What Is The Home Guarantee Scheme?

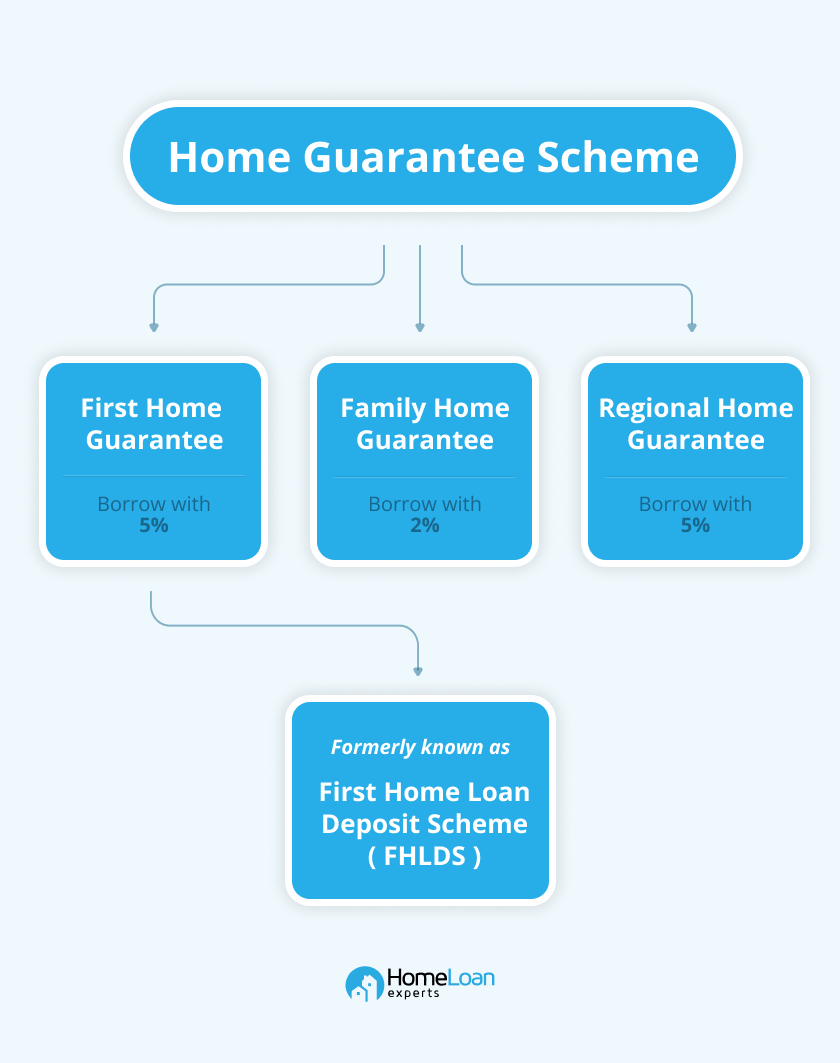

The government introduced the Home Guarantee Scheme to help borrowers with a deposit of at least 2% qualify for a home loan without paying Lenders Mortgage Insurance (LMI).

Typically, to avoid paying LMI, you need a 20% deposit. However, under the scheme, eligible borrowers can avoid LMI even with a deposit as small as 2%, since the government will guarantee up to 18% of the value of the property.

Home Guarantee Scheme Eligibility

The Home Guarantee Scheme offers three types of guarantees: First Home Guarantee (FHBG), Regional First Home Buyer Guarantee (RFHBG), and Family Home Guarantee (FHG). Below are the eligibility details for each:

First Home Guarantee (FHBG) and Regional First Home Buyer Guarantee (RFHBG)

- Applicants: You can apply as an individual or as two joint applicants. Friends, siblings and other groups of family members can jointly apply.

- Residency: Must be an Australian citizen or permanent resident

- Age: Must be at least 18 years old.

