How Do I Know If I Am Under Mortgage Stress?

If you are finding it difficult to make your mortgage repayments on time, but have not missed any payments and are not in arrears yet, you are considered under mortgage stress. This means you may be in danger of falling in arrears or defaulting by completely missing a repayment.

Note that the Australian Bureau of Statistics (ABS) calculates who is under mortgage stress by dividing mortgage repayments by income. If the repayments are greater than or equal to 30% of the household income, the borrower is under mortgage stress. However, some households can afford to pay more than 30% of their income and may want to pay off their mortgage sooner. So in practical terms, the 30% guideline is not a true measure of who is under mortgage stress.

Mortgage Stress calculator

Why Are Australians Under Mortgage Stress?

When the Reserve Bank of Australia (RBA) increased the cash rate in May, it was the first time many mortgage holders had experienced a rate rise, because there had not been an increase in over 12 years. Australians are in mortgage stress because:

- The home loan interest rates are rising off the back of the frequent cash rate rises.

- The cost of living is increasing due to inflation.

- Wage growth is stagnant.

New research from Roy Morgan revealed an estimated 1.43 million mortgage holders were at risk of being under mortgage stress in the three months to June 2023. They experienced two cash rate rises during this time, which brought the official cash rate to 4.1% in June 2023.

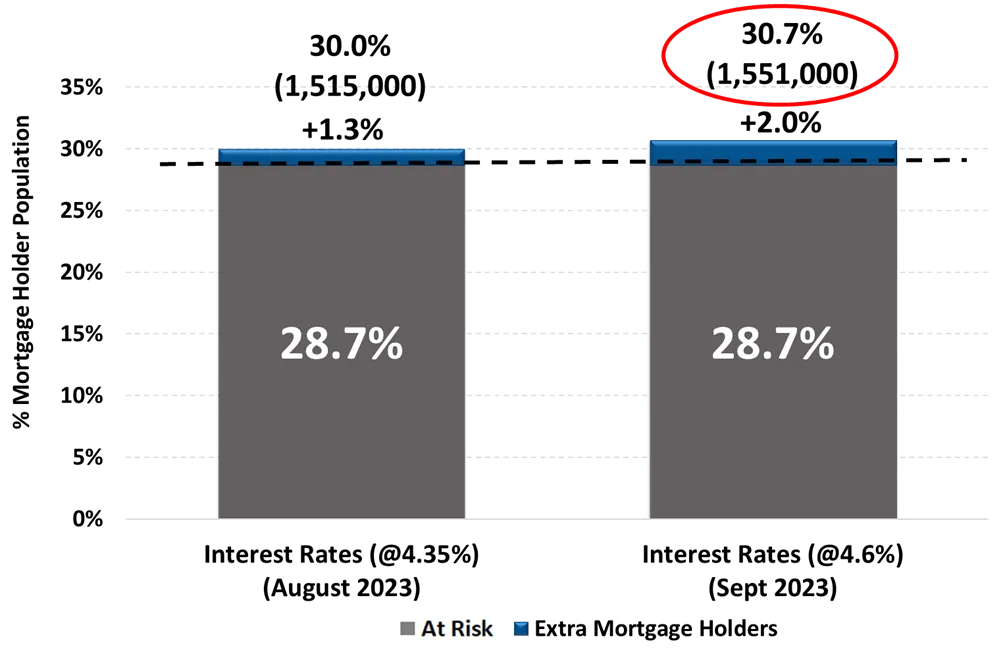

The research also revealed that over 1.51 million people might be under mortgage stress if the cash rate rises by .25 percentage points. The graph shows how many more mortgage holders will be affected by the cash rate increase.

Source: Roy Morgan Single Source (Australia), April – June 2023, n=3,656. Base: Australians 14+ with owner occupied home loan.

What Are The Signs Of Mortgage Stress?

You know you are under mortgage stress or will be facing it soon if:

- There has been a change in your financial situation due to a loss of job or loss of income.

- The portion of your income that goes towards repaying your mortgage is increasing.

- You cannot make timely repayments on your other bills, such as for utilities and credit cards.

- You cannot budget for unexpected expenses like medical bills.

- You are using your credit cards to the limit.

- You are taking out personal loans to cover repayments.

It is better to take action when you’re under mortgage stress, before you fall into arrears or default. A default will lower your credit score.

What Do I Do If I Am Under Mortgage Stress?

To relieve yourself from mortgage stress, you need to either increase your income or decrease your repayments.

Here are some ways to manage mortgage stress:

- Refinance your home loan to a lower rate. We’ve outlined five ways you can save money by refinancing.

- Consolidate debts like credit cards and personal loans into your home loan.

- Cut living expenses now and cut more than you think is necessary.

- Look for ways to increase your income, like getting a second job

- Switch to interest-only repayments (note: this increases the total cost of the loan).

- Move out of your home and rent it out to earn extra income.

- If unable to make the repayments, immediately contact your lender or mortgage broker to discuss hardship options. Lenders are generally more reasonable when a borrower works with them to manage mortgage stress than if they’re already in default.

It’s important to seek advice before doing any of these things.

How To Avoid Mortgage Stress

- Be realistic about how much you can afford. You can use a repayment calculator to find out what amount of borrowing fits into your budget.

- Revise your budget as needed, as your financial situation will change over the life of the loan. Make sure to set aside buffer funds for emergency expenses.

- Check on your home loan every two years to ensure the rates are competitive and the loan is working for you.

- Make use of loan features like offset accounts and split loans, to make your repayments more manageable.

- If you’re buying a new home, don’t get into a bidding war and buy above your price range.

- Weed out expenses you can do without. You might be paying for a service that you’re no longer using.

- Lower the limit on your credit cards or cancel them to reduce the temptation to overspend.

- Choose a home loan that is right for you. Determine whether a fixed-rate or variable-rate home loan is the right option.

Get Help From The Experts

Our mortgage brokers will work with you to help you avoid mortgage stress. If you’re already under mortgage stress, we can work through various strategies to help you avoid a default on your home loan. Call us on 1300 889 743 or enquire for free online today.