Updated: 13 Jan, 2025

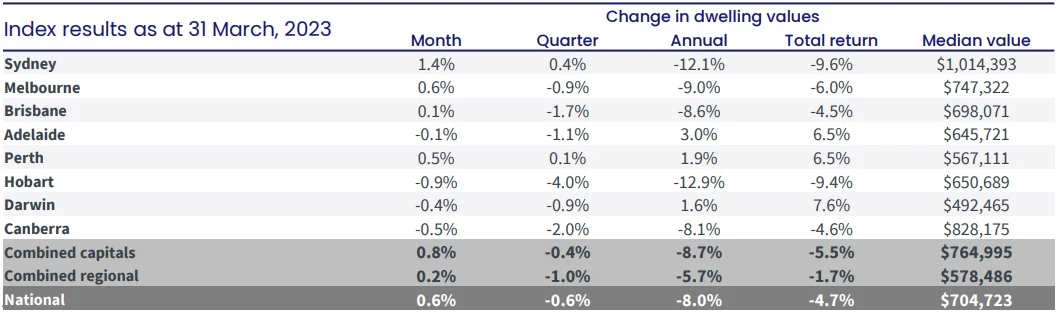

After 10 months of decline, CoreLogic’s Home Value Index posted a month-on-month rise of 0.6% in March 2023. Values rose in the four largest capital cities, led by a 1.4% increase in Sydney.

CoreLogic research director Tim Lawless noted that the rise was due to a mix of low advertised stock levels, tight rental conditions and additional demand from migration.

The lift in housing values was most prominent in Sydney’s upper-quartile market. In the most expensive segment of the market, house values were up 2% and units were up 1.4% in March. Lawless noted, “Sydney upper-quartile house values fell by 17.4% from their peak in January 2022 to a recent low in January 2023, the largest drop from the market peak of any capital city market segment. We may be seeing some opportunistic buyers coming back into the market where prices have fallen the most.”

Regional housing markets experienced a rise of 0.2% over the month. Housing values across regional Western Australia and regional South Australia were still at cyclical highs despite the recent rate hikes. The regional areas that led capital growth in March were:

- Fleurieu-Kangaroo Island, SA with a 2.6% rise

- Dubbo, NSW with a 2.5% rise

- Wellington, Victoria with a 2.4% rise

- Mid West, WA with a 2.1% rise

Lawless notes, “In today’s market, it is mainly rural areas that are seeing the strongest increases, rather than the commutable coastal and lifestyle markets that were booming through the upswing. However, we are seeing some subtle growth return to regions within commuting distance of the major capitals, after many recorded a sharp drop in values.”

But, housing values did drop in many capital cities and regional areas. Hobart recorded the largest fall among the capital cities, at 0.9%. Canberra, Darwin and Adelaide experienced falls in values of 0.5%, 0.4%, and 0.1%, respectively. In regional Victoria and regional Tasmania, values fell 0.1% and 0.7%, respectively.

Property Market Highlights

Here’s a summary of the major data points from the Australian property market in March 2023.

- Housing values across the capital cities and broad rest-of-state areas remained higher, relative to the onset of the pandemic in March 2020. Melbourne’s values were still close to pre-COVID levels, only 0.6% above March 2020. On the other hand, values in Adelaide and regional South Australia were 41.2% and 49.2%, respectively, above March 2020 levels.

- There were 24,730 new listings over the four weeks ending 26 March 2023. This is 17.7% below the same time last year and 9.1% below the five-year average. Every capital city except Hobart recorded a total advertised listing count lower than the previous five-year average.

- There were 83,933 active listings over the four weeks ending 26 March. This is 6.8% below the same time last year and 19.5% below the five-year average.

- Purchasing activity rose 10.4% in March. The month-on-month lift was still smaller than the usual seasonal rise for this time of year (the long-term average is 11.1% between February and March), estimated sales over the month were the highest since May last year.

- Vendors may be motivated by better selling conditions. For private treaty sales, vendor discounting rates eased from -4.3% in December 2022 to -4% in March. The median number of days on the market plateaued around 34 across combined capitals.

- Across the largest capital cities, rental growth accelerated for the unit sector. In Sydney, the annual pace of growth across the unit sector was 18.1%, almost double that of houses, which was 9.4%. With the strong growth in house rents, tenants had no choice but to look for more affordable options. Overseas migrants and students also fueled the demand for units.

- Rents are not rising in all cities and regions. Over the March quarter, Darwin house and unit rents fell 1.5% and 0.4%, respectively. Canberra recorded an annual reduction in house rents, down 0.8% over the past 12 months.

- Borrowers have yet to experience the full impact of the interest rate rise, due to a lag before cash rate

movements get passed on to borrowers. About 30% of borrowers are on fixed rates, so they are yet to experience the 350 basis points of rate hikes to March 2023. - Households might pull back their spending. They are saving less and spending less; many could experience a dip in their savings buffers.

- Low consumer sentiment might mean no sustained improvement in housing market activity.

- If economic growth slows and skilled migration rises, unemployment will rise. This could dampen wage growth.

- Only a small portion of current home lending is to borrowers with low deposits or high debt levels relative to their income or loan size. Most borrowers are assessed at a higher assessment rate, making qualifying for a loan difficult.

- If there is a rise in the number of listings without increased purchase activity, there could be some renewed

downward pressure on housing prices. - Headline inflation dropped from 8.4% in December 2022 to 6.8% in February 2023. While it has not reached the 2-3% target range, the lower-than-expected outcome might mean the RBA could pause or halt the rate hiking cycle soon.

- Net overseas migration is at a record high and could add to housing demand. Normally, overseas migration significantly influences rental demand, but with most cities experiencing vacancy rates of 1%, high migration rates will probably generate more purchasing demand than usual.

- With most people employed and positive equity in housing values, mortgage defaults will probably remain low.

Will Housing Values Keep Rising Now?

While the trend in Australia’s housing market looks positive, there are a few factors that could impede the rise in values over the coming months:

It’s not all doom and gloom, though: