Here’s something not everyone realises: You can actually buy a home in Australia without a deposit.

Most standard home loans require a deposit of at least 5% to 20%, which can take years to save. But with the right support, such as a guarantor or access to a government-backed scheme, you could borrow the full purchase price and get into the market much sooner.

They’re not for everyone, and there are a few hoops to jump through, but if you understand how it works and whom it’s designed for, it can help you get into the property market faster.

Let’s break down how no-deposit home loans work, who’s eligible, and how to improve your chances of getting approved.

What Is A No-Deposit Home Loan?

A no-deposit home loan, also known as a 100% home loan or zero-deposit loan, is a type of home loan that allows you to borrow the full purchase price of a property without needing to contribute an upfront deposit. Typically, lenders require at least a 5% to 20% deposit before approving a home loan. With a no-deposit loan, that requirement is removed through alternative support.

The most common type of zero-deposit home loan is a guarantor loan, in which a family member offers their property as security.

How Do No-Deposit Home Loans Work?

No-deposit home loans work by replacing the need for a cash deposit with alternative forms of security or financial backing.

Here are the most common ways this works:

1. Guarantor Home Loan

This is the most common way to get a no-deposit home loan. A close family member, typically a parent, offers part of their property’s equity as security for your loan. With this support, you can even borrow up to 110% of the property value, which covers not just the purchase price but also extra costs like stamp duty, legal fees, and moving expenses. It’s worth noting that without a guarantor, no lender will offer more than 100% of the property’s purchase price.

The guarantor must be an immediate family member, have enough equity in their home, and be willing to provide a limited guarantee. Most lenders will also require them to get independent legal and financial advice before the loan is approved. As you build equity in your property and pay down the loan, the guarantor can be released from the agreement.

As the borrower, you’ll need to show strong repayment capacity and have enough funds to cover upfront costs associated with the purchase. If you’re borrowing up to 100% with a guarantee, many lenders will want to see genuine savings (usually 5% of the property value held for at least three months).

For a full breakdown of eligibility and lender requirements, check out our Guarantor Home Loans guide.

2. Use Equity As A Deposit

If you already own a property, you may be able to use the equity you’ve built up as a deposit for a new home. This is a popular option for current homeowners who want to upgrade, invest, or buy a second property without dipping into their savings

If you have sufficient equity, then you don’t need any savings at all. You can use your existing equity as a deposit by refinancing. In some cases, lenders may even offer a cash rebate to refinance. We can value your property for free and let you know if this option is available to you.

To qualify for this strategy, you have to have enough usable equity built up in your current property in Australia.

Lenders assess serviceability by looking at your income, expenses, and debts to make sure you can comfortably manage the loan repayments.

Learn more about equity loans and how they work.

Use our no-deposit calculator to see which loan deposit option best meets your needs.

Pros And Cons Of No-Deposit Home Loans

Pros

- Allows buyers to purchase a home without saving a large deposit.

- Helps first-home buyers get into the market sooner.

- Lets you keep your savings for other expenses, like stamp duty, moving costs, or furnishing your new home.

- Guarantor options allow parents or family members to help without giving you cash by using their property as security.

- Can be used to invest earlier and take advantage of property growth.

- May be combined with government schemes and grants to reduce upfront costs.

Cons

- Lenders apply stricter eligibility requirements.

- Fewer lenders offer no-deposit home loans.

- Higher risk of negative equity if property values drop.

- Increases the chance of over-borrowing and future financial stress.

- You’ll still need to cover upfront costs such as stamp duty, legal fees, and inspections.

Who Can Qualify For A No-Deposit Home Loan?

