- Borrow up to 95% with waived LMI: Borrow up to 95% of the property value and avoid Lenders Mortgage Insurance (LMI)

- Interest rate discounts that aren't available to the general public.

- Higher exposure limits for investors with several properties and want to continue growing their portfolio.

- Flexible credit criteria for new graduates and new dental clinics.

- Your income comes from a source other than the insolvent company.

- You can prove your income.

- Your company is not currently in external administration.

- Loans to refinance directors’ guarantees or debts are considered.

- You are borrowing no more than 90% of the property value.

- First home buyer: 95% of the property value (restrictions apply).

- Investor: 95% of the property value.

- Guarantor loans: Borrow up to 100% with select lenders only.

- Low doc: 80% of the property value.

- Discounts: Competitive professional package and basic loan discounts are available.

- Borrow up to 95% of the property value: You'll need a clear credit file, earn a regular income, have a strong debt to income ratio and be purchasing a standard property in a mainstream location.

- Borrow up to 110% of the property value: With a guarantor loan, you need no deposit because your parents can use their home to secure the property value plus the purchase costs.

- Competitive interest rates: We can often negotiate significant interest discounts with our panel of lenders.

- A clean credit history: Your credit history should be clear of defaults, judgments and bankruptcies. Missed repayments over the last 6 months or too many credit enquiries will also reduce your chances of approval.

- A sufficient deposit: You’ll need a 15% deposit with at least 5% in genuine savings, which most lenders accept as a deposit that you’ve saved in a bank account for at least 3 months. However, some lenders can consider a gift from your parents or a lump sum deposit as evidence of savings.

- Stable employment: In most cases, you’ll need to have worked in your current job role for at least 3 to 6 months. If you’ve changed jobs, most lenders will want you to have been working in the same industry for the past 2 years.

- Excellent income: When it comes to 85% investment loans, banks tend to be a bit more conservative so you’ll need to show that you earn a significant enough income to meet the mortgage repayments. If you can prove that you have a strong income then some lenders may even take negative gearing into account.

- Standard investment property: It’s much more difficult to get approved if you’re looking at investing in an unusual or non-traditional property type such as those located outside of capital cities or major regional locations.

- You have to be refinancing an existing loan worth at least $250,000.

- You must also hold an NAB transaction account at the time of drawdown.

- Your current mortgage must be refinanced to NAB.

- The primary borrower listed on your loan should have an active NAB transaction account at drawdown.

- This offer is available to individual applicants who are owner-occupiers or residential investors. Refinancing of First Home Loan Deposit Scheme loans and loans to businesses, non-residents, trusts, and other non-natural people are not included.

- Up to 105% of the purchase price with a guarantor loan.

- Up to 100% with a no deposit loan subject to an extensive approval criteria.

- Up to 80% with special interest rate discounts.

- Switch to a variable rate without paying break fees if interest rates go down during the fixed term.

- Make extra repayments without caps or penalties.

- Split their loan up to four ways and take advantage of an offset sub-account applicable on any variable interest rate portion.

- Australian citizens or permanent residents living and working in Japan can generally borrow up to 80% of the property value.

- You can qualify for the same interest rates as an Australian citizen and we even know lenders that will apply the Japanese tax rate when assessing your income which improves your borrowing power.

- Some lenders will use the tax rate of Japan, as opposed to Australian tax rates, which can greatly improve your borrowing power.

- If you're earning Japanese Yen but you can't provide sufficient documents to prove your foreign income, such as recent payslips or tax returns, then you may be limited to borrowing less than 80% of the property value.

- Loans available for purchase, refinance, investment property or to buy a house and land package.

- If you're a dual citizenship holder or you're married to a foreign national, some lenders may unfairly treat you as a foreigner so choosing a lender that favors expats is essential to borrowing at the maximum Loan to Value Ratio (LVR).

- A Power Of Attorney (POA) in the name of a solicitor or family member is required by some banks.

