Updated: 13 Jan, 2025

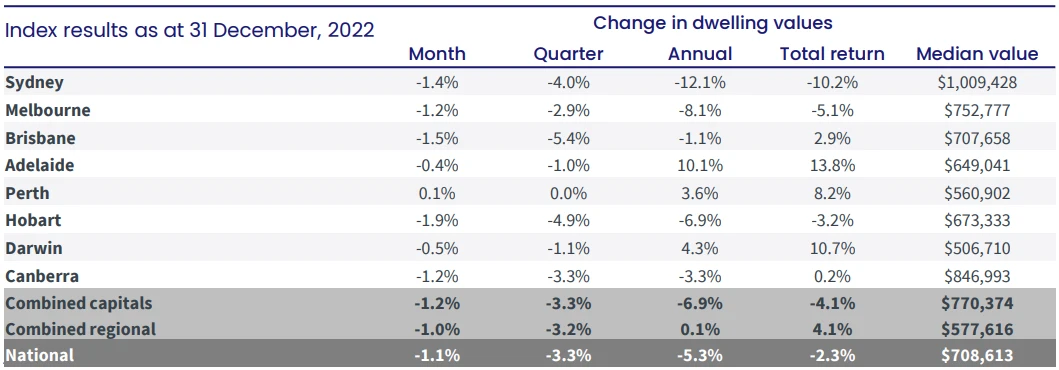

CoreLogic’s Home Value Index fell 1.1% in December 2022, which took values 5.3% lower over the 2022 calendar year.

That result for the 12 months to December marked the largest calendar year decline since 2008, when values were down 6.4% during the Global Financial Crisis.

Annual housing value falls were most significant in Sydney and Melbourne, at 12.1% and 8.1%, respectively. Hobart, Canberra and Brisbane experienced annual declines of 6.9%, 3.3% and 1.1%, respectively. Adelaide, Darwin and Perth were the only capital cities to experience an annual rise in housing values – of 10.1%, 4.3% and 3.6%, respectively.

What Happened To Australia’s Property Market In 2022?

CoreLogic research director Tim Lawless noted that 2022 was a year of contrasts, as housing values rose through the first four months then fell as the RBA steadily increased the cash rate.

- The daily index series recorded national home values peaked on 7 May 2022, shortly after the cash rate moved off emergency lows. Since then, the national index has fallen 8.2%, following a dramatic 28.9% rise in values through the upswing.

- The upper quartile of the housing market led the downturn. However, in recent months, some cities have recorded a lower performance gap between the housing values of the upper quartile and those in the lower quartile and the broad middle of the market.

- The housing values across combined regional areas were roughly unchanged for the year, rising just 0.1%. However, the results were mixed across the states. Regional NSW and Regional Victoria recorded annual falls of 2.7% and 1.3%, respectively, which offset declines in other states. On the other hand, Regional SA recorded an annual rise of 17.1%. The Barossa wine region led the gains, with a 23% rise in value in 2022.

- Housing values remained well above pre-COVID levels. Housing values for combined capital cities were 11.7% above where they were at the onset of COVID, while they were 32.2% above for combined regional markets.

Property Market Highlights

Here’s a summary of major data points from the Australian property market in December 2022:

- Over the four weeks ending Christmas Day, there were 7.8% fewer capital city homes advertised for sale than a year ago.

- The total advertised supply was 19% below the previous five-year average for the period.

- New capital city listings added to the market over the past four weeks were 30.6% lower relative to the same period in 2021, and almost 10% below the five-year average.

- The median time on the market increased from 20 to 31 days, which drove up vendor discounting rates, from 3.1% a year ago to 4.2% at the end of 2022.

- The estimated capital city dwelling sales for the December quarter were 30.1% lower than a year ago and 9.2% below the previous five-year average. In annual terms, sales were 16.5% lower relative to 2021 but 7.4% above the five-year average.

- National dwelling rent values increased 0.6% in December, which made them 2% higher through the December quarter and up 10.2% over the calendar year.

- The strong rental appreciation was accompanied by low vacancy rates. The combined capital rental vacancy rate finished at 1.2%, ranging from 0.4% in Adelaide to 1.8% in Darwin.

- However, the pace of rental growth has eased, from 2.9% over the June quarter to 2% in the December quarter. The slowdown probably reflects seasonal factors and pressures on affordability.

- Throughout 2022, the higher density rental markets across most capitals recorded a faster pace of rental growth relative to houses. The annual growth in unit rental values reached 14.1% this year, compared with a 9.5% rise in house rents.

- Rental yields were still below the decade average, but the national gross rental yield rose to 3.78% in December.

CoreLogic’s Housing Outlook For 2023

In 2023, CoreLogic forecasts:

- Home values will fall further in the early months and will stabilise after interest rates find a peak.

- An increase in borrowers under mortgage stress could lead to an increase in distressed sales. The December cash rate of 3.1% pushed recent borrowers to the upper limit of the serviceability under which they were assessed.

- A surge in fixed-rate refinancing. The Reserve Bank of Australia noted that 35% of outstanding housing credit is on fixed terms, with two-thirds of these loans expiring in 2023.

- An increase in mortgage arrears from borrowers whose fixed rates have expired, leaving them exposed to higher repayments.

- A rise in the number of newly listed properties as pent-up supply pours into the market. New listings were low in the second half of 2022, and the number of freshly advertised properties normally moves through a seasonal upswing from February to Easter.

- An ease in APRA’s serviceability buffer, or more homebuyer incentives like the government schemes could help stabilise housing values.

- A tight rental market. Domestic rental demand could decline as properties associated with the HomeBuilder grant are completed. But with the return to normal overseas migration, the relative lack of rental supply would keep the market tight.