- Income: Annual income must not exceed $125,000 for individuals or $200,000 for joint applicants, as stated on their most recent Notice of Assessment from the Australian Taxation Office.

- Deposit Requirement: Applicants need between 5% and 20% of the property’s value as a deposit. The minimum is 5%, but lenders may ask for a higher percentage based on financial circumstances.

- Ownership History: Applicants must be first-home buyers or previous homeowners who have not owned or had any interest in real property (including land) in Australia in the past 10 years.

- Occupancy: Must intend to live in the purchased property as an owner-occupier.

- Costs: Eligible buyers are responsible for all associated costs, such as stamp duty, application fees, and legal fees.

- Price Caps: FHBG and RFHBG have property price caps ranging from $40,000 to $900,00, which vary between states and territories.

Family Home Guarantee (FHG)

- Applicants: You must apply as an individual (no joint applicants).

- Parental status: A single parent or legal guardian of at least one dependant.

- Residency: Must be an Australian citizen or permanent resident

- Age: Must be at least 18 years old.

- Income: Annual income must not exceed $125,000, as shown on the Australian Taxation Office’s Notice of Assessment.

- Deposit Requirement: Applicants must save between 2% and 20% of the property’s value as a deposit. The minimum deposit for the FHG is 2%, but lenders may ask for a higher percentage based on financial circumstances.

- Occupancy: Must intend to live in the purchased property as an owner-occupier.

- Ownership Status: Cannot currently own any property and, upon settlement, must not intend to own any other property.

- Price Caps: FHG has property price caps ranging from $40,000 to $900,00 for regional centres, which vary between states and territories.

We can help you apply for any one of the guarantees in the Home Guarantee Scheme. Call us on 1300 889 743 or complete our free assessment form today.

Here is a summary of the three plans.

| Details | First Home Guarantee | Family Home Guarantee | Regional First Home Buyer Guarantee |

|---|---|---|---|

| What is the minimum deposit? | 5% | 2% | 5% |

| What type of property is accepted? | A new or existing home | A new or existing home | A new or existing home |

| How many places are available? (from 1 July 2024) | 35,000 each year | 5,000 each year | 10,000 each year from 1 July 2024 |

| Who can apply? | Single people or couples | Single parent with at least one child dependant | Single people or couples |

| Is it only for first home buyers? | Yes | First-home buyers or previous homeowners who do not currently own a home | Yes |

| Are there location restrictions? | No | No | Yes, you can buy only in regional areas |

Having a strong credit history, without any defaults or arrears, is essential.

Limited Spots. Don’t Miss Out. Reserve Your Spot Today!

Is the New Home Guarantee part of the Home Guarantee Scheme?

No, the New Home Guarantee is not included in the Home Guarantee Scheme.

The New Home Guarantee was an extension of the First Home Guarantee that was introduced during the pandemic. Under this scheme, first-home buyers could only build or purchase new homes.

The New Home Guarantee ended on 30 June 2022.

What Are The Benefits of the Home Guarantee Scheme?

- You don’t have to wait and save for a large deposit.

- The three different plans cater to borrowers with different property ownership histories.

- First-home buyers can use the scheme with other grants and concessions

- You can potentially save over $39,000 in LMI fees

How much do I save in LMI?

| Value of the property | How much are you borrowing | LVR | LMI saved |

|---|---|---|---|

| $950,000 | $902,500 | 95% | $39,273 |

| $850,000 | $807,500 | 95% | $35,139 |

| $750,000 | $712,500 | 95% | $31,005 |

| $650,000 | $617,500 | 95% | $26,871 |

| $550,000 | $522,500 | 95% | $22,737 |

The figures in this table are estimates. You can use our LMI calculator to find out how much you save in different states and territories.

What Are The Price Caps For The Home Guarantee Scheme?