- Australian citizens and permanent resident (PR) visa holders living in Hong Kong may be able to borrow up to 90% of the property value.

- Get the same interest rates as an Australian citizen.

- Some lenders will use the tax rate of Hong Kong, as opposed to Australian tax rates, which can greatly improve your borrowing power.

- Self-employed borrowers may be able to borrow up to 80% of the property value with one of our lenders and we have at least one that will use 90% of your net income rather than gross income.

- Loans available for purchase, refinance, investment property, or to buy a house and land package.

- If you’re a dual citizenship holder or you’re married to a Hong Kong citizen, some lenders may treat you as a foreigner, so choosing a lender that favours expats is essential to borrowing at the maximum Loan to Value Ratio (LVR).

- If you’re earning Hong Kong Dollars (HKD) but you can’t provide sufficient documents to prove your foreign income, such as recent payslips, or tax returns, then you may be limited to borrowing up to 80% of the property value.

- A Power Of Attorney (POA) in the name of a solicitor or family member is required by some banks.

- Borrow up to 90% of the property value as an Australian citizen or permanent resident (PR) living in China.

- You can qualify for the same interest rates as an Australian citizen.

- Some lenders will use the tax rate of China, as opposed to Australia tax rates, which can improve your borrowing power.

- Self-employed borrowers may be able to borrow up to 80% of the property value with one of our lenders and we have at least one that will use 90% of your net income rather than gross income.

- Loans available for purchase, refinance, investment property, or to buy a house and land package.

- If you’re a dual citizenship holder or you’re married to a Chinese citizen, some lenders may treat you as a foreigner, which means that choosing a lender that favours expats is essential to getting approved.

- If you’re earning Chinese Yuan (CNY) or Renminbi (RMB) but you can’t provide sufficient documents to prove your foreign income, such as recent payslips or tax returns, then you may be limited to borrowing up to 80% of the property value.

- A Power Of Attorney (POA) in the name of a solicitor or family member is required by some banks.

- Higher interest rates: This will mainly depend on the lender and the type of verification or supporting documentation you can provide. Some of our lenders offer the same low rates as they do for full documentation home loans.

- Larger deposit: 20% of the purchase price is typically required, although some lenders require less.

- LMI: Mortgage insurance is usually applicable if you borrow over 60% Loan-to-Value Ratio (LVR).

- Find out which documents you can provide, what your needs are and which lenders you can qualify with.

- Select the lender with the lowest interest rate, fees and LMI premium, as well as the loan features that you require.

- Present your application in a way to make sure it is seen favourably by the lender.

- Australian citizens and permanent resident (PR) visa holders living in Switzerland may be able to borrow up to 90% of the property value.

- You can qualify for the same interest rates as an Australian citizen.

- Self-employed borrowers may be able to borrow up to 80% of the property value with one of our lenders and we have at least one that will use 90% of your net income rather than gross income.

- Loans available for purchase, refinance, investment property or to buy a house and land package.

- If you’re a dual citizenship holder or you’re married to a foreign national, some lenders may unfairly treat you as a foreigner so choosing a lender that favours expats is essential to borrowing at the maximum Loan to Value Ratio (LVR).

- A Power Of Attorney (POA) in the name of a solicitor or family member is required by some banks.

- Borrow up to 90% of the property value as an Australian citizen or permanent resident (PR) living in Germany.

- You can qualify for the same interest rates as an Australian citizen.

- Self-employed borrowers may be able to borrow up to 80% of the property value with one of our lenders and we have at least one that will use 100% of your net income rather than gross income.

- Loans available for purchase, refinance, investment property or to buy a house and land package.

- If you’re a dual citizenship holder or you’re married to a foreign national, some lenders may treat you as a foreigner which means that choosing a lender that favours expats is essential to getting approved.

