Why Do I Need A Stat Dec?

As part of your home loan application, your bank may ask you to provide a statutory declaration (also known as a ‘stat dec’) to confirm a particular piece of information.

Lenders tend to be overly cautious and ask for statutory declarations for information that’s either not relevant for a loan or has already been verified via another document.

In most cases, it’s easier to get a stat dec than to argue with the lender!

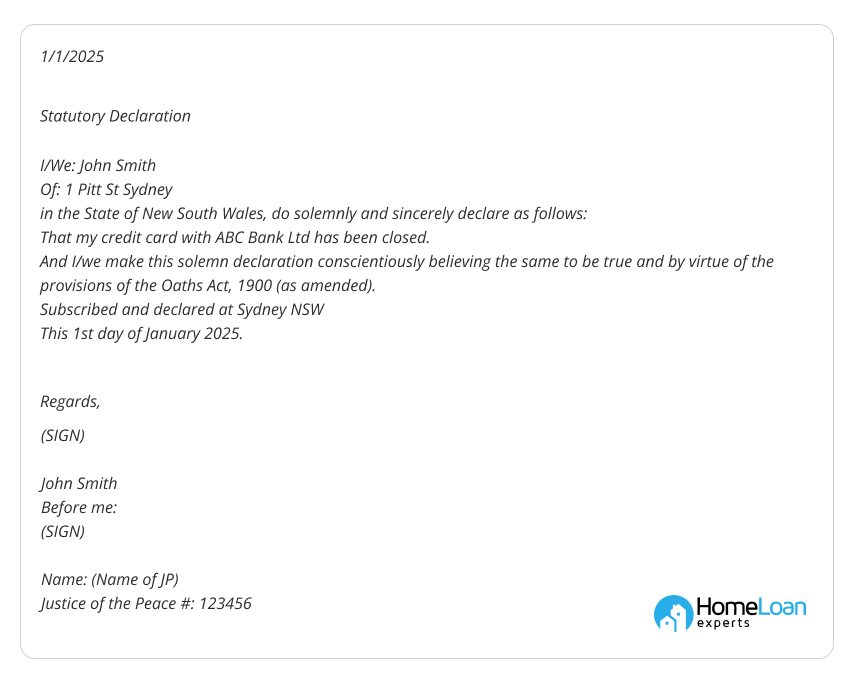

Statutory Declaration Sample

The below template should be copied into a word document, edited, printed and then signed in the presence of a Justice of the Peace (JP) or other acceptable witness.

Ask a question on our comments section below, call 1300 889 743 or fill in our free assessment form.

One of our mortgage brokers can let you know if there are other lenders that don’t require a stat dec.

Editable Templates

You can use these templates to create your own stat dec:

Everything you need to know for a home loan approval- and more.

Don’t miss out on the best home loan deals anymore.

Learn all important homebuying secrets by professionals.

SIGN UP FOR FREEStatutory Declaration Sample Letters

Below are some example declarations that a lender may ask you to provide.

Please ask your bank or mortgage broker for the exact declaration that they require.

- Statutory declaration for name variations: That my name is, and I would like to be known as, John Smith. My birth certificate shows my name as John James Smith but this is an error. I am one and the same person.

- Change of name: My current name is Jane Smith. Previously I was known as Jane Johnston. I changed my name on 1/1/2016 when I married my husband.

- Loan purpose: We intend to use the loan funds to purchase blue chip shares.

- Existing companies: We registered ABC Pty Ltd on 1/1/2015. This customer has not traded, has not lodged any tax returns and has no liabilities.

- Default explanation: Please refer to our default letter page.

- Gift letter: Please refer to Template 2 on our gift letter page.

- Separation (for FHOG): Me and my husband, John Smith, married on 1/1/2010 and separated on 1/1/2015. He is living at 1 George Street, Sydney, NSW. I have no intention of reconciling or cohabiting with him.

- Renting: I am currently renting the property at 1 George St, Sydney, NSW for $350 a week. This is a private lease agreement with no agent involved.

- Living rent free with parents: I am currently living with my parents and do not pay any rent or board.

There are many other types of stat decs that may be required by the banks.

Please refer to your bank if they ask for a specific stat dec.

Stat Dec Requirements

There are several common mistakes made when completing a stat dec. In particular:

- Forgetting to date the declaration.

- Not including middle names of the person signing the declaration or the witness.

- Only one applicant for the mortgage signs the declaration.

- The witness isn’t an authorised witness or doesn’t state their qualification e.g. doesn’t include their JP number.

- The handwriting is illegible.

- The wording of the declaration isn’t the wording requested by the lender.

- The original stat dec isn’t provided to the lender or mortgage broker.

If you’d like your home loan approved quickly, we recommend that you double check your stat dec before returning it to the lender.

Do You Need To Include Anexures?

Sometimes you may need to attach supporting documents as evidence of the claims made in your stat dec.

These supporting docs are known as anexures in legal terms and you need to provide a short description explaining what each anxure is.

You’ll need to provide supporting docs in your mortgage application at any rate so it’s best to discuss with your mortgage broker about what anexures to include.

Usually it’s better to provide the bare minimum of what the bank is asking for clarity around.

Who Can Witness A Stat Dec?

We’re specialist mortgage brokers that can help you get your mortgage approved.

If your lender is asking you to sign a stat dec that you believe is unreasonable, talk to us and we can help you find a bank that doesn’t have this requirement.

If you’d like to make an appointment or speak to a mortgage broker, please call 1300 889 743 or complete our free assessment form today.

Still have questions? Feel free to comment below and we’ll get back to you as soon as possible.

[sg_popup id=65221]

Contact Us For Assistance

We’re specialist mortgage brokers that can help you get your mortgage approved.

If your lender is asking you to sign a stat dec that you believe is unreasonable, talk to us and we can help you find a bank that doesn’t have this requirement.

If you’d like to make an appointment or speak to a mortgage broker, please call 1300 889 743 or complete our free assessment form today.

Still have questions? Feel free to comment below and we’ll get back to you as soon as possible.

[sg_popup id=65221]