Price Caps For First Home Guarantee And Family Home Guarantee

| Region | 2024-25 Price Caps* |

|---|---|

| NSW – Sydney & regional centres (Newcastle, Lake Macquarie & Illawarra) | $900,000 |

| NSW – rest of state | $750,000 |

| VIC – Melbourne & regional centre (Geelong) | $800,000 |

| VIC – rest of state | $650,000 |

| QLD – Brisbane & regional centres (Gold Coast & Sunshine Coast) | $700,000 |

| QLD – rest of state | $550,000 |

| WA – Perth | $600,000 |

| WA – rest of state | $450,000 |

| SA – Adelaide | $600,000 |

| SA – rest of state | $450,000 |

| TAS – Hobart | $600,000 |

| TAS – rest of state | $450,000 |

| ACT | $750,000 |

| Northern Territory | $600,000 |

| Jervis Bay Territory & NorfolkIsland | $550,000 |

| Christmas Island and Cocos (Keeling) Islands | $400,000 |

*The 2024-25 price caps are applicable for the First Home Guarantee and Family Home Guarantee from July 2024.

Price Caps For Regional First Home Buyer Guarantee

| State | Regional Centre* | All Other Regional Areas |

|---|---|---|

| New South Wales | $900,000 | $750,000 |

| Victoria | $800,000 | $650,000 |

| Queensland | $700,000 | $550,000 |

| Western Australia | - | $450,000 |

| South Australia | - | $450,000 |

| Tasmania | - | $450,000 |

*Regional centres are Newcastle and Lake Macquarie, Illawarra, Geelong, Gold Coast and Sunshine Coast.

| Territory | All Areas |

|---|---|

| NT Regional | $600,000 |

| Jervis Bay Territory & Norfolk Island | $550,000 |

| Christmas Island & Cocos (Keeling) Islands | $400,000 |

| ACT | Not applicable |

What Is The First Home Guarantee (First Home Loan Deposit Scheme)?

The First Home Guarantee (formerly known as the First Home Loan Deposit Scheme), helps first-home buyers with a deposit as low as 5% buy a home without paying Lenders Mortgage Insurance (LMI).

| First Home Guarantee | Details |

|---|---|

| When was it introduced? | It was first introduced on 1 January 2020 as the First Home Loan Deposit Scheme, but is now known as First Home Guarantee. |

| Who can apply? | Australian citizens who are first-home buyers |

| What is the income cap? | Single applicants with an annual taxable income of less than $125,000 or less than $200,000 for couples |

| How many places are available? | 35,000 places from 1 July 2024. |

For more information on the First Home Guarantee (previously known as the First Home Loan Deposit Scheme), go here.

What Is The Family Home Guarantee?

The Family Home Guarantee helps single parents with children as dependants buy an existing home or build a new one with a deposit as low as 2%.

| Family Home Guarantee | Details |

|---|---|

| When was it introduced? | 1 July 2021. |

| Who can apply? | Australian citizens who are single parents and either first-home buyers or previous homeowners who do not currently own a home |

| What is the income cap? | Annual taxable income must not exceed $125,000 |

| How many places are available? | In 1 July 2024, 5,000 places are available each year through 30 June 2025. |

For more details, about the Family Home Guarantee, go here.

What Is The Regional First Home Buyer Guarantee?

The Regional First Home Buyer Guarantee allows you to buy or build a new home in a regional area with at least a 5% deposit.

| Regional Home Guarantee | Details |

|---|---|

| When was it introduced? | It was introduced during the 2022 federal elections |

| Who can apply? | Australian citizens who are first-home buyers |

| What is the income cap? | Single applicants with an annual taxable income of less than $125,000 or couples with less than $200,000 |

| How many places are available? | 10,000 places each year from 1 July 2024 through 30 June 2025. |

You will need to send your application to a participating lender. We can help you with your application. Call us on 1300 889 743 or enquire online today.

How To Apply For The Home Guarantee Scheme

You will need to send your application to a participating lender. We can help you with your application. Call us on 1300 889 743 or enquire online today.