- If you’re earning Euro but you can’t provide sufficient documents to prove your foreign income, such as recent payslips, or tax returns, then you may be limited to borrowing up to 80% of the property value.

- A Power Of Attorney (POA) in the name of a solicitor or family member is required by some banks.

- Max loan $1,000,000 at 85%.

- Max $1,250,000 in total loans with no LMI.

- You must have a clear credit history.

- You may need to meet minimum income criteria with some lenders.

- This is for low risk borrowers only, strict criteria apply.

- Standard employment

- Contracting via an ABN

- Contracting as an employee

- Medical partnerships

- Profit share / commissions

- Depending on your situation, you may still qualify for exclusive interest rate discounts and avoid the cost of Lenders Mortgage Insurance (LMI) when borrowing up to 100% of the property value.

- CBA / Colonial: Call CBA on 132 407.

- St George Bank: Call St George on 13 33 30.

- Westpac: Call Westpac on 132 032.

- ANZ: Call ANZ on 13 13 14. Note that for most loans ANZ does not automatically reduce your repayments when interest rates fall so you may not need to call them.

- Citibank: Call Citibank on 1300 361 922 or 13 24 84.

- AMP: Call AMP Banking on 133 030.

- Mortgage House: Call Mortgage House on 133 144. In some cases you may have to fax a signed and dated letter to client services on 02 9407 3083

- United States Dollar (USD)

- Great Britain Pounds Sterling (GBP)

- Euro (EUR)

- Singapore Dollar (SGD)

- Canadian Dollar (CAD)

- United Arab Emirates Dirham (AED)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- Swiss Franc (CHF)

- New Zealand Dollar (NZD)

- Chinese Renminbi (CNY) - Conditions apply

- Bahrain Dinar (BHD)

- Bruneian Dollar (BND)

- Danish Krone (DKK)

- Fijian Dollar (FJD)

- Indian Rupee (INR)

- Indonesian Rupiah (IDR)

- Kuwaiti Dinar (KWD)

- Macau Pataca (MOP)

- Malaysian Ringgit (MYR)

- Norwegian Krone (NOK)

- Oman Rial (OMR)

- Papua New Guinean Kina (PGK)

- Philippine Peso (PHP)

- Qatari Riyal (QAR)

- Samoan Tala (WST)

- Saudi Arabian Riyal (SAR)

- Solomon Island Dollar (SBD)

- South African Rand (SAR)

- South Korean Won (KRW)

- Sri Lankan Rupee (LKR)

- Taiwan New Dollar (TND)

- Thai Baht (TBH)

- Tongan Pa’anga (TOP)

- Turkish Lira (TRY)

- Vanuatu Vatu (VUV)

- Vietnamese Dong (VND)

- Desktop Valuation: Fully remote, relying solely on property data and market trends.

- Kerbside Valuation: Involves a physical inspection of the property’s exterior.

- Full Valuation: A thorough internal and external inspection.

- A property can see a huge increase in value when rezoning is announced.

- It can allow you to subdivide your lot or sell it to a developer who can subdivide and build residential unit blocks or commercial and industrial properties.

- A couple's home can be in just one name.

- A couple's investment property can sometimes be in just one name.

- Your business can borrow against a home owned by your partner.

- You can't borrow against a property owned by someone unrelated, except with a guarantor loan.

- Your home loan rate: You could be getting a better interest rate by refinancing to another lender.

- Switching between fixed and variable: Whether you started on a variable rate or a fixed rate, a home loan health check can help you make an informed decision.

- Your property value: We can provide a free property valuation and let you know if you are in a position to access equity in your home.

- Debt consolidation: If you're struggling with mortgage repayments because you're juggling multiple debts and bills, you can consolidate your debts into your home loan.

- Refinancing back to a prime lender: If you are currently on a low doc, bad credit or any other type of specialist home loan, you're paying a higher interest rate and may be in a position to refinance back to a major lender at a sharper rate.