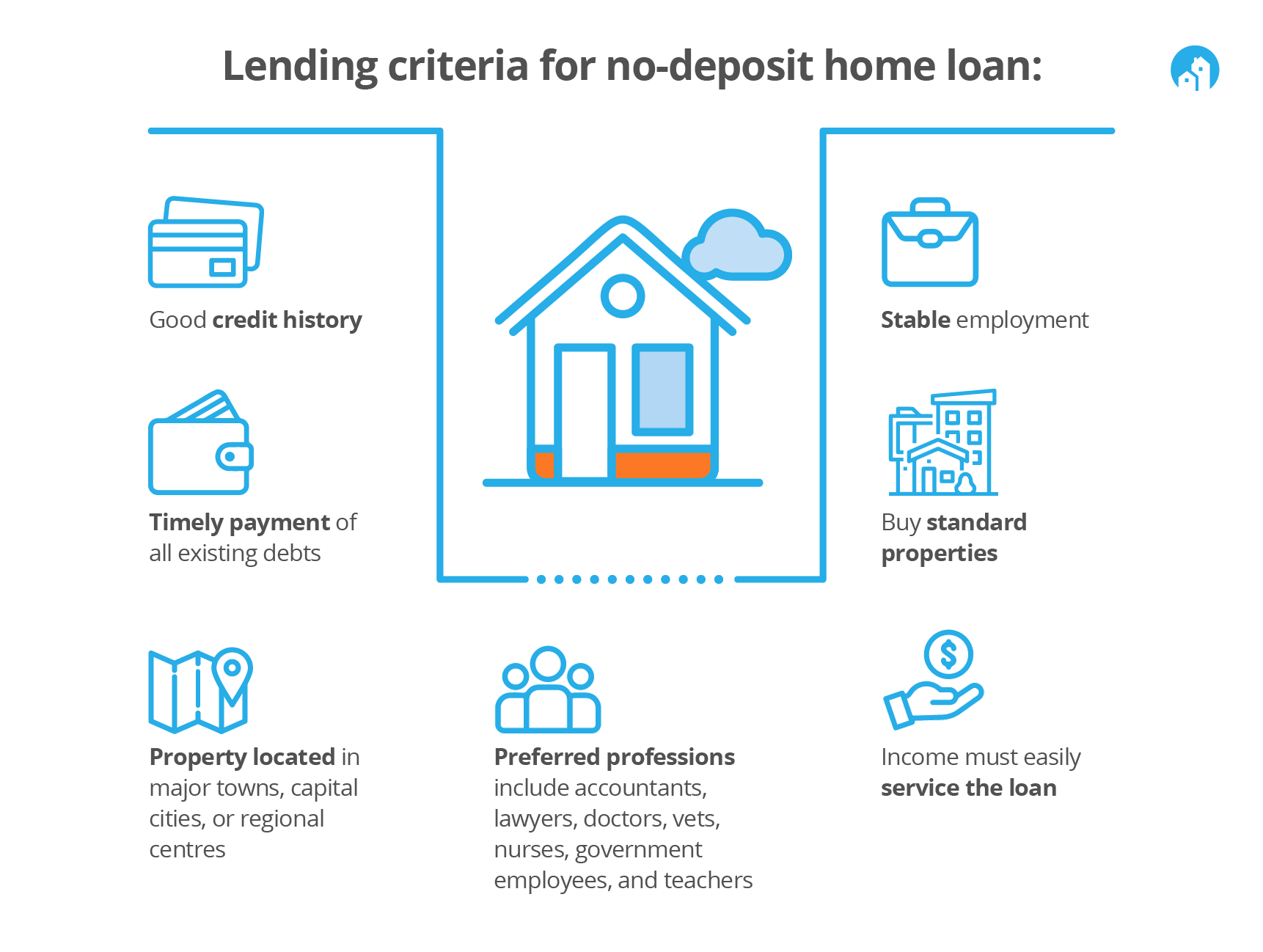

No-deposit home loans aren’t available to everyone. Because you’re not contributing a deposit, lenders need extra assurance that you’re financially stable and low-risk. Here’s what lenders look at when assessing your no-deposit home loan application.

- Credit history: You must have a perfect credit history with Equifax. No Australian lenders will make an exception to this policy if LMI approval is required.

- Repayment history: You must be paying all of your current debts, such as credit cards, personal loans and rent on time.

- Location restrictions: You must be buying in a major town, capital city or regional centre. One of our lenders is willing to consider anywhere in Australia but most lenders are strict about the location.

- Property type: You must be buying a standard type of property, such as a house, townhouse, unit or vacant land. As a general rule, unusual or unique properties are not acceptable.

- Stable employment: Your employment situation must be stable and ongoing.

- Income: Your income must be high enough that you can easily service the loan. You cannot borrow to your limit with a high Loan-to-Value Ratio (LVR) mortgage.

- Profession: Professionals such as accountants, lawyers, doctors, vets, nurses, government employees and teachers are highly sought after by lenders because they are well known to be a lower risk than people in other professions. You don’t need to be a professional to get approved but it helps.

How To Apply For A No-Deposit Home Loan

Applying for a no-deposit home loan involves a guarantor or alternative deposit strategy. This is where a mortgage broker becomes especially valuable. A limited number of lenders offer no-deposit home loans, and the eligibility criteria can vary widely.

