What Is A Guarantor Home Loan?

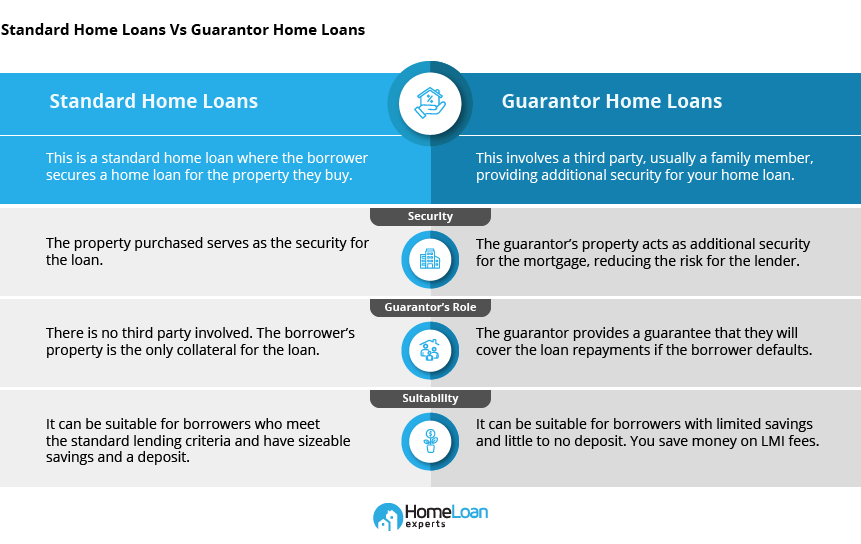

A guarantor home loan is a type of home loan in which a borrower can secure a mortgage without any deposit by having a family member act as a guarantor. This allows homebuyers to borrow 100% to 110% of the property’s purchase price.

A guarantor on a mortgage is a family member, usually a parent, who provides their property as security for the loan. Typically, 80% of the loan is secured against the purchased property, while the remaining balance is covered by the guarantor’s equity as the guarantee amount.

How Does A Guarantor Home Loan Work?

A guarantor home loan allows a family member, usually a parent, to use their own home equity as security to help a borrower buy a home. This reduces the borrower’s loan-to-value ratio (LVR), which can eliminate the need for lenders mortgage insurance (LMI) and potentially increase borrowing power. The guarantor secures only a portion of the loan (for example, 20% of the property value) not the full amount, minimising their financial risk while still assisting the borrower.

If the borrower fails to meet repayments, the lender can claim the guaranteed portion from the guarantor, which may put their property at risk. However, many lenders allow borrowers to remove the guarantor once they’ve repaid enough of the loan or refinanced. This setup is particularly beneficial for first-home buyers who lack a large deposit but have family members willing to provide financial backing.

To qualify, both the borrower and guarantor must meet the lender’s eligibility criteria, including credit assessments and income checks.

Here’s an example of how a guarantor home loan can work:

Suppose you want to buy a home worth $600,000, but you’ve saved only $60,000 (a 10% deposit). Many lenders prefer at least a 20% deposit ($120,000) to avoid Lenders Mortgage Insurance (LMI), which adds to your costs.

If you don’t have the extra $60,000, a guarantor, usually a close family member, can offer part of their property’s equity as security to cover the shortfall. This helps you meet the lender’s deposit requirement without needing to save the full amount yourself.

It’s crucial to understand that if you can’t keep up with repayments, the lender may require your guarantor to cover the guaranteed portion of the loan, putting their property at risk. To discuss your options with a mortgage broker who specialises in guarantor loans, enquire online or call us on 1300 889 743.

How Much Can I Borrow With A Guarantor?

Having a guarantor allows you to borrow more than a standard loan, sometimes up to 105% or even 110% of the property value, depending on the lender’s criteria. This means you may be able to cover not just the purchase price but also additional upfront costs like stamp duty, conveyancing fees, and inspections. While there’s no strict borrowing limit, loans over $1 million often require additional financial checks and stricter lending criteria.

