Bank requirements for rental letters

Your rental letter should:

- Be dated.

- Be signed.

- Confirm your name and the address of your investment property.

- Confirm the current rent, estimate market rent or give a range of the likely rent.

- Contain the name of the person who signed the letter.

- Be on a letterhead that contains the company details of the managing agent or selling agent.

Most lenders will accept a faxed copy of your rental ledger. However, some will require your mortgage broker to hold the original on file.

Please be aware that there can be big differences in the way that banks assess rental income. As a result, there’s often a lot of variation in the amount they will lend to investors.

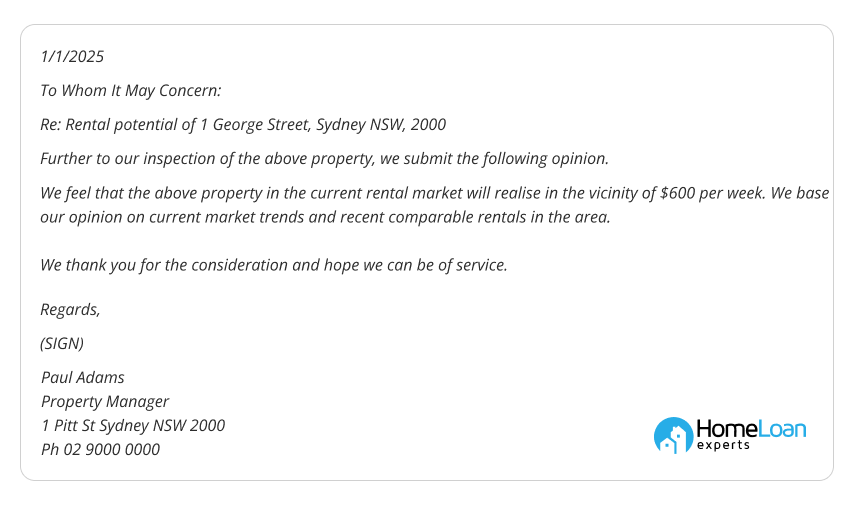

Rental letter template: not currently rented

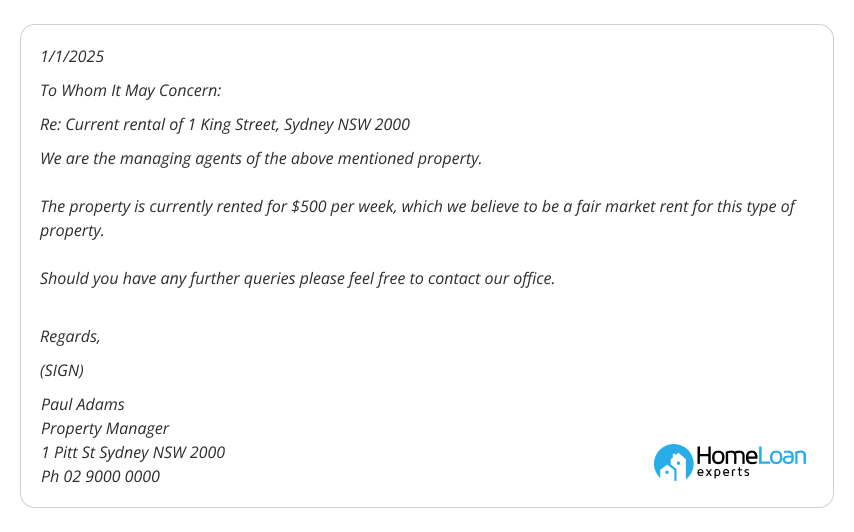

Rental letter template: tenanted

Why might a bank need a rental letter?

You’re required to provide the bank with a rental letter so that they are aware of the total amount of rent income that you will receive.

This will enable them to accurately assess your loan and determine how much you’re entitled to borrow, to fund your investment property purchase.

How can rental income be proven?

Your rental income can be proven in the following ways:

- Letter from an agent confirming market rent (ideal if the property is not yet tenanted / also very simple for the bank).

- A bank valuation (if a full valuation is completed).

- A rental statement issued by the managing agent.

- A copy of the lease agreement (may also need letters informing tenants of rent increases if lease has gone up).

- Bank account statements showing the rent paid in (not reliable as managing agents take fees and bills out first and often the payments are not clearly labelled).

What is a rental letter?

A rental letter is a letter from a property manager or selling agent that confirms the current market rent of a property.

It details all of the relevant particulars so that the banks know how much you’ll be receiving from that property each week.

This way, they can calculate your anticipated income and determine if you’ll be able to afford the loan.

How is rent determined?

The agent will inspect the property and estimate the potential or current rent income for the property by comparing it with similar investment properties in the area.

For example, if you own a two bedroom home in Burwood, the agent will look at homes similar to yours that are currently on the rental market.

Depending on the differences in features between both houses, the estimated market rent will be increased or lowered accordingly. Some agents will give a range instead of an exact figure to allow for the uncertainties and fluctuations associated with the rental market.

Apply for a home loan

We can talk to your agent directly to obtain a rental letter that meets the bank’s requirements! Our mortgage brokers will help get your loan approved.

Please call us on 1300 889 743 or fill in our free assessment form to speak to one of our experienced staff who can help you apply for a home loan and take care of all the stressful paper work.