A mortgage broker, like one at Home Loan Experts, knows which lenders offer these types of loans and can help you avoid going through multiple failed applications. They’ll assess your financial situation, including your income, credit score, and whether you have the support of a guarantor or enough equity to move forward.

Once you’re in a position to apply, your broker will guide you through gathering the necessary documents, such as proof of income, bank statements, ID, and any paperwork related to your guarantor or current property. They can help you get pre-approval, giving you a clear idea of your borrowing power and helping you stand out to sellers.

After you’ve found a suitable property that meets the lender’s criteria, your broker will handle the application process and work with the lender to get your loan formally approved.

Get Expert Help With Your No-Deposit Home Loan

Getting a no-deposit loan takes more than luck, it takes knowing the right lender. That’s where we come in.

Let us do the hard work for you.

Get Assessed For Free Today!What If You Don’t Qualify For A No-Deposit Home Loan?

Not everyone will qualify for a no-deposit home loan. If you don’t have a guarantor, own an existing property, or meet the eligibility criteria, that doesn’t mean your home ownership journey has to stop. There are low-deposit options that allow you to get into the market with as little as 5% saved, and some of them help you avoid paying Lenders Mortgage Insurance (LMI) as well.

First Home Guarantee

The First Home Guarantee is a nationwide program to help first-home buyers purchase a property with a deposit as low as 5% without having to pay LMI. From 1 July 2024 – 30 June 2025, 35,000 places are available.

You may be eligible if you:

- Are an Australian citizen or permanent resident

- Earn up to $125,000 as a single, or $200,000 as a couple (or partners, siblings, other family members, or friends)

- Plan to live in the property as your primary place of residence

- Have at least 5% of the property price in genuine savings

You can read the full details of the scheme on our First Home Guarantee page.

Gifted Deposit Home Loan

A gifted deposit is a lump-sum amount of money given to you by your parents with no expectation of repayment. Many lenders will accept this as your home loan deposit, and you may be able to borrow up to 95% of the property value with a gifted deposit.

In most cases, lenders will also expect you to have saved at least 5% of the purchase price on your own. This is called genuine savings.

You can read more about this option on our gifted deposit page.

Personal Loan As A Deposit

You could also use a personal loan as a home deposit; however, many lenders do not favour this option, as you would then need to keep up with repayments for both the personal loan and the home loan. You can borrow up to 95% of the purchase price plus the personal loan. For this option, you will need:

- A minimum deposit of 5% of the property value.

- A high income to afford both repayments.

- Little existing debt (car loans, high credit-card balances, etc).

- A clear credit history.

A personal loan isn’t suitable for all people. We recommend that you speak with your parents about a guarantor loan before you consider this option.

You can read more on our personal loan as a home deposit page.

Shared-Equity Scheme

A shared-equity scheme or arrangement is when an equity partner acts as both the lender and an investor in a property. The partner contributes a portion of the purchase price of the property in exchange for an interest in the property. For most of these shared-equity schemes, a deposit of at least 5% of the property price is required.

There are different types of shared-equity schemes and arrangements available in Australia.

- Under the nationwide Help To Buy scheme, the government contributes 40% for new builds and 30% for existing properties.

- There are also state and territory-wide shared-equity schemes available.

Helpful Tip

We currently have a lender offering up to 98% (inclusive of LMI) with just a 2% deposit plus costs.

This offer is available to owner-occupiers and investors, and it’s not limited to first-home buyers.

Want to know if you’re eligible? Call us on 1300 889 743 and we’ll walk you through it.

FAQs

Is It Better To Save A Deposit Or Borrow With No Deposit?

It depends on your local market and risk tolerance.

In a rising market, opting to borrow 100% with a guarantor or 95% with Lenders Mortgage Insurance (LMI) might prove more cost-effective than waiting to accumulate savings. The risk of waiting lies in potentially missing out on capital gains during the saving period. In a stable or declining market, however, it may be prudent to save a 5%-10% deposit for a 95% loan if you prefer not to use a guarantor.

You can use our calculator to decide if you should buy now or save a larger deposit.

Can I Borrow 100% And Consolidate My Debts?

Do Home Loans Without A Deposit Have Extra Features?

How High Will My Interest Rate Be?

How Much LMI Will I Pay On A No-Deposit Home Loan?

Which Lenders Have No-Deposit Loans?

Still need answers? We're here to help!

Ask an expertOur team of mortgage experts will assist you within 24 hours.