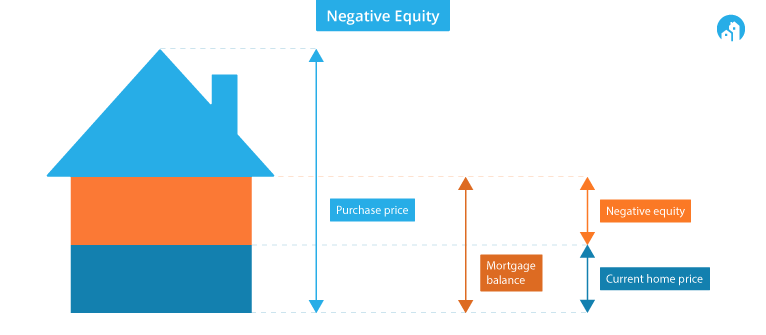

Negative equity occurs when a property’s value is less than the outstanding balance on the mortgage. Being ‘underwater’ is a colloquial term for negative equity.

But what is equity? Equity is the difference between your home’s value and the outstanding amount to pay on the mortgage. In general, your equity in your home increases as you make repayments over time.

How Does Negative Equity Occur?

Falling home values generally cause negative equity.

Let’s say you bought a house worth $500,000 with a deposit of 10% – $50,000, and you took out a loan of $460,000. After a year, you repay $25,000 of the principal. You owe your lender $435,000, calculated as the total mortgage ($460,000) minus the amount of the principal repaid ($25,000). But home prices have dropped, and your home is now worth just $400,000. If your house sells at $400,000 today, you will owe your lender $35,000 more than you received for it, so you have negative equity of $35,000.

Keep in mind that paying only interest will increase the risk of negative equity because the monthly repayment doesn’t contribute to decreasing the value of your debt.

As a historical example, high iron ore and coal prices caused strong growth in mining towns across Australia in the early 2000s. Many investors bought into the local housing market, and property prices increased. When commodity prices fell, the housing demand in these mining towns fell – and so did the property values. Investors who had paid high prices ended up with homes with negative equity.

Today, in 2023, around 120,000 homeowners across Australia, who took a low-deposit loan towards the end of the pandemic boom, have fallen into negative equity, as soaring interest rates have triggered declining property prices.

Nearly 300,000 homeowners who purchased between November 2021 and April 2022, when home prices were increasing, are getting close to negative equity, with home prices falling 8.9% from their 2022 peak.

Factors Causing Negative Equity

High Loan-to-Value Ratio (LVR)

When you purchase a property with a small deposit, you have a high Loan-to-Value Ratio (LVR) and you will probably be underwater if the market takes a substantial fall. For instance, if you buy a property for $1,000,000 by borrowing $950,000 (95% LVR), the value of your million-dollar home has to fall only about $60,000 (6%) to leave you with negative equity.

Purchasing A Home When Market Prices Are High

The property market cycles between periods of growth and contraction. When purchasing at the market’s peak, there is a greater chance that a property’s value will fall after the purchase, increasing the chance of going underwater.

Overpaying

Making a purchase based on emotions – such as during an auction or when you have fallen in love with the property – can lead to paying more than the actual value of the property. This can leave you with negative equity from the start, depending on the size of your deposit. Overpaying can also leave you with less of a buffer before you fall into negative equity, making you very vulnerable to price falls. Finally, it means it takes longer to benefit from potential capital growth, a huge disadvantage for a buyer, and it may limit your ability to invest elsewhere.

Overcapitalisation

This means you have invested more money in your property than you can recoup by selling it. This situation occurs when you spend a lot on renovating, upgrading or maintaining your home or you have overpaid while purchasing it.

How Do I Reduce Negative Equity?

It will help if you continue making repayments, as each one will take you a step closer to positive equity. If you pay both principal and interest while making repayments, your equity in the property should improve over time.

A borrower paying only interest is more at risk of falling into negative equity because the monthly repayment doesn’t decrease the size of the debt or increase the equity in the property.

Here are some other ways of increasing your equity in your property.

Make Extra Repayments

Make extra or increased repayments to improve your equity faster and pay off your home loan sooner; for example, instead of monthly repayments, make fortnightly payments. Before you do this, check to see if extra repayments attract any fees on your mortgage.

Get A Property Valuation

Arrange an independent valuation to find out your property’s worth in the current market. This will give an idea of the gap between your property value and your remaining mortgage balance (your equity).

Renovations

Make simple additions that lift your home’s value. Focus on adding the features buyers value most. You want to narrow the difference between your mortgage balance and the price of your home, so be mindful to improve your property value without increasing your debt. Renovating the kitchen or bathroom and adding a patio to your backyard will add considerable value to the property. Click here to find out more ways to increase your home’s value.

Negotiate For Better Rates

Contact your lender or mortgage broker to find out if refinancing your loan for a better rate is possible. If not, a broker may be able to help you negotiate a better interest rate – and therefore lower repayments – with your current lender. It is more complicated to refinance a home loan with negative equity. This is something that becomes increasingly important if you are facing financial hardships.

Watch The Property Market

If the value of your property increases, your negative equity decreases. So, watch out for any new trends in the suburb and surrounding area that may work in your favour.

We Are Here To Help!

If you are under mortgage stress or want to know your available options when in negative equity, then Home Loan Experts’ experienced mortgage brokers are here to help. We will assess your situation and help you determine the best option. Call us on 1300 889 743 or fill in our free online assessment form today!

FAQs

What happens if you are in negative equity?

Negative equity doesn’t imply that you are in financial trouble unless you are selling, refinancing or using the property as a security for another loan. If the property appreciates over time, your negative equity might be eliminated, but if you need to sell it before that happens, you may owe an outstanding debt to the lender after the sale. Refinancing with a new lender might also be difficult with negative equity because lenders typically won’t accept borrowers with mortgages bigger than their property value.

Does negative equity hurt your credit score?

Should you sell in negative equity?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.