- Home loan features:You may not be getting the most out of your home loan features, especially if your personal situation will or has recently changed, such as starting a family, renovating your home or buying an investment property.

- CBA / Colonial: Call CBA on 132 407.

- St George Bank: Call St George on 13 33 30.

- Westpac: Call Westpac on 132 032.

- ANZ: Call ANZ on 13 13 14. Note that for most loans ANZ does not automatically reduce your repayments when interest rates fall so you may not need to call them.

- Citibank: Call Citibank on 1300 361 922 or 13 24 84.

- AMP: Call AMP Banking on 133 030.

- Mortgage House: Call Mortgage House on 133 144. In some cases you may have to fax a signed and dated letter to client services on 02 9407 3083

- Investor Retirement Visa (Subclass 405)

- Temporary Business (Long Stay) – Standard Business Sponsorship (Subclass 457)

- Foreign Government Agency Visa (Subclass 415)

- Domestic Workers Visa (Subclass 426)

- Diplomats Visa (Subclass 995)

- Medical Practitioner (Temporary) Visa (Subclass 422)

- Adelaide Bank

- Advantage (Formerly known as Challenger / Interstar)

- AMP

- ANZ

- Australian First Mortgage (AFM)

- Australian Secured and Managed Mortgages (ASMM)

- Australian Unity

- Bank of Queensland (BQLD)

- BankWest (BW)

- Better Mortgage Company (BMC)

- Better Mortgage Management (BMM)

- Bluestone (Risk fee)

- Citibank

- Collins Securities

- Commonwealth Bank of Australia (CBA)

- FirstMac

- Heritage Building Society

- Homeloans Limited

- Homeside Lending

- ING Direct (REF risk fee and LMI)

- La Trobe Financial

- Liberty Financial (LMP risk fee and LMI)

- Loan Ave

- Mainstream Capital

- Merchant Mortgages

- MKM Capital (Risk fee)

- Mortgage Asset Services (MAS)

- National Australia Bank (NAB)

- Paramount Mortgage Services

- Pepper Home Loans (Risk fee)

- RAMS Home Loans

- St George Bank (StG / SGB)

- Suncorp Bank

- The Rock Building Society

- Westpac Bank (WBC)

- Borrower: ABC Pty Ltd As Trustee For The Smith Unit Trust

Mortgagor / property owner: ABC Pty Ltd As Trustee For The Smith Unit Trust

Guarantor: John Smith - Borrower: John Smith

Mortgagor / property owner: ABC Pty Ltd As Trustee For The Smith Unit Trust

Guarantor: ABC Pty Ltd As Trustee For The Smith Unit Trust - Temporary Business (457) (this is the most common subclass)

- Skilled Independent (189)

- Skilled Nominated (190)

- Skilled Nominated or Sponsored (489)

- Business Talent (132)

- Business Innovation and Investment (188, 888)

- Employer Nomination Scheme (186)

- Regional Sponsored Migration Scheme (187)

- A good income: Lenders tend to be quite strict when assessing your means of paying off a 5% deposit home loan, otherwise known as your ‘serviceability ratio’.

- Stable employment history: Although there are exceptions, this usually means that you’ve been working in the same job for the past 6 to 12 months.

- A clear credit history: Your credit file must have minimal credit enquiries and be free of defaults. As a general rule, credit cards, rent and bills like utilities and mobile plans need to have been paid on time for the past 6 months.

- Strong asset position: Lenders will assess your income to asset position relative to your age. It’s assumed, for example, that if you’ve been working full time for a few years that you’ll have a car and a decent amount of savings relative to your income.

- Little to no existing debt: Having more than one credit card and/or personal loans is a red flag for most lenders.

- Proof of 5% in genuine savings: This is usually in the form of consistent deposits into a savings account over a period of 3 months. There are some exceptions to this though.

- Non-traditional property or location: Banks are pretty conservative when it comes to property located in high rise units and small or regional. There are other types of ‘unusual property’ that may see your home loan application declined.

