Do You Need A Letter From An Accountant?

If you’re self-employed, you may find it difficult to provide your most recent financials to prove your income.

Other times, your financials don’t accurately reflect your yearly earnings, particularly if you’ve purposely reduced your income for tax purposes.

To make life easier for you, this page contains letter templates that your accountant can use when your bank asks you to provide evidence of your income.

Bank Requirements For An Accountant Letter

The accountant letter should be:

- On your accountant’s company letterhead, including contact numbers and the firm’s Australian Business Number (ABN)

- Contain details of any industry memberships / CPA qualifications

- Dated

- Signed

- Contain the name of the person who signed the letter

- Contain the name of the person who the letter is about, including their company (if applicable)

- Should confirm that the firm acts as the accountant for the person who the letter is about

- Most accountants will require some kind of disclaimer to be in the letter to protect them from legal action

Most lenders will accept a faxed copy but some will require your mortgage broker to hold the original on file.

Simplify the mortgage maze with the 360° Home Loan Assessor

Get results on:

- Your maximum borrowing power

- The hidden costs of buying a home

- Interest-rate options based on your situation

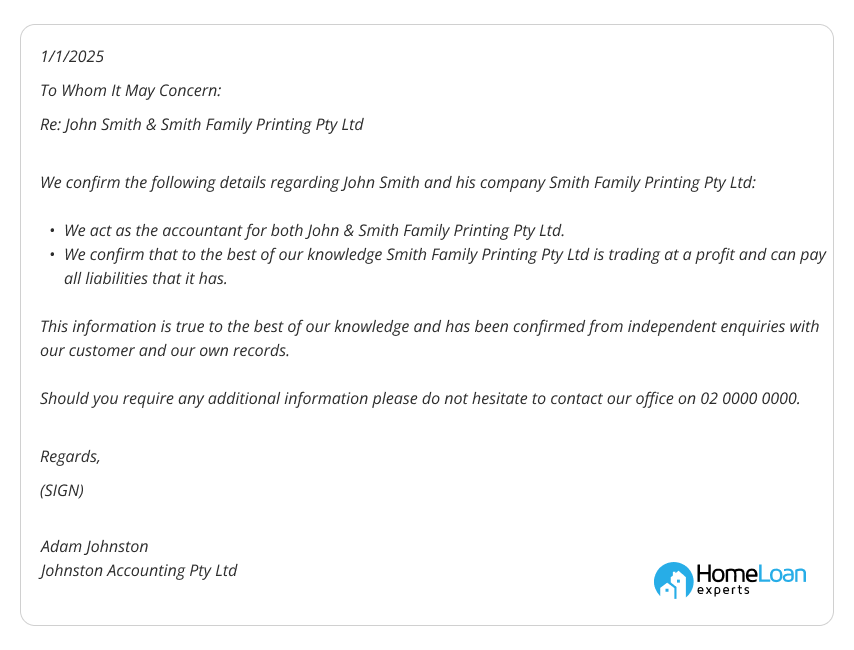

Accountant Letter Template

You can ask your accountant to use this sample letter from accountant confirming income as a template.

All they need to do is copy it onto their letterhead, amend the details, print, sign and fax to us, your mortgage broker.

This sample letter is used when the bank requires a letter confirming that a business is trading at a profit.

This is required when the bank hasn’t seen financial statements or tax returns for the business.

Other Types Of Accountant Letters

There are many different reasons why a bank may request an accountant’s letter so there are many different templates that you may need to use.

Below, we have included text that you may need for the most common accountant letters.

Due to privacy legislation, many accountants won’t talk to the bank directly or to your mortgage broker, so you’ll have to request your accountant to write a letter for the bank.

By providing them with the template, they’ll have less work to do, write the letter faster and charge lower fees, if any at all.

Below are some circumstances that banks commonly ask for clarity around.

Business Not Trading

We confirm that to the best of our knowledge Smith Family Printing Pty Ltd is no longer trading and has no liabilities of significance.

One-off Expenses

We confirm that Smith Family Printing Pty Ltd had a bad debt to their largest client in the 2015/2016 financial year which they were forced to write off. This is a one off event and is unlikely to occur again. It would be appropriate to add back this expense when calculating the customer’s ability to service a new loan.

Change In Income Between Financial Years

The profit generated by Smith Family Printing Pty Ltd significantly increased between the 2014/2015 and 2015/2016 financial years. This is because John Smith was not working for over 6 months of the year due to a personal issue that required his attention. For this reason, it would be appropriate to use the figures from the 2015/2016 financial year when assessing John’s ability to service a new loan.

Change In Income Due To Start Up Expenses

The profit generated by Smith Family Printing Pty Ltd has significantly increased between the 2008/2009 and 2009/2010 financial years. This is because 2008/2009 was the first year of the businesses operation and so there were one off start up expenses, initial advertising costs and a smaller existing customer base. For this reason, it would be appropriate to use the 2009/2010 financial years income to assess John’s ability to service a new loan. Based on recently lodged BAS and independent inquiries with the director, it would appear that this level of income is likely to continue or increase.