Here’s how much you can borrow with a guarantor loan:

- First-home buyers: Up to 105% of the property value

- Construction loans: Up to 105% of the total land value and construction cost

- Refinancing: Up to 100% of the property value

- Debt consolidation and purchase: Up to 110% of the property value

- Investment loans: Up to 105% of the investment property’s value

Your borrowing capacity will depend on factors like your income, monthly expenses, existing debts, and credit score, as well as your guarantor’s financial position. Lenders will assess these factors to ensure you can comfortably meet your repayments.

Know Your Borrowing Power Right Now

If you're serious about buying a home, the fastest way to see how much you can borrow is by using our Guarantor Home Loan Calculator. In just a few seconds, you’ll get a clear estimate based on your financial situation.

CALCULATEWho Can Be A Guarantor?

Most banks require a strong family relationship between the borrower and the guarantor. Here’s who typically qualifies:

- Parents (including step-parents and legal guardians)

- Co-borrower’s parents

- Adult children (in rare cases, children can guarantee a parent’s loan)

- Spouse or de facto partner (often to protect shared assets)

- Grandparents

- Siblings and step-siblings (some lenders allow this, case by case)

- Aunts, uncles or cousins (only if they had a parental role in your life)

For a deeper understanding of guarantor eligibility, lender requirements, and how it all works, visit our page on Who Can Be a Guarantor?.

Requirements To Be Eligible For A Guarantor Home Loan

The borrower must meet the lender’s requirements. These typically include:

Age And Residency

- Borrowers must be at least 18 years old (legal minimum to enter a loan contract).

- Must be an Australian citizen or permanent resident (temporary residents considered, case by case).

Guarantor Availability

- A qualified guarantor (usually an immediate family member) must be willing to provide security.

- Guarantors must have sufficient equity in their property and meet lender requirements.

- Guarantors are required to obtain legal and financial advice before approval.

Income Stability

- Borrowers must have a stable and sufficient income to meet loan repayments.

- Lenders prefer consistent employment (minimum 6-12 months in the same job or industry).

- Self-employed borrowers must provide tax returns for the past two years.

Credit And Financial History

- Borrower must have a reasonable credit score (no severe defaults, bankruptcies or missed payments).

- Lenders will review past loan history, credit cards, and financial obligations.

- Bank statements will be assessed for responsible financial conduct (no overdrawn accounts, excessive spending, missed rent due or unpaid debts).

Loan Repayment Capacity

- Lenders will calculate whether you can service the total loan amount (principal and interest).

- Includes assessment of existing debts, living expenses, and potential future financial commitments.

- Banks apply buffer rates to ensure repayment capacity remains strong even if interest rates rise.

Savings And Deposit

- Some lenders require genuine savings (typically 5% of the property value, held for at least three months).

- Borrowers must cover stamp duty, legal fees, and additional property costs.

Loan-to-Value Ratio (LVR) And Property Criteria

- With a guarantor, borrowers may access up to 100% LVR (borrowing the full purchase price).

- The property must meet the bank’s valuation and lending criteria.

- Some lenders impose restrictions on rural properties, off-the-plan purchases, or high-density apartments.

Pros And Cons

Getting a guarantor home loan comes with great benefits as well as some risks. While it can fast-track your homeownership journey, it also involves financial and emotional responsibility for both you and your guarantor. Before committing, it’s essential to weigh the advantages and potential downsides.

Pros

- A guarantor loan allows you to secure a home loan with a smaller deposit, reducing the time needed to save. If property prices are rising, this can be a great advantage, helping you enter the property market sooner.

- With a guarantor covering part of your loan, you can avoid Lenders Mortgage Insurance (LMI) costs, which typically apply when borrowing more than 80% of a property's value. This could save you thousands of dollars upfront.

- Lenders often approve larger loan amounts for borrowers with a guarantor, making it easier to buy a home in a competitive market. Additionally, a lower LVR can help you secure a more favourable interest rate.