- With a guarantor home loan, you can borrow up to 105% of the property value.

- There are lenders that offer up to 95% LVR home loans.

- Lenders often have exposure limits or other restrictions so most high-net-worth doctors end up having more than one lender to service their needs.

- As you start adding more properties to your portfolio, seek advice about the Loan-To-Value Ratios in your portfolio. There's no one-size-fits-all approach.

- Save thousands of dollars in waived LMI

- Negotiate a competitive interest rate

- See if you can avoid LMI at higher LVRs

- Structure the loan so you can take advantage of LMI waivers and pay off your investment loan faster

- Get free property reports so you know what’s happening in Australia’s property market and see if you can use equity for your investment purchase.

- Find creative solutions to cater for small deposits and short-term ABNs, especially if you’ve transitioned from PAYG to self-employed.

- Do not use multiple accounts, as it can be difficult to track how much you’ve spent on each platform and budget repayments.

- Plan to make sure you have the funds to make payments on time. Set a realistic budget and stick to it.

- Do not link your account to a credit card. A credit card can lead to further debt and incur interest. If you use a debit card, you’re using your own money to pay instalments.

- Set reminders to check there are sufficient funds available when instalments are due. The instalments are automatically deducted from your nominated account. If you have sufficient funds, you avoid late fees.

- Read the fine print. Some companies perform a credit check, and some even report defaults to credit agencies.

- Try not to use these services if you have pressing debts and commitments to pay. You do not want to add more debt when you’re applying for a home loan.

- Try to reduce commitments and make early repayments if you can afford them.

- Do not use BNPL to purchase items and services you can’t afford.

- Tell your bank that you’re using buy now, pay later when applying for a home loan. You will be asked about it to ensure you have a good grasp of your finances and the banks like to avoid surprises when they do a credit check.

- A "land loan" to cover the cost of buying the block of land.

- The construction loan, to cover the building costs.

- An investment loan if you're planning to hold on to one of the properties.

- DA approval from the local council

- Clearing the block of land

- Driveway and landscaping

- Architects

- Engineers

- Legal fees

- The past history of income and how variable it was.

- The likely future reliability of this income.

- If there are any other income sources to support the application.

- The percentage of royalty income that is needed to prove that you can afford the home loan.

- Your partner has a valid temporary visa for Australia (see the temporary visa mortgage page for a list of acceptable visas).

- Your partner is living in Australia or has family ties to Australia.

- You and your partner have children together.

- You're married or have been in a de facto relationship for over two years.

- You're an Australian citizen or PR holder and you're the main income earner.

- Did the credit department accept my application?

- Has the lenders mortgage insurer approved my application?

- What are the conditions of approval?

- Can I satisfy the conditions of approval?

- Can I satisfy the conditions before I make an offer on a property or when going to auction?

- Can I bid at auction in the knowledge my loan will be approved?

- Accountants, including actuaries, finance managers, and auditors.

- Legal professionals, including solicitors, barristers, and lawyers.

- Medical practitioners, such as dentists, veterinarians, and doctors.

- Mining engineers, including surveyors, geologists, and geophysicists.

- We’ve helped many customers who are Australian citizens or dual citizens living overseas who want to invest in the Australian property market.

- We will choose a lender that accepts your situation. This way, you can avoid many of the headaches associated with applying for a loan.

- Most of our services are free.

- We know over 50 banks & lenders.

The second job needs to be in the same line of work so a role as a tutor will typically be accepted.

Some lenders will accept 100% of your income if you can show that you have a 6- to 12-month work history and have been earning a regular income.

If you’re self-employed, you need to have been working for at least 2-3 years and provide your tax returns, Notices of Assessment (NOAs) and an accountant’s letter to verify your income.

Some lenders will consider approval with less than three months’ work history if you’re in a strong financial position with a clear credit history.