The Labor opposition party recently announced a Help To Buy scheme to make it easier for low- and middle-income home buyers to get onto the property ladder. The scheme will go into effect with the First Home Guarantee and the Regional First Home Buyer Support Scheme.

Let’s find out what each of these schemes offers and which one is better for you.

Labor’s Help To Buy Scheme

The Help To Buy Scheme allows home buyers to purchase with a 2% deposit without paying Lenders Mortgage Insurance. Here are the basic details:

Sure, here is the code updated with the requested class name and format:

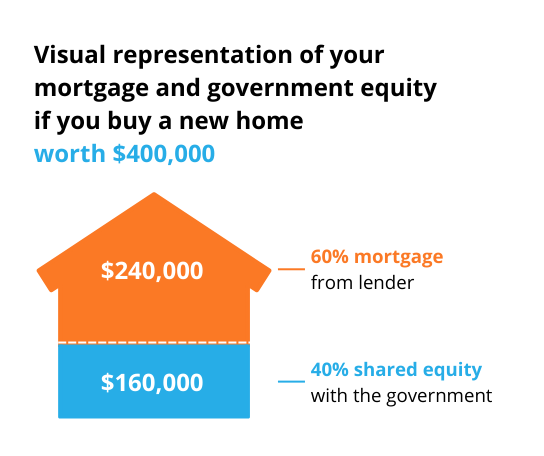

- The government pays a large portion of the price of the home and retains ownership of that portion – up to 40% for new homes or 30% for existing homes.

- Homeowners would not pay rent on the portion of their home the government owns.

- The homeowner eventually would buy the government’s portion, either during the term of the loan or when they sell the house.

Liberal’s First Home Guarantee

The First Home Guarantee (formerly known as the First Home Loan Deposit Scheme), helps first home buyers with a deposit as low as 5% buy a home without paying Lenders Mortgage Insurance (LMI). Under this scheme, the government does not own a stake in the home, rather, it acts as guarantor for up to 15% of the value of the property.

The First Home Guarantee is one of the plans under the Coalition’s Home Guarantee Scheme. The other schemes are the family home guarantee for single parents with dependants and the Regional Home Guarantee buying in regional areas.

Note that not all lenders will be participating in all schemes. Home Loan Experts brokers can connect you with a participating lender with whom you can qualify for a place. Call us on 1300 889 743 or complete our free assessment form today!

| Details | Help to Buy | First Home Guarantee |

|---|---|---|

| Who proposed it? | Australian Labor Party (ALP), under Anthony Albanese | The Coalition Government, under Scott Morrison |

| When will it apply? | The government has not confirmed a date for when the scheme will commence. | First Home Guarantee is already in effect; however, from 1 July 2022, price caps have increased and more places have become available |

| What is it? | It is a shared equity scheme where the government contributes 40% for new builds and 30% for existing properties. | It is a guarantor scheme where the government acts as a mortgage insurer and guarantees up to 15% of the property value so that borrowers do not have to pay Lenders Mortgage Insurance (LMI). |

| What is the minimum deposit? | 2% | 5% |

| How many places are available?* | 10,000 places each year* | 35,000 places each year* |

| Is it only for first home buyers? | No. It’s available for anyone who does not own property | Yes. |

| Who can apply? | Australian citizens | Australian citizens |

| What is the income cap? | Single applicants with an annual taxable income of less than $90,000 or less than $120,000 for couples | Single applicants with an annual taxable income of less than $125,000 or less than $200,000 for couples |

| What are the benefits of the scheme? | You get into the market sooner with a smaller loan, which equates to smaller repayments and less interest. You do not need to pay rent on the portion of the property owned by the government. | You get into the market sooner and don’t need to pay LMI. You own 100% of the home. The government does not have a stake in your property. |

| What are the disadvantages of the scheme? | The government owns a portion of your property, which you have to buy back while you own the home or when you sell it. | A larger loan, which means higher repayments and you pay more interest over the life of the loan. |

*Note: The government plans on running Help to Buy alongside the First Home Guarantee and its Regional First Home Buyer Support Scheme, so the total combined number of places under Labor will include all of those schemes.

Help To Buy Vs First Home Guarantee: Which Is Better For Me?

Which of these two schemes would serve you best depends on your particular situation. Let’s take a closer look. Remember that Labor’s plan will go into effect only if it wins the election in May 2022.

If you can afford only a small deposit

If saving a large deposit is difficult for you, then Help to Buy is the better plan. It requires only a 2% deposit, compared with 5% for the First Home Guarantee.

If you have a relatively low income

If competition for places is fierce

If your focus is on retaining your equity

See What Your Low Deposit Can Achieve!

Unlike traditional calculators, the 360° Home Loan Assessor offers a full breakdown of your borrowing capacity, deposit contribution, and costs involved. Find out how close you are to approval and explore flexible low-deposit loan options.

Get StartedWhich Scheme Offers Higher Price Caps

| Region | Price Caps For Help To Buy | Price Caps For First Home Guarantee |

|---|---|---|

| NSW – capital city & regional centres | $950,000 | $900,000 |

| NSW – rest of state | $600,000 | $750,000 |

| VIC – capital city & regional centre | $850,000 | $800,000 |

| VIC – rest of state | $550,000 | $650,000 |

| QLD – capital city & regional centre | $650,000 | $700,000 |

| QLD – rest of state | $500,000 | $550,000 |

| WA – capital city | $550,000 | $600,000 |

| WA – rest of state | $400,000 | $450,000 |

| SA – capital city | $550,000 | $600,000 |

| SA – rest of state | $400,000 | $450,000 |

| TAS – capital city | $550,000 | $600,000 |

| TAS – rest of state | $400,000 | $450,000 |

| ACT | $600,000 | $750,000 |

| NT | $550,000 | $600,000 |

The scheme with the higher price cap is in bold. Besides the capital cities and regional centres of NSW and Victoria, the First Home Guarantee offers higher price caps for the other cities and the remaining areas of the states.

12 Steps To Home Loan Approval And Beyond

Your Step-By-Step Roadmap From Applying For A Home Loan To Finally Moving In

We Can Help You Secure A Place

Labour’s Help To Buy Scheme and Liberal’s First Home Guarantee offer different benefits and price caps for home buyers. Whichever scheme goes into effect, our mortgage brokers can help you get approved for a home loan. Call us on 1300 889 743 or complete our free assessment form.