- Once you've built enough equity in your home, through either repayments or an increase in value, the guarantor can be released from their obligation. This means a guarantor’s commitment isn’t permanent.

- A guarantor doesn’t provide cash but equity in their property. This means family members can assist without dipping into their savings.

- Successfully managing a guarantor loan can improve your credit history, positioning you better for future financial opportunities.

Cons

- If you default on repayments, your guarantor is financially liable for covering the portion of the loan they guaranteed. If they also can’t meet the repayments, their property could be at risk.

- Since the guarantor’s property is used as security, their ability to take out new loans or other credit could be restricted while they are still guaranteeing your loan.

- Money and family don’t always mix well. If financial troubles arise, the stress of a guarantor agreement could damage personal relationships.

- If the borrower defaults and the lender takes legal action, the guarantor’s credit report could be negatively affected, making it harder for them to secure future loans.

- In the worst-case scenario, if neither the borrower nor the guarantor can cover repayments, the guarantor’s property could be seized to recover the loan.

- While a guarantor loan allows you to buy with a smaller deposit, this means borrowing a higher amount, leading to larger interest payments over the life of the loan.

Case Studies

Using A Guarantor To Avoid Saving A Deposit

The situation

Nick has been renting for a couple of years and decides to buy his very own home.

He has found a lovely 3 bedroom house not far from where he works. The property is worth $500,000 but he knows that he’ll miss out on buying it if he doesn’t act fast.

The problem is that he has not saved up a deposit to get a home loan due to renting. He needs at least 5% plus costs to qualify for a mortgage.

His parents – who are both retired – are willing to gift him the money for the deposit, but it’ll take them around 3 months or so for them to save the money to give to him.

If that wasn’t enough, the gifted deposit wouldn’t be classed as genuine savings, and it’d take Nick another year or so to build up 5% of the purchase price in his own savings.

The solution

Instead of saving the money and gifting Nick the money for the deposit, his parents can use the equity in their property as security for his home loan.

Their home is valued at $600,000 with around $255,000 owing on their mortgage. Since both of Nick’s parents are retired, there is one lender that will accept this guarantor scenario.

Using their parents’ property as security for a home loan, Nick can borrow up to 105% of the purchase price to cover the home loan plus the costs of stamp duty and conveyancing fees.

If Nick were to buy the property with his own 5% deposit, he’d be paying more than $20,000 in Lenders Mortgage Insurance (LMI), a one-off fee payable when borrowing more than 80% of the property value.

The Result

- Nick was able to quickly buy the property before someone else did.

- He was able to avoid mortgage insurance.

- He was able to use the few thousand that he had saved for the deposit as extra repayments on his mortgage with enough left over to take a little holiday.

Using A Guarantor To Consolidate Debt

Get Expert Help with Your Guarantor Home Loan

With Home Loan Experts, securing a guarantor loan is simpler and stress-free.

- Use a family guarantor to secure your home loan sooner.

- Avoid LMI and save thousands with the right loan structure.

- Expert guidance to make the process smooth and stress-free.

Frequently Asked Questions

How Long Does A Guarantor Stay On A Mortgage?

- You can afford the repayments without any assistance.

- Your loan is for less than 90% of the property value (ideally 80% or less).

- You haven’t missed any payments in the last six months.

You must apply with the bank to remove the guarantee – it isn’t automatic! Most people can remove the guarantee somewhere between two and five years after they set up the loan, although this can vary.

Many guarantees are set up because the borrower has no deposit, so removing the guarantee often depends on how much the property appreciates in value and how much in extra repayments the borrower can afford to make.

You can still remove the guarantee if you owe more than 80% of the property value, but you may have to pay LMI to achieve this.

How Is A Guarantor Home Loan Structured?

What Happens If I Can’t Make the Repayment On A Guarantor Loan?

What Other Low-Deposit Options Exist?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.