New Business In The Same Industry As A Previous Job

We confirm that John Smith was previously employed as an IT consultant for 10 years before starting his own business in the same industry. Although John’s business has only been trading for one year, it has already generated a substantial income and has a loyal customer base. Based on enquiries with the director and recently lodged BAS, it would be reasonable to expect the income from John’s business in the next financial year to be equal to or better than that in the most recent 2009/2010 financial year.

Contractor With No Major Expenses

We confirm that John Smith is operating as a sole trader that contracts to an IT business. He is paid an hourly contract rate and has no major expenses such as staff, tools or rent that other types of businesses may incur. For this reason, it would be reasonable to assess his income in a similar method to that of someone who is employed on a PAYG basis.

Change In ABN / Business Structure:

We confirm that Smith Family Printing Pty Ltd is the same business that was previously using John Smith’s sole trader ABN. Although this is a new entity, the business is essentially the same. John has been self employed in this business for over 6 years. For this reason, it would be reasonable to assess these two entities as the same business when assessing John Smith’s ability to service a new loan.

Family Employees

We confirm that Anna Smith is employed by Smith Family Printing Pty Ltd which is owned by her father John Smith. She’s been working for Smith Family Printing Pty Ltd for only four months and as such there has been no group certificate issued. We confirm that her income is $40,000 p.a. as shown on her payslips.

Check out the family job home loan page for more information.

Loan Purpose Confirmation

We confirm that to the best of our knowledge John Smith is using the proposed loan from ABC Bank to invest in shares.

Discretionary Trust Distributions

We confirm that John Smith is the sole director and shareholder of the trustee company and also the appointer for his discretionary trust. He has full control of the current and future distribution of income from the trust.

He has chosen to distribute income from the trust to his mother and his sister to reduce his taxable income.

Check out the discretionary trust page for more information.

Complicated Ownership Structure

Check out this word doc for a full example template.

Low-doc Loan Accountants Letter (Example 1)

Re: John Smith,

I have acted as an accountant and tax agent for the above mentioned client since 1/1/2010. The client is involved in the IT consulting industry. The income stated by the applicant, John Smith, on the self-certification form of $100,000 p.a. is gross profit after expenses and before income tax, is considered to be in line with previous financial year’s income level. If you have any further queries please do not hesitate to contact me on 02 0000 0000.

Check out the low doc loan page for more information.

Low-doc Loan Accountants Letter (Example 2)

I understand that the Borrower has applied for a loan of $100,000, through ABC Bank, repayable by monthly instalments of $416.66 over 30 years at an interest rate of 5.00% per annum variable interest only. I know the Borrower’s income and expenditure and, based on that knowledge and my understanding of the Borrower’s financial position, I am of the opinion that the Borrower is able to repay the loan in accordance with its term and can do so without substantial hardship. I am not aware of any factors which may affect the Borrower’s ability to make the repayments or which may cause substantial hardship to the Borrower to make repayments. I confirm that the Borrower is a registered tax payer with the Australian Taxation Office (‘ATO’) and have lodged their most recent tax return for ATO assessment of income tax.

For more information, please refer to our low doc loan with an accountant’s letter page.

There are many more situations where the lender may require a letter from your accountant.

We always try to discuss your situation with the lender’s credit manager to try to avoid wasting your accountant’s time by requesting a letter.

Some lenders, for example La Trobe Financial, Pepper Home Loans or MKM Capital, have their own low doc loan accountant letter template for you to use.

If you’re having trouble drafting a suitable accountant letter, please call us on 1300 889 743 or enquire online for assistance.

Adding A Disclaimer

Some accountants are unwilling to write a letter confirming the particulars of your situation.

Normally, this is because they’re concerned about potential legal action.

Although no accountant will sign a letter confirming something that isn’t true, it’s unreasonable for an accountant to refuse to sign a letter that is true.

Banks will normally accept a disclaimer being added to the bottom of the letter.

The wording of the disclaimer can be however the accountant sees fit. For example:

This information has been confirmed via independent enquiries with the above mentioned client. Whilst we believe the information to be true to the best of our knowledge, we accept no liability regarding the accuracy of this information or any loss incurred by any person or company who relies upon the information in this letter.

Why Does A Bank Need A Letter From Your Accountant?

When assessing a loan application, the lender needs to be certain that they are assessing your income and other aspects of your loan application in the correct way.

A letter from accountant confirming income will help clarify these issues and can often allow lenders to bend their guidelines to accept home loans that they would otherwise decline.

Do You Need Help With Your Home Loan?

If you need the services of a mortgage broker to help get your loan approved then why not talk to us at the Home Loan Experts?

Please call us on 1300 889 743 or enquire online to speak to one of our